Amid health system megamergers in 2023, retail giants like Amazon and Walmart joined integrated payer/providers Aetna/CVS Health, Humana, and UnitedHealthcare in evolving care delivery strategies that calcify an industry-wide movement toward a “new world” — which may one day be replete with medication-delivering drones, drugstore-owned home healthcare, and ”payvider” hegemons motivated to turn healthcare consumers into lifelong wellness patients. While the key players’ strategies differ, all are focused on bending the cost curve while increasing patient touchpoints and engagement.

Strategy #1: innovate and create

Amazon founder Jeff Bezos has said that overnight success takes about 10 years — and that ramp-up period may be what’s playing out for the ecommerce giant in healthcare. Amazon’s big splash happened in February 2023 when it purchased the national primary-care practice One Medical for $3.9 billion, following an earlier failed healthcare venture with Berkshire Hathaway and JPMorgan Chase. One Medical offers a membership-based virtual and in-person care model. Since buying the chain, Amazon has made strategic expansions of its brick-and-mortar locations (Connecticut, San Francisco, and Milwaukee), increased IDN partnerships for specialty referrals to 18, and introduced healthcare-focused subscription services, including One Medical and RxPass. RxPass offers more than 50 select prescriptions at no additional cost for $5 per month. Amazon CEO Andy Jassy recently indicated that offering One Medical memberships to Prime members at half price has seen “very good take-up.”

Amazon’s mergers, acquisitions, and partnerships (March 2023 to March 2024)

| Deal | Date | Details |

| Blue Shield of California contracts with Amazon Pharmacy | August 2023 | As part of Blue Shield’s Pharmacy Care Reimagined initiative, Amazon Pharmacy is one of five companies to deliver drugs to its members; the initiative is expected to save the insurer up to $500 million in annual drug costs |

| One Medical partnership with Virginia Mason Franciscan Health (Seattle) | November 2023 | One Medical, which has nearly 30 locations in the greater Seattle market, formed a partnership for its members to receive specialty care from the Virginia Mason Franciscan Health IDN. This IDN had signed an agreement with UnitedHealth Group’s Optum nearly five months earlier. |

| One Medical partnership with Hackensack Meridian Health (New Jersey) | November 2023 | Through One Medical’s partnership with Hackensack Meridian Health, multiple locations will open over the next several years, including are and specialty care settings” |

| One Medical partnership with national employer cooperative Health Transformation Alliance | November 2023 | HTA, a national employer cooperative with more than 4 million employees and 60 member companies including Coca-Cola, JPMorgan Chase, Walgreens and others, partners with One Medical as the employer cooperative builds a national primary-care network for its members |

| Digital health company Omada Health becomes the first partner for Amazon’s Health Condition Programs | January 2024 | Amazon’s newly launched Health Condition Programs partners with digital health companies, connecting insurance members and employees with covered digital benefits; first partner Omada Health’s cardiometabolic programs focus on preventing diabetes and managing care for patients with diabetes and hypertension |

| Horizon BCBS of New Jersey contracts with Amazon Pharmacy | February 2024 | Under the agreement with Horizon BCBS, Amazon Pharmacy’s home delivery services are available to commercial and Medicare members |

| Virtual healthcare delivery platform hellocare partnership with Alexa Smart Properties | March 2024 | Alexa’s integration with the hellocare platform allows patients to place calls and request care from doctors and nurses using just their voice through the Hello 2 device, which is plugged into their TV sets |

| Amazon Pharmacy partnership with Eli Lilly for direct-to-consumer home delivery | March 2024 | Amazon Pharmacy is one of two options (the other being Truepill) for Eli Lilly’s new direct-to-consumer service, LillyDirect, which allows consumers to obtain migraine, diabetes, and obesity drugs (including weight-loss medication Zepbound) directly from the drug company |

*Source: News reports and company releases.

More recent developments provide a look into Amazon’s interest in treating patients with chronic conditions, including a pharmacy consultation pilot for high-risk seniors with complex medical needs. A patient’s provider can request pharmacy consultations in an initiative described as helping patients who would otherwise qualify for home hospital services. Amazon also introduced Health Condition Programs, which partners with digital health companies such as Omada Health to connect members of health plans and employer-sponsored insurance with covered digital benefits. In classic Amazon style, its pharmacy offers two-day shipping on prescriptions by mail, with same-day delivery available in seven markets, with plans to add a dozen more cities by year end. In College Station, Texas (northwest of Houston), eligible Amazon Pharmacy customers can get their prescription dropped outside their door by drone delivery within one hour. In 2024, watch as the global trendsetter brings to bear its technological expertise combined with a captive Prime membership, brand recognition, and national employer buy-in to re-envision healthcare that truly works around the patient.

