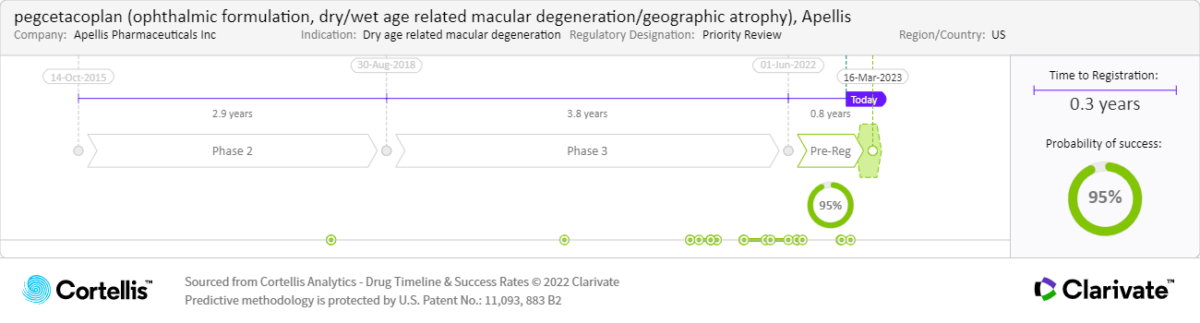

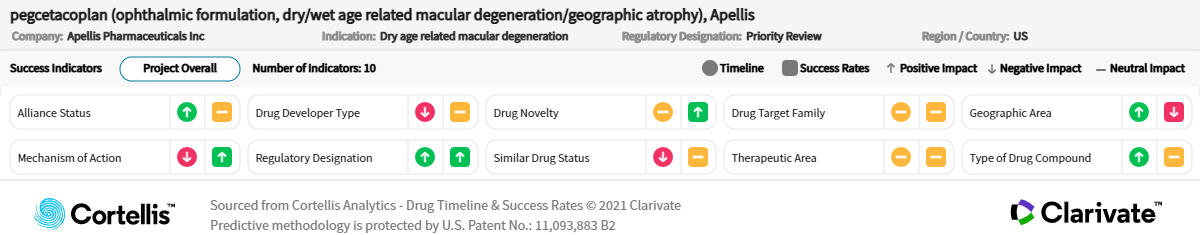

“Pegcetacoplan and Zimura both seem to slow down the growth of lesions. They both seem to have effectiveness. They both seem to increase the risk of developing wet AMD, which is a big problem because if you have dry AMD and you suddenly develop wet AMD, you have to give two injections into the eye. It sounds very promising because we have nothing to offer to these patients. I think the drugs’ effects are not major effects. I think the studies have been done on very late disease, and therefore, it could be that we are using them perhaps too late. I’m not sure which of the two will be the first to get to the market, but the one that is first to the market will have a huge advantage.”

- Retinal specialist,

- United States