About valoctocogene roxaparvovec

-

BioMarin Pharmaceutical Inc.

-

AAV5-based gene transfer therapy

-

Single intravenous infusion to treat severe hemophilia A

-

~16,500 cases of severe hemophilia A in the G7 markets in 2021

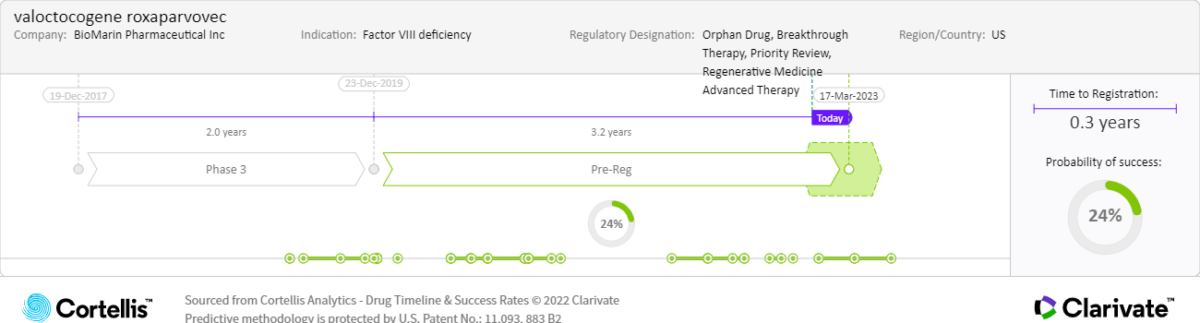

Approved by the European Commission (EC) in August 2022, valoctocogene roxaparvovec is also poised to be the first gene therapy to launch in the United States for severe hemophilia A. Treatment benefit is expected to last for years, reduce the number of bleeding events, minimize the need for replacement factor VIII (FVIII) and negate the use of otherwise burdensome prophylaxis treatment.

August 2022:

• Marketing authorization: EC

September 2022:

• Marketing authorization for AAV5 DetectCDx™ Kit companion diagnostic: EC

• Biologics License Application (BLA) resubmitted: U.S. FDA

March 31, 2023:

• PDUFA date

Actual and expected launch:

• 2022: Europe

• 2023: United States

Patents estimated to expire beginning in 2033

Access global intelligence, advanced analytics and global experts from Clarivate.