As Amazon taps technology to rewire healthcare and medicine delivery, employee-owned supermarket chain Hy-Vee is launching new programs that draw consumers to its robust retail health and pharmacy business, which includes a fleet of mobile health units and numerous healthcare clinics operated by provider partners, among other services. In the last year, Hy-Vee inked a new direct primary care partnership with Exemplar Care in Iowa and launched a Smart Benefits program with health technology company Soda Health to offer personalized health and wellness benefits like nutritional counselling and incentives for fresh produce. Hy-Vee also opened its first multispecialty infusion clinics in West Des Moines, Iowa and Chicago, with limited distribution medications through subsidiary Amber Specialty Pharmacy. Other highlights include a new health and wellness subscription for consumers that includes preventative health screenings and nutritional counselling. Keep an eye on Hy-Vee as the retailer steadily builds an empire of subsidiaries and partnerships that anchor it to consumers, patients with chronic conditions and employers.

Strategy #2: recalibrate

As Amazon and Hy-Vee find new ways to engage patients, Walgreens is reconsidering its aggressive growth plans for majority-owned subsidiary VillageMD under new leadership. As the dust settles on a series of acquisitions from 2021 to 2023 (including VillageMD, Summit Health/CityMD, Shields Specialty Pharmacy, and home healthcare company CareCentrix), the drugstore giant is conducting “an intense review” of assets and is shedding approximately 160 underperforming VillageMD sites (which are part of its U.S. Healthcare segment) across the nation as part of a $1 billion cost-cutting strategy. Divesting clinics (as VillageMD did in Rhode Island in March 2024) rather than closing them altogether may play into this strategy as well. At the time of reporting, Walgreens had exited 140 locations including ones in Florida, Indiana, Massachusetts, Nevada, New Hampshire, Rhode Island, and Illinois, where VillageMD had just opened a new Chicago clinic in fall 2023.

The downsizing is not a total reversal of Walgreens’ aggressive primary-care clinic expansion plan (which in 2021 imagined 1,000 VillageMD clinics by 2027), but rather a reallocation of capital to increase VillageMD’s density in “high-opportunity” markets—i.e., those with high patient volumes. After all, Walgreens sees “rightsizing” and “optimizing” VillageMD as integral to recovering from multi-billion dollar operating losses in fiscal year 2023. In its second-quarter earnings call in March 2024, Walgreens reported it had delivered its first-ever quarter of positively adjusted EBITA for its U.S. Healthcare segment and another quarter of significant year-on-year growth led by both Shields and VillageMD.

Walgreens mergers, acquisitions, and partnerships (March 2023 to March 2024)

| Deal | Date | Details |

| Acquisition of post-acute and home health care company CareCentrix | March 2023 | Under the deal, CareCentrix CEO John Driscoll joined Walgreens as the president of Walgreens’ U.S. Healthcare sector before being replaced by Mary Langowski in February 2024 |

| Partnership with Pearl Health | September 2023 | By leveraging Pearl Health’s value-based care platform, Walgreens hopes to be the “partner of choice for providers and health systems looking to transition quickly and effectively to value-based care” |

*Source: News reports and company releases.

