Pharmacy benefit managers, M&A activity among integrated delivery networks, disruption by nontraditional healthcare entities, enrollment, and the 2024 presidential election are five areas to pay attention to moving into 2024. Clarivate experts explain why these topics are ones to watch in 2024.

PBMs in the spotlight

Pharmacy benefit managers (PBMs) will be under the microscope in 2024, both in terms of how they manage certain drugs as well as the impact they have on drug pricing and buying. Five specific areas will bear monitoring as PBMs attempt to navigate a potentially choppy 2024.

The weight loss drug conundrum

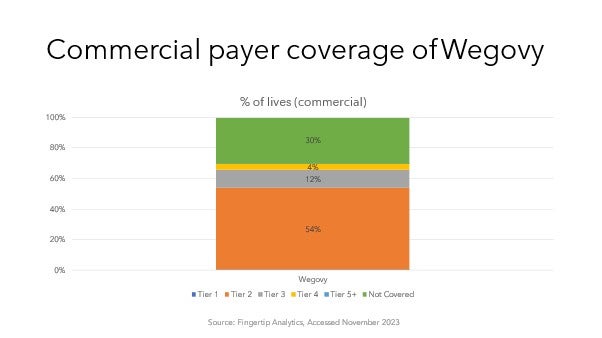

PBMs may rethink their coverage policies for GLP-1 receptor agonists after the November 2023 approval of Eli Lilly’s Zepbound™ whose active ingredient was already available as diabetes drug Mounjaro® and which joins Novo Nordisk’s Wegovy® among the latest class of FDA-approved options. The potential of GLP-1s has already propelled both companies’ share prices, but also represents a budget impact for payers. With analysts estimating that obesity drug sales could top $100 billion annually, concerns over the financial hit is likely why plans covering 30% of lives do not reimburse Wegovy, per Clarivate Fingertip Analytics data. The arrival of a second drug may drive PBMs to expand coverage in exchange for aggressive rebates.

Biosimilar strategies

PBMs will get another bite of the biosimilar apple with the expected approval of the first biosimilar versions of EYLEA® in 2024. The experience of biosimilars in oncology (bevacizumab and trastzumab) and ophthalmology (ranibizumab) has already shown aggressive contracting by manufacturers. Now Medicare Advantage plan-aligned PBMs are awaiting the first biosimilars of ophthalmology treatment EYLEA – the No. 2 Medicare Part B drug in terms of 2021 spending – that are expected to launch next year. Given the sheer number of EYLEA biosimilars in pipeline, payers are likely to limit coverage to just a few in exchange for hefty rebates.

Manufacturer pricing strategies

PBMs’ negotiating processes are increasingly drawing scrutiny, particularly as they affect the industry. Amgen in 2023 launched its adalimumab biosimilar with two different NDC codes and wholesale acquisition costs; this strategy is believed to appeal separately to PBMs that value bigger rebates over lower WACs vs. MCOs that favor low net costs. However, the PBM-focused strategy can result in higher out-of-pocket costs for patients who pay coinsurance for drugs based on WAC prices and may spur further criticism.

Internal reorganizations

While group purchasing organizations are common for buy-and-bill activities, PBMs have formed their own internal GPOs such as Ascent Health Services and Zinc health Services as carveouts of their traditional manufacturer rebate negotiations. Although a seemingly minor move, the formation of a GPO may provide safe harbor protections shielding their contracting operations from potential accusations of violating anti-kickback statutes.

Catching the eye of Washington

The rise of PBMs finds them under increasing scrutiny as stakeholders look to point the finger at who is driving up drug prices. The Federal Trade Commission has already demanded records from the largest PBMs while states and federal legislators are increasingly (but unsuccessfully to date) filing bills to increase transparency over PBM operations – a topic that may crystalize during an election year.

IDNs coalesce along Competitive Service Regions

As nonprofit IDNs push out from their home markets and for-profit and Catholic IDNs pull back from earlier expansions, distinct competitive service regions with common rivalries are developing across the nation. The most attention-getting M&A activity has happened as contiguous markets merge into larger regions, but less populated areas are seeing under-the radar consolidation that could accelerate as national players and academic medical centers acquire smaller systems.

