About

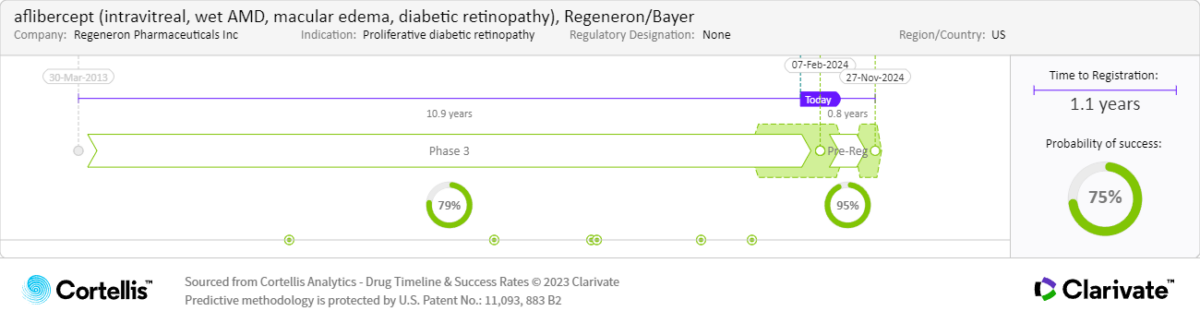

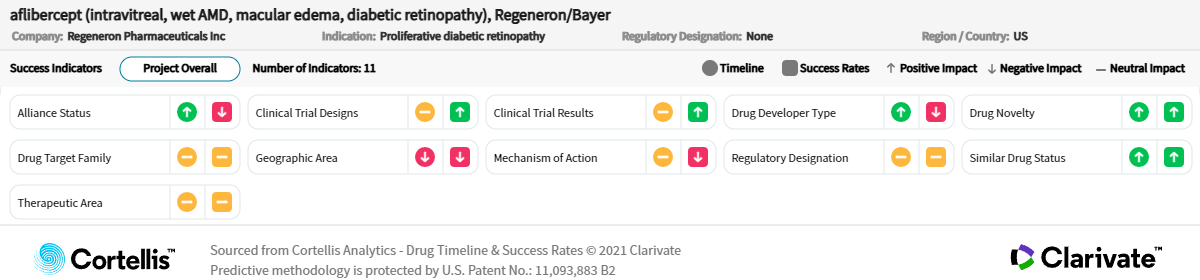

aflibercept

-

Bayer and Regeneron Pharmaceuticals Inc

-

VEGF inhibitor

-

Intravitreal (IVT) administration to treat wet AMD, DME and DR

-

Also being studied to treat macular edema secondary to retinal vein occlusion (RVO) as well as macular telangiectasia type 1

-

2.55M people in the G7 markets expected to be drug-treated for wet AMD by 2032

-

2.0M people with DME in the G7 markets expected to be drug-treated by 2032

-

~130K people with severe non-proliferative DR and proliferative DR in the G7 countries expected to receive drug treatment by 2032