-

Maintenance therapies will be the primary growth driver of the COPD market.

-

Although biologics will capture less than 1% of COPD patients, they could generate combined sales of more than $3.4 billion, contributing to nearly 14.2% of the COPD market in 2032.

-

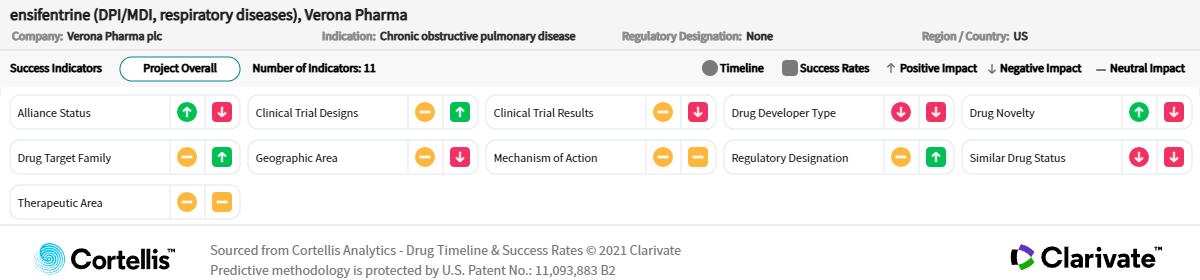

However, novel emerging therapies, such as ensifentrine, that address daily symptoms, minimize exacerbations and improve quality of life will likely contribute significantly to the COPD market toward the end of the forecast period (depending on approval).

-

Ensifentrine is in the most advanced stage of development of all novel drugs including biologics, and it will most likely be used as an add-on to a long-acting bronchodilator therapy.