What hurdles might it need to overcome to reach blockbuster status?

Datopotamab deruxtecan is likely to face stiff competition from various agents in both the HR-positive/HER-negative breast cancer and the NSCLC segments.

For HR-positive/HER-negative breast cancer, major hurdles in uptake and thus sales potential include competition from established earlier-to-market therapies (e.g., endocrine therapies, aromatase inhibitors, oral selective estrogen receptor degraders [SERDs]) and emerging novel therapies (e.g., other TROP2 inhibitors, immune checkpoint inhibitors, PARP inhibitors, vaccines). Multiple novel drug classes are being developed for metastatic HR-positive/HER-negative breast cancer with the aim of tackling endocrine resistance. These novel agents, including novel PI3K/AKT/mTOR inhibitors and ER-targeted therapies, could push the use of ADCs, including datopotamab deruxtecan, to later lines of treatment. In addition, the efficacy of sequential use of ADCs (e.g., use of datopotamab deruxtecan following treatment with ENHERTU) is uncertain and could potentially hamper the use of TROP2-agents after treatment with ENHERTU. The market entry of multiple agents creates a growing need to optimize treatment sequencing across lines of therapy, and physicians may experience challenges determining the best treatment sequence following first-line therapy.

In triple-negative breast cancer, datopotamab deruxtecan is expected to face fierce competition from TRODELVY, which has the advantage of being the first of its class to market.

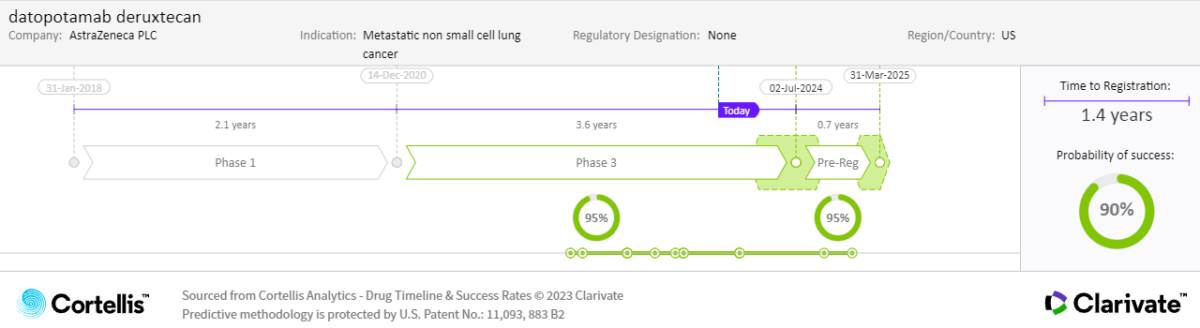

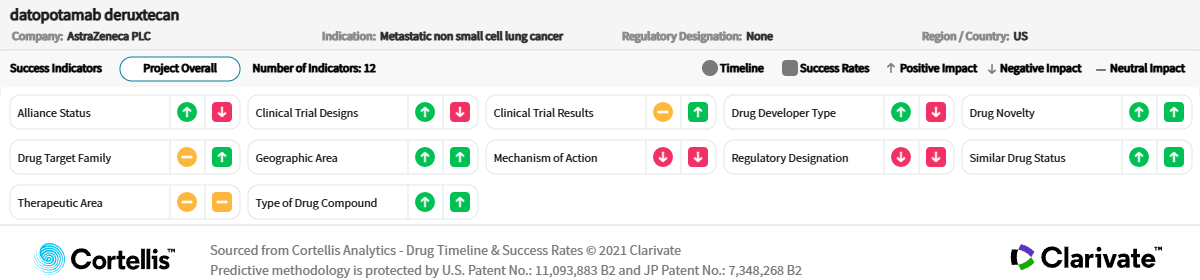

For NSCLC, similar competition from entrenched therapies (e.g., immune checkpoint inhibitors, monoclonal antibodies) and emerging therapies (e.g., antibody-drug conjugates) will need to be overcome. In first-line metastatic NSCLC, treatment choices are increasingly fragmented depending on biomarker status, and combined immunochemotherapy is a standard of care for patients without driver mutations. The addition of datopotamab deruxtecan to existing combinations will need to demonstrate convincing efficacy improvements (and a favorable benefit-risk profile) if it is to get a slice of this fiercely competitive but lucrative market segment.