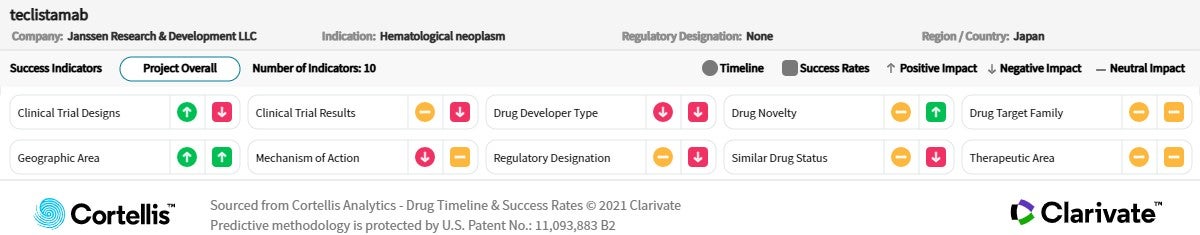

About teclistamab

-

Janssen Pharmaceutical Companies of Johnson & Johnson

-

Bispecific antibody targeted at BCMA and CD3

-

Weekly subcutaneous injection to treat R/R multiple myeloma

-

~72,000 diagnosed incident cases of multiple myeloma in the G7 markets in 2021