Payers’ reaction to the newly approved obesity drugs suggest manufacturers are offering significant rebates to reduce the use of restrictions and even facilitate preferred access.

Long available for type 2 diabetes, the GLP-1 agonists expanded into weight management with approval of Saxenda® (liraglutide) by the United States Food and Drug Administration (FDA) in 2014. However, the potential of this drug class was turbocharged by the FDA’s December 2017 approval of Novo Nordisk’s weekly injectable Ozempic (semaglutide) and May 2018 approval of Eli Lilly’s dual agonist Mounjaro (tirzepatide), both for type 2 diabetes.

Expansion from type 2 diabetes to obesity

The ability of Ozempic® and Mounjaro® to not only improve glycemic control but also significantly reduce patients’ weight made these drugs obvious potential treatments for obesity, a disease estimated to cost the U.S. nearly $173 billion annually (Ward, et. Al, 2021).

Following their approvals in diabetes, some physicians prescribed Ozempic and Mounjaro off label as manufacturers separately worked to repurpose these drugs specifically for obesity. The FDA eventually approved Wegovy (semaglutide) in 2021 for adult patients with a body mass index of:

- ≥30kg/m2 (obese) or

- ≥27 g/m2 (overweight) with at least one other weight-related comorbidity (e.g., type 2 diabetes).

The FDA in December 2023 approved Lilly’s Zepbound (tirzepatide) for the same population.

While offering a much-need treatment option for patients, this class of drugs rang alarm bells for payers once the budget impact was calculated — at an annual cost of nearly $18,000, based on wholesale acquisition cost combined with an adult obesity prevalence rate of 41.9% in 2017 (National Health and Nutrition Examination Survey, 2020).

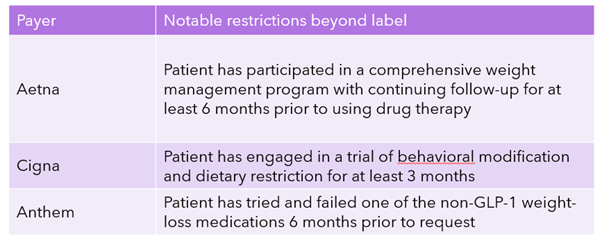

While this situation commonly would drive payers to sharply constrain access through onerous prior authorization rules, restrictions data suggest that many commercial payers are allowing use of Wegovy® by patients meeting the BMI requirements if they have either failed on previous treatment or have taken part in a weight management program. Notably, Elevance Health, parent of Anthem, announced in February 2024 a program to provide coaching and tools to help customers monitor weight loss, essentially offering the same benefit other insurers were requiring for GLP-1 use.

Table 1: Initial use restrictions for Wegovy by commercial plans

Source: Clarivate Fingertip Restrictions and payers’ respective prior authorization documents

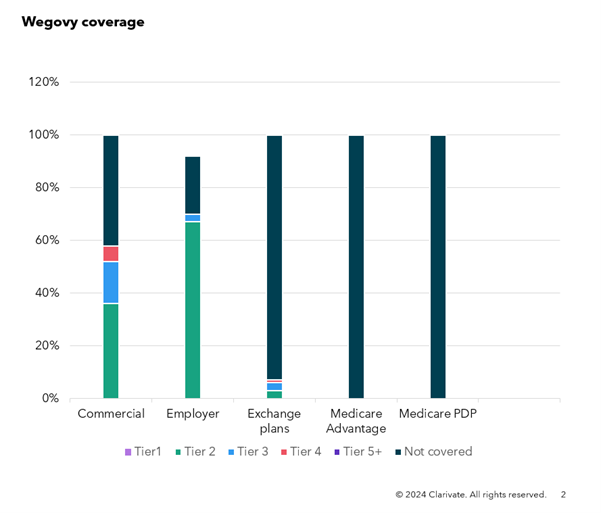

In addition to a relatively light hand in restricting access, Aetna, Cigna, and Anthem list Wegovy on Tier 2 of their commercial and employer formularies, reflecting widespread coverage for the drug (Fingertip Analytics, accessed February 2024). In its fourth-quarter earnings call, Novo Nordisk estimated that about 50 million Americans with obesity now have access to Wegovy. Supply constraints limited the availability of Wegovy in 2023, which generated net sales of $920 million in the U.S. (6.13 billion Danish kroner).

Reimbursement appears particularly strong in employer plans that are typically self-insured and therefore have a financial incentive for their employees to live healthier lives. Added to that is the potential push for including obesity treatments in state mandates for payers, as demonstrated by this recently filed Missouri bill.

How long this favorable environment lasts will be up to payers. Employers appear to be moving in the opposite direction, limiting or ending access, creating annual per-member spending caps, or in the case of Cigna limiting year-over-year price increases.

Figure 1: Reimbursement of Wegovy in commercial plans, February 2024

Source: Clarivate Fingertip Analytics, accessed February 2024

Source: Clarivate Fingertip Analytics, accessed February 2024

Likely impact of rebating

The current highly favorable reimbursement environment for Wegovy is likely tied to extensive rebates offered by Novo Nordisk to payers. Like most life science companies, Novo does not disclose the size of drug-specific rebates, but the company said in its 2023 annual report that rebates in the U.S. erased 74% of gross sales, including rebates for managed care plans, Medicare, Medicaid and the 340B Drug Pricing Program. In all, discounts and rebates for U.S. managed care and Medicare alone exceeded $30 billion in 2023 (223.2 billion Danish kroner). In addition to obesity, Novo is heavily involved in the competitive diabetes sector, which is known to be highly rebated.

Table 2: Novo Nordisk gross and net sales globally

Source: Novo Nordisk 2023 annual report

Notably, Novo does not separate commercial health plans from Medicare in its filing, but Wegovy’s favorable commercial coverage does not appear to extend to Medicare plans and those on the health insurance exchange, which may reflect payers’ attempt to avoid adverse selection or a decision by the manufacturer to not rebate as heavily in this channel.

While Wegovy’s performance is instructive, Zepbound’s relatively recent approval leaves limited data from which to analyze. However, Cigna’s Tier 2 coverage of the drug on its commercial plan suggests Lilly may also be employing a similar rebating strategy.

With supply issues resolving, Novo Nordisk and Eli Lilly start 2024 in a heated competition over patient share in this booming market. Payer reactions will continue to be guided by pricing and contracting with the added wrinkle of potential regulation.

Clarivate helps life science companies navigate a fast-changing market access environment across global markets. Learn more about our market access solutions here.