Strategy #3: execute

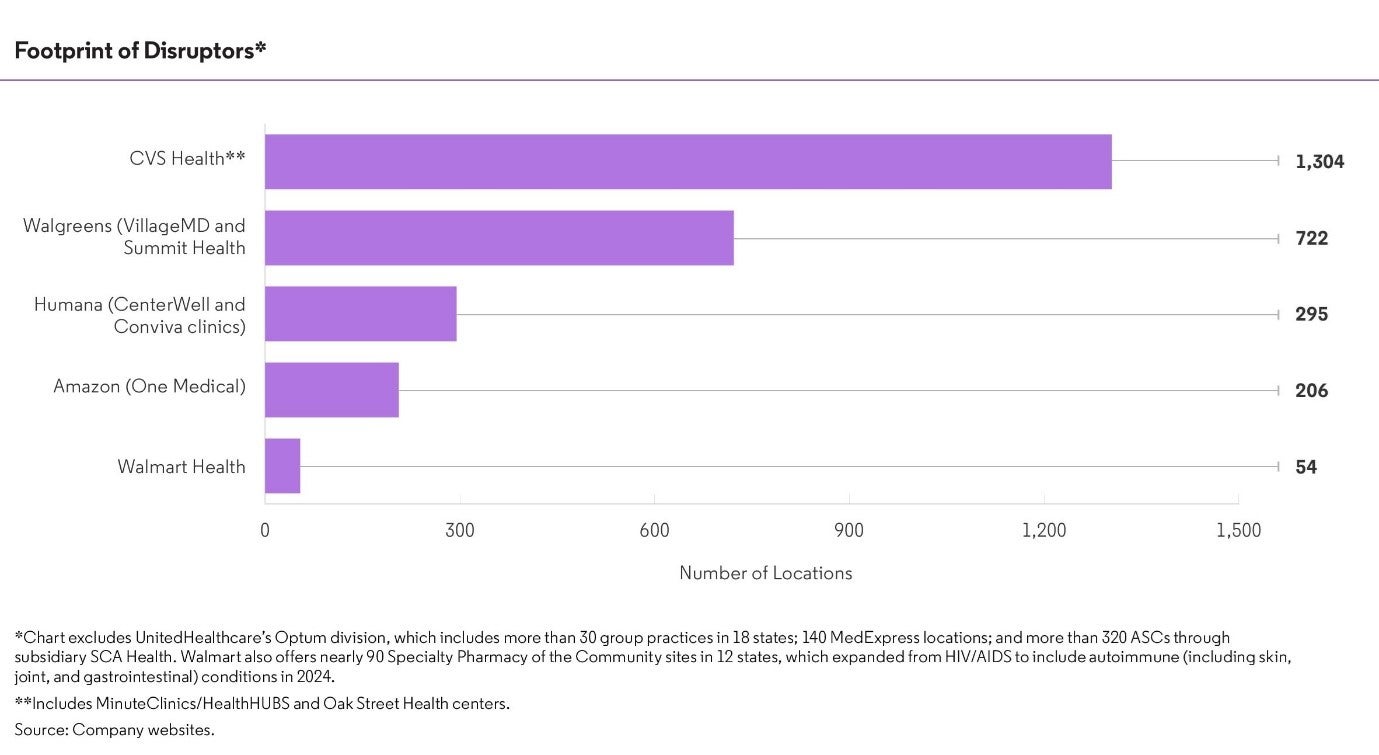

CVS Health, Humana, UnitedHealthcare and Walmart are executing geographic and clinical scale-up plans in 2024 through new merger and acquisition activity (including partnerships) and capital expansion projects. While CVS Health recently shuttered nearly 30 MinuteClinics in Southern California and New Hampshire as part of a massive downsizing plan first announced in 2021, the payvider still has ambitious growth plans for its senior-centered primary-care subsidiary Oak Street Health. Oak Street opened as many as 35 locations in 2023, and expects to open 50 to 60 additional centers by the end of 2024. CVS leverages its various other assets of pharmacy and home health (through Signify Health) to drive volume and patient engagement at Oak Street, especially for Aetna Medicare Advantage members. As of January 2024, CVS reported the number of Aetna members being treated by Oak Street had doubled.

CVS Health’s mergers, acquisitions, and partnerships (March 2023 to March 2024)

| Deal | Date | Details |

| Acquisition of home healthcare provider and value-based care enabler Signify Health | March 2023 | CVS Health acquired Signify Health for $8 billion; with 11,000 clinicians in 50 states, Signify offers home visits to identify chronic conditions, close gaps in care, and address social determinants of health. Signify’s healthcare platform also assists 65,000 provider partners to participate in value-based care with nearly 1 million attributed lives |

| Oak Street Health acquisition | May 2023 | CVS acquired Oak Street for $10.6 billion; the payer-agnostic, value-based primary-care network includes 600 primary-care providers and more than 200 centers in 25 states |

| CVS Accountable Care collaboration with The Ohio State Wexner Medical Center | January 2024 | The CVS ACO participates in the Medicare Shared Savings Program Enhanced track, initially supporting the care of Medicare beneficiaries following hospitalization |

*Source: News reports and company releases.

