When global trademark filing activity fell in 2022, questions rose around what this signified. Would 2023 data show a second year of decline, indicating uncertain economic outlooks? Or would filing activity recover?

To answer this question, we dove into curated trademark data from CompuMark™ to analyze application and filing history. With access to over 147 million trademark records, including application and filing history gathered directly from Patent and Trademark Offices (PTOs) such as the European Union Intellectual Property Office (EUIPO), we extracted trademark intelligence that revealed macro-trends and key market insights.

The significance of EUIPO trademark filing trends

The EUIPO is one of the world’s most important trademark registers. It covers a commercial market with 27 member countries, a population of over 450 million people (larger than the United States), and an economy estimated to have a combined GDP of over $ 18 trillion USD in 2023 (larger than Mainland China).

This coveted market is a hub for global trademark activity, with the trends seen at the EUIPO acting as an indicator of broader global trademark strategic trends. Analyzing activity here helps us to spot potential risk development, flag areas of growth and reveals the priorities of major actors.

Poland and Mainland China drive 2023 growth trend

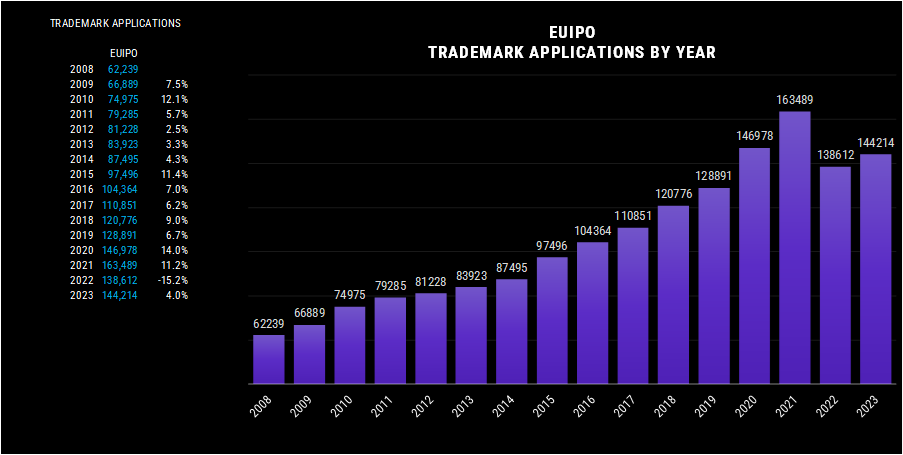

Total filing volume (144,214 applications) for European trademarks (EUTMs) in 2023 was 4% higher than in 2022 (138,607 applications), with much of the growth due to increased filing activity from Mainland China and Poland.

Source: CompuMark SAEGIS®

EU based applicants accounted for around 63% of applications, while Mainland China (15%) and the US (7%) were also significant sources of work. Applicants from Poland filed more EUTM applications in 2023 than applicants from the UK. This indicates that Polish companies are becoming more commercially active in the EU. Applications from Mainland China were up by 9% compared with 2022, while Polish applicants filed 19% more EUTM applications than in 2022. Applications from the United States fell by 12%.

Filing volume by applicant nationality in 2023 at the EUIPO:

1. Mainland China – 21,701 (up by 9% compared to 2022)

2. Germany – 19,391 (down by 3%)

3. Italy – 12,380 (down by 2%)

4. Spain – 10,989 (up by 7%)

5. United States – 9,399 (down by 12%)

6. France – 7,221 (up by 3%)

7. Poland – 6,573 (up by 19%)

8. United Kingdom – 5,741 (down by 4%)

9. Netherlands – 5,037 (up by 4%)

10. Austria – 3,494 (up by 2%)

11. Sweden – 3,296 (down by 8%)

12. Belgium – 2,314 (no change)

United States filings in European Union lose steam as Mainland China surges

The Top 75 representatives at the EUIPO in 2023 between them filed nearly 44,000 EU trademark applications this year – that’s almost one in every three EUTM applications filed.

Five of the top 10 representatives at the EUIPO in 2023 were based in Spain, with all ten of the leading representatives by filing volume acting mainly for applicants from Mainland China:

Source: CompuMark

The merger between Arpe Patentes y Marcas and H&A (Herrero and Asociados) in November 2023 created a practice that together filed over 2,000 EUIPO applications in 2023, which would have placed the merged firm in third place.

Representatives based in Spain led the list with 18 entries. Poland is making a mark again with five representatives. The majority of Spanish and Polish representatives act mainly for clients from Mainland China.

Top 75 representatives in 2023 at the EUIPO – location:

Spain – 18

Italy – 11

Germany – 10

Multiple locations – 8

Poland – 5

France – 5

Netherlands – 4

Ireland – 4

Sweden – 2

Lithuania – 1

Romania – 1

Luxembourg – 1

Slovak Republic – 1

Cyprus – 1

Greece – 1

Finland – 1

Belgium – 1

25 of the top 75 representatives filed EUTM applications in 2023 mainly for clients based in Mainland China. Applicants from the United States continue to instruct firms with a presence in the United Kingdom to manage their EUTM portfolios, although the downturn in work from the US in 2023 saw most of these firms filing fewer EUTM applications than in 2022.

Application and filing growth signals increasingly complex risk landscape

Last year saw a return to more predictable trademark filing activity at the EUIPO after three consecutive years of unprecedented growth and decline, with filing volume steady throughout the year and a particularly strong fourth quarter.

High interest rates and cost of living issues do not appear to be strongly impacting brand creation and investment, which suggests that 2024 should see increased demand for EUTM applications and growth in the range of 4% to 6%.

With a focus of Mainland China on the EU market and thriving innovation domestically, the risk landscape of creating and protecting brands will likely grow in complexity in 2024.

Contact us today, to learn how Clarivate can help you build and protect strong brands in a complex risk landscape with our market-leading Full Availability Search and Trademark Watch solutions.