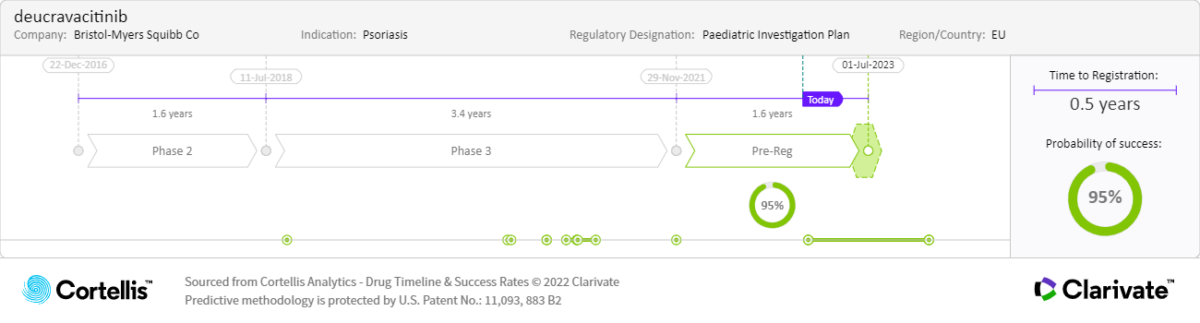

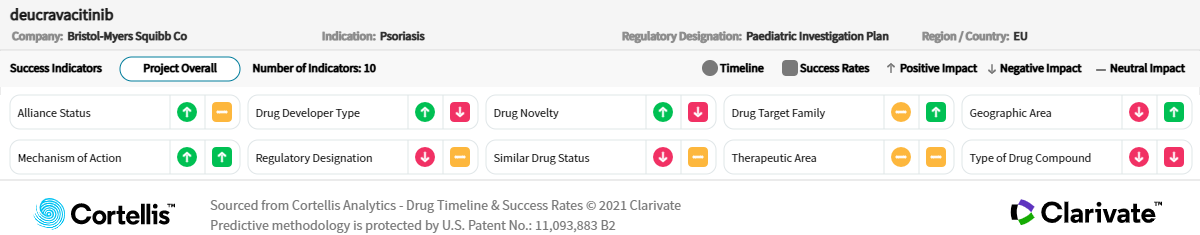

About deucravacitinib

-

Bristol Myers Squibb

-

Allosteric TYK2 inhibitor

-

Once-daily oral administration to treat moderate-to-severe plaque psoriasis

-

Also being investigated to treat pustular psoriasis, erythrodermic psoriasis, psoriatic arthritis, systemic lupus erythematosus and inflammatory bowel disease

-

~11.7 million symptomatic psoriasis cases in the G7 markets in 2021

-

45 years - average age of symptomatic psoriasis cases