Humana is following a similar growth strategy as it sharpens competition with UnitedHealthcare in the Medicare Advantage sector. In 2023, Humana’s care delivery component CenterWell launched a senior-centered “Primary Care Anywhere” program for in-home primary care in Georgia and Louisiana (where Humana leads the MA sectors) and increased senior membership in value-based home care models nationwide to more than 840,000. Humana is also on track to add 30 to 50 new senior-focused primary-care centers each year through 2025.

Humana’s mergers, acquisitions, and partnerships (March 2023 to March 2024)

| Deal | Date | Details |

| Expansion of partnership with Aledade, a value-based independent primary-care network | March 2023 | Under the 10-year agreement, Aledade physicians provide risk-bearing care to Humana seniors in both established and new markets |

| Acquisition of senior-focused clinics from Cano Health, a value-based primary-care company | September 2023 | The clinics are in Texas and Nevada, where Humana lags UnitedHealthcare’s MA enrolment by wide margins |

| Partnership with Greater Good Health, a value-based primary-care company | October 2023 | Humana and Greater Good Health opened new clinics in Missoula, Billings, and Great Falls |

| Partnership with Patina, a patient-centered primary-care company | January 2024 | Patina now provides virtual and in-home primary-care services to Humana’s MA members in Charlotte, North Carolina starting Nov. 01, 2023; this expansion builds on an existing partnership with Patina in Philadelphia |

| Expansion of partnership with Strive Health, a kidney care provider | March 2024 | Strive Health now offers Humana MA members in Indiana, Illinois, Kentucky, Michigan and northwest California access to value-based kidney care, including medication management and transplant coordination; the agreement builds on an existing relationship that began in 2020 |

*Source: News reports and company releases.

UnitedHealthcare may assert further dominance over Humana if its acquisition of home healthcare company Amedisys closes, a controversial transaction thwarted by antitrust concerns and legal pushback from a February 2024 cybersecurity attack on subsidiary Change Healthcare, which the American Hospital Association referred to as “the most significant and consequential incident of its kind against the U.S. health care system in history“. But, even without Amedisys, the insurer still has home healthcare company LHC Group, acquired in early 2023, and will leverage a long-term partnership with Walmart plus the nation’s largest network of employed and affiliated physicians through Optum to manage patient health and drive down costs for vulnerable patients. The pending acquisition of Stewardship Health, the physician component of the financially ailing, Dallas-based Steward Health Care, would add as many as 5,000 physicians to Optum’s physician network and mark Optum’s entry into several new states, including Louisiana, where UHC falls behind Humana in terms of market share.

Optum’s mergers, acquisitions, and partnerships (March 2023 to March 2024)

| Deal | Date | Details |

| Patient referral partnership with Virginia Mason Medical Center in Seattle | June 2023 | The Polyclinic (which Optum acquired in 2018 and will rebrand as Optum in April 2024) now refers patients to Virginia Mason Medical Center for inpatient care; the agreement also calls for Virginia Mason and Optum to co-manage Virginia Mason’s Medicare Advantage patients; Virginia Mason serves as a Center of Excellence for spine surgery in the CEO program at Walmart (a partner of UnitedHealthcare) |

| Acquisition of home healthcare provider Amedisys | Pending (agreement signed in June 2023) | A few months after acquiring home health firm LHC Group, Optum announced its planned acquisition of Amedisys, which provides post-acute care and home healthcare across more than 500 locations in 37 states and D.C.; the company includes more than 102,000 physicians |

| Acquisition of Corvallis Clinic in Oregon | Emergency approval for the acquisition granted by Oregon Health Authority in March 2024 | 100 providers faced significant pushback from physicians, patients, and other community members; Corvallis filed an emergency application in early March asking for the deal to be expedited to avoid service delays for patients |

| Acquisition of Stewardship Health (the physician component of Steward Health Care) | Pending, announced March 2024 | The acquisition would add as many as 5,000 physicians to Optum’s physician network and mark Optum’s entry into Arkansas (where UHC leads the MA sector by nearly double that of Humana), Louisiana (where Humana has a healthy MA lead), New Hampshire (where UHC dominates the MA space, and Pennsylvania (where UHC falls into fourth place for MA) |

Like Humana, Walmart is planning to open nearly 30 new Walmart Health centers by the end of the year. It signed its first health system partner Orlando Health in November 2023 to coordinate care for its patients who receive services from the IDN, helped in part by the fact they both use the Epic EHR. The partnership indicates Walmart will tap health systems — potentially those already affiliated with Walmart through the Center of Excellence program — to help improve care coordination between primary and specialty care.

