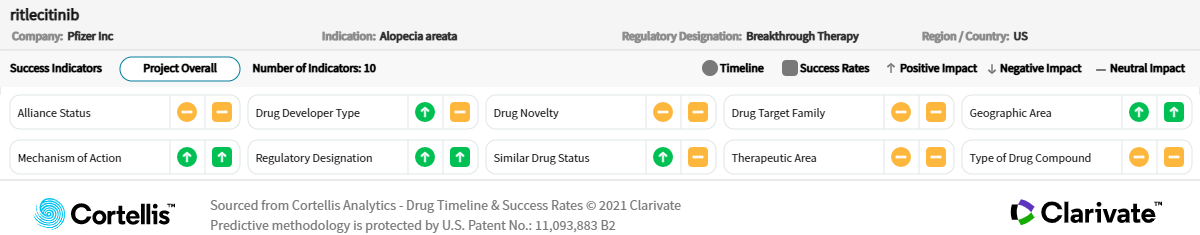

About ritlecitinib

-

Pfizer Inc

-

Janus kinase 3 (JAK3)/TEC inhibitor Daily oral administration to treat alopecia areata

-

Also being evaluated for vitiligo, Crohn’s disease, ulcerative colitis and, in combination with either tofacitinib or zimlovisertib, rheumatoid arthritis

-

~4.7 million people with alopecia areata in the United States and top five European markets in 2020