For example, in Illinois and Wisconsin, Advocate Health and Ascension have focused along the West Shore of Lake Michigan, prompting Milwaukee’s Froedtert Health to propose merging with ThedaCare in the Fox Valley, creating a locally based IDN that mirrors the footprint of the national IDNs in the Badger State. To the west, Duluth, Minnesota-based IDNs Essentia Health and St. Luke’s Duluth are in the process of merging with central Wisconsin IDNs Marshfield Clinic and Aspirus Health, respectively; the latter pair each grew by buying discarded hospitals from Ascension. As the Northern Tier coalesces around Essentia/Marshfield and Aspirus/St. Luke’s, a few independent hospitals in the area have proposed merging into Tamarack Health to preserve their autonomy.

Similar jostling is happening across the nation, from Western Montana (where Billings Clinic and Logan Health merged in September 2023 after Utah-based Intermountain Health acquired SCL Health) to Upstate New York (where Arnot Health and Cayuga Health System plan to merge as Guthrie Clinic is buying an Ascension castoff in Binghamton). Expect more mergers between IDNs in contiguous markets, such as the I-4 corridor in Florida, Eastern Pennsylvania, and across the Mountain West.

After Kaiser Permanente completes its acquisition of Geisinger Health, we should learn more about which other IDNs will be targets of KP’s new expansion vehicle, Risant Health. Will Risant grow from Geisinger’s northeastern Pennsylvania base into neighboring Lehigh Valley, acquire a Geisinger-like IDN elsewhere (such as Carle Health in Central Illinois), or build out in major markets where KP already has health plan operations but a smaller acute-care presence (such as the Pacific Northwest or Denver).

Nontraditional entrants counter IDN dominance, disrupting the status quo

2023 was a watershed year for investments by giants Amazon, CVS Health, Walgreens, and Walmart as they scooped up primary-care chains and home health companies and announced expansions, leaving health systems concerned about whether they would measure up in patient convenience and access. In 2024, these conglomerates will continue their momentum to expand brick-and-mortar footprints and seek IDN partnerships.

Payers will continue to take ownership of providers, with numerous Blue plans staking a claim to settings where they can funnel patients to lower-cost care. At the top of this list is UnitedHealth Group’s Optum with 70,000 employed or affiliated physicians; and Humana, the country’s second-largest Medicare Advantage insurer, with its CenterWell and Conviva clinics.

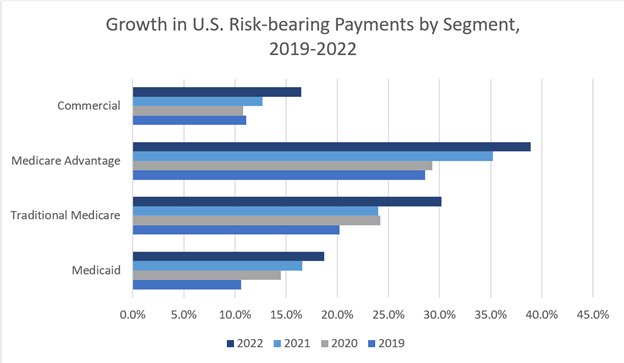

Underpinning these shifts is the gradual march of value-based care, with the Center for Medicare and Medicaid Innovation setting the goal of having all Medicare beneficiaries in an accountable care relationship or Medicare Advantage plan by 2030, and the vast majority of Medicaid recipients in such an arrangement. Typically, BCBS plans offer an iteration of VBC to providers in their state. Including their subsidiaries, Amazon, CVS, Walgreens, Optum, and Humana all participate as a Medicare Shared Savings Program (MSSP), ACO or in the newly launched ACO REACH program.

Source: Health Care Payment Learning & Action Network. Measuring Progress: Adoption of Alternative Payment Models in Commercial, Medicaid, Medicare Advantage, and Traditional Medicare Programs. Oct. 30, 2023.