Walmart’s mergers, acquisitions, and partnerships (March 2023 to March 2024)

| Deal | Date | Details |

| Walmart partnership with Lyra Health for its employees | April 2023 | California-based Lyra Health agreed to facilitate mental health education for the company’s leaders and managers, teaching them how to deal with associates struggling with a behavioral health challenge |

| Walmart Health partnership with Orlando Health | November 2023 | Walmart Health and Orlando Health have agreed to coordinate care for their patients |

| Walmart Health partnership with Ambetter from Sunshine Health (Centene) | November 2023 | Walmart Health centers are a preferred provider for health insurance exchange members of Centene’s Ambetter from Sunshine Health plan in select Florida counties |

CONCLUSION

The pace of change in healthcare continues to accelerate following major milestones that include 2010’s Affordable Care Act and its subsequent—and ongoing—support of innovative care delivery models, and the COVID-19 pandemic, which brought care settings such as telehealth and the patient’s home to the forefront. At the heart of this change is the ability to manage care for high-risk patients with multiple chronic conditions effectively, and it remains to be seen which disruptive healthcare players can bring this model to scale at a time when relative outsider Amazon has entered the scene.

In the near term, watch as Amazon, brick-and-mortar retailers like Hy-Vee and Walmart, and payviders accelerate care delivery through various inorganic and organic growth strategies. Amazon’s pace-setting innovation strategy, Walgreens’ recalibration strategy, and the execution of CVS Health will tell whether these disruptors can bring their model to scale more quickly and effectively than traditional players—or whether traditional players will prove integral to these disruptors’ success.

| Player | Future growth plans |

| UnitedHealth Group (Optum) | UnitedHealth Group announced plans in March 2024 to acquire Steward Health Care’s medical group of up to 5,000 providers in nine states. It purchased dozens of ASCs in 2023; a fast-track acquisition of The Corvallis Clinic is underway in Oregon; and Optum planned to begin work on a $3.5M, three-story office building in Tacoma, Washington in early 2024. In 2019, UnitedHealth Group CEO David Wichmann indicated a plan to make Optum a $100B business by 2028, including by partnering with health systems for administrative services such as RCM and IT. |

| Walgreens (VillageMD and Summit Health) | Prior to incurring operational losses in 2023, Walgreens’ growth plans announced in 2021 called for expansion to 1,000 VillageMD clinics by 2027. Now, Walgreens is focused on “rightsizing” and “optimizing” VillageMD by shedding approximately 160 underperforming sites across the nation. |

| Humana (CenterWell and Conviva clinics) | Humana’s growth target is 30 to 50 clinics annually for a total of 100 new clinics between 2023 and 2025. It expected to end 2023 with net growth of 60 to 65 clinics, including the 24 centers it acquired from Cano Health in Texas and Nevada (half of which were expected to be consolidated into existing centers or closed by year-end 2023). |

| Amazon (One Medical) | In 2022, One Medical planned to expand to markets accounting for 40 percent of the U.S. population (pediatric, adult, and senior care). Additional Amazon One medical offices are expected in Milwaukee in early 2024; three additional clinics are expected to open in Connecticut (for a total of five); and one location is expected in New Jersey in 2024, with multiple other New Jersey locations planned over the next several years. |

| CVS Health (Oak Street Health) | Oak Street Health opened 35 centers in 2023, entering four new states, and it will build 50 to 60 more clinics in 2024. CVS expects to accelerate Oak Street’s footprint expansion in coming years, with previously stated plans of having more than 300 centers in total by 2026. |

| Walmart Health | Walmart Health is on track to have more than 75 centers nationwide by the end of 2024. |

*Source: News reports and company releases.

Learn more about how Clarivate helps life science companies navigate market access here.

This post was written by Renée Burnham and Michelle La Vone. Renée Burnham is a manager within Clarivate Market Access Insights where her role encompasses content review and operational support. With a keen eye on the industry’s pivotal shift from volume to value, her expertise lies in navigating the complex landscape of market access and population health management. She is dedicated to helping clients enhance patient and community outcomes through strategic and innovative approaches that account for broad market influences. Michelle La Vone has been with Clarivate Market Access Insights (formerly Decision Resources Group) since 2013. As a lead healthcare research and data analyst, she analyses the Texas and Georgia healthcare markets and tracks the rapidly evolving convenient care industry.