-

Hormonal therapy is the cornerstone of drug treatment in all patient populations and will remain the dominant drug class, including novel hormonal therapies (e.g., abiraterone, enzalutamide) expecting to hold approximately 50% of the total prostate cancer market by 2032.

-

However, treatment is becoming increasingly diversified with the approval of novel targeted agents such as PARP inhibitors and prostate-specific membrane antigen (PSMA)-targeted radioligands.

-

The late-phase pipeline spans a wide range of drug classes and novel therapies (e.g., PARP inhibitors, kinase inhibitors, PSMA-targeted radioligands, angiogenesis inhibitors).

-

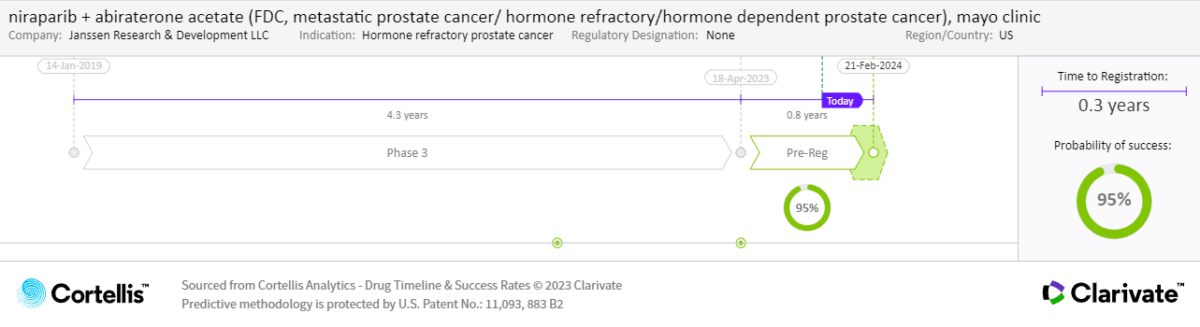

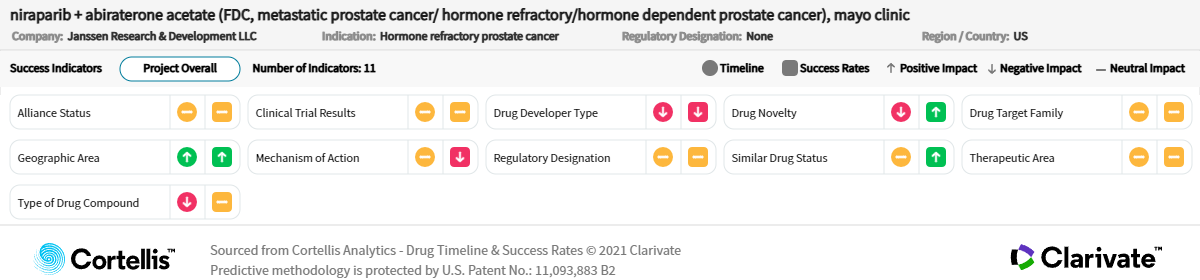

Niraparib + abiraterone acetate will be the sales-leading emerging agent, earning major-market sales of $2.9 billion in 2032. Due to long treatment durations and the premium price of niraparib + abiraterone acetate, 75% of those sales will come from the mHSPC setting.

-

Although other PARP inhibitor + hormonal therapy combinations (e.g., Lynparza + abiraterone from AstraZeneca and MSD) are available, they are “open” combinations (i.e., two drugs administered as separate tablets with different dosing schedules).