Laid bare by the pandemic, social determinants of health have also entered the lexicon. Medicare is a proponent of health equity, introducing Z codes in 2016 for tracking patients’ social needs, and requiring ACO REACH participants to “make measurable changes to address health disparities.” This industry focus will remain with us as long as social determinants affect health outcomes, even if progress comes incrementally around the margins.

2024 Presidential Election

For the first time in decades, healthcare reform is unlikely to take a central role in the presidential campaign, despite likely Republican candidate Donald Trump’s recent vow to repeal the Affordable Care Act. Republicans have pivoted away from efforts to completely overturn the ACA while court cases to undo parts of the law such as prevention care and contraception coverage are ongoing. Democratic lawmakers have made several enhancements to the Act through the American Rescue Plan and the Inflation Reduction Act.

Congress enacted reforms in the 2022 Inflation Reduction Act are far-reaching for the pharmacy industry and will be touted by the Biden reelection campaign but expect little emphasis on new reforms from President Joe Biden or his likely opponent, former President Donald Trump. The IRA does not incite nearly the opposition from politicians as the Affordable Care Act did during its early years, so changes in a new administration would not be major. Changes to the IRA provisions about drug negotiation and inflationary rebates are unlikely to be diminished by either administration given their impact on the Medicare-age population. While PBMs have been in the legislative spotlight in the Senate with bipartisan support for regulations, there won’t gain much attention during the 2024 campaign.

The arrival of another “subsidy cliff” when enhanced exchange subsidies expire in 2025 could receive a spotlight but it won’t enter the top 5 or even 10 issues around which the 2024 campaign will center. If 2025 starts with another split Congress or total Republican control, subsidies face a much tougher road for renewal.

Enrollment

Every segment of the health insurance market faces opportunities and challenges for 2024, although Medicaid will be the only segment certain to see enrollment losses. Health insurance exchange and Medicare Advantage markets should continue to see healthy returns.

The full impact of Medicaid unwinding will be felt by mid-2024, although it has been less than expected and most disenrollments have been due to technical factors, not members no longer being eligible. Some states, such as New Mexico, delayed new Medicaid MCO contracts to begin enrolment after redeterminations are complete. Carriers with large Medicaid exposure such as Centene have shifted those members losing coverage to exchange plans where subsidies can cover most premium costs.

Exchange plans have become an increasingly integral part of the coverage spectrum, extending coverage to those who lose Medicaid coverage while offering income-based subsidies to higher earners not eligible for coverage. Commercial group plans could see a small bump if people no longer eligible for Medicaid have access to employer coverage. Overall, 2024 should be a steady year for exchange business, although there will be growing pressure to avoid a “subsidy cliff” and keep the popular expanded subsidies past their expiration in 2025.

Medicare Advantage (MA) plans cover more than half of all Medicare beneficiaries and should continue to grow among the senior population aging into Medicare. However, there are some warning signs from providers that could stunt MA growth. A number of providers have begun leaving MA provider networks, reporting major losses on MA business and high claim and prior authorization denials. Systems shedding MA business include San Diego’s Scripps Health, Oklahoma’s Stillwater Medical Center, and Brookings Health System in South Dakota. In Kentucky, Louisville-based Baptist Health even dropped Louisville-based carrier Humana. Losing network providers has always been a key driver in which Medicare Advantage plan beneficiaries pick. If the number of systems letting contracts end widens, the MA growth rate could see reduction in coming years.

This report was authored by: Roy Moore, Senior Healthcare Research & Data Analyst; Renée Burnham, Manager, Healthcare Research & Data Analyst, Content; Mark Cherry, Lead Healthcare Research and Data Analyst, Content; and Bill Melville, Lead Healthcare Research and Data Analyst, Content.

For more on the forces driving IDNs, please view our recent webinar on IDN and provider trends. You can learn more about how Clarivate helps life science companies understand the provider landscape and navigate market access here.