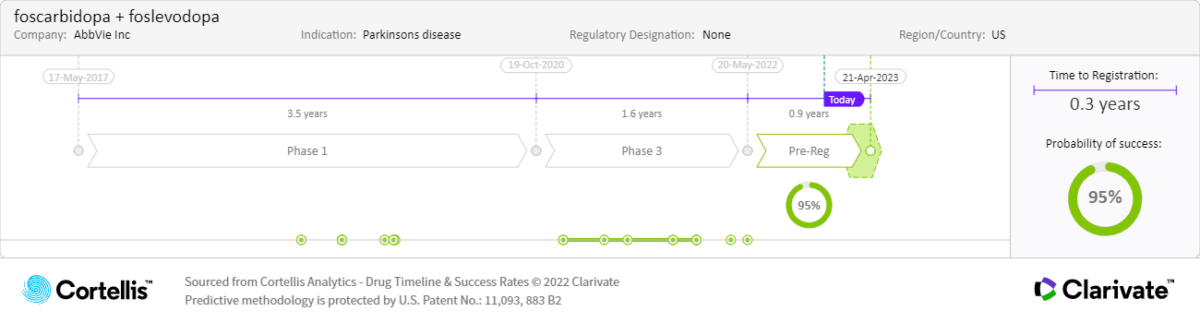

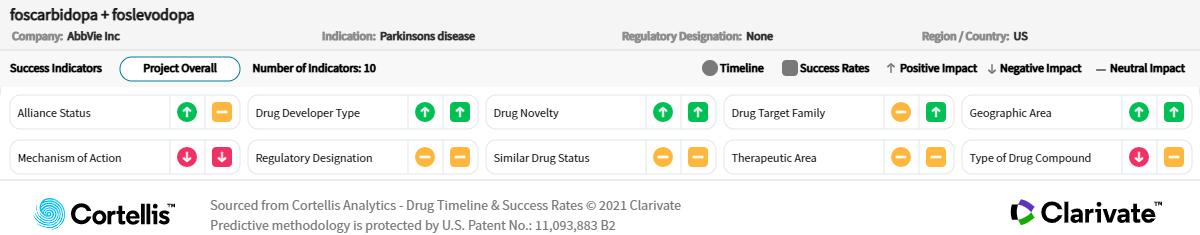

About foscarbidopa/

foslevodopa

-

AbbVie

-

Carbidopa and levodopa prodrugs

-

Continuous 24-hour subcutaneous infusion to treat motor fluctuations in patients with advanced Parkinson’s disease

-

2.8 million diagnosed prevalent cases of Parkinson’s disease in the G7 markets in 2021