About JANUVIA®

-

Marketed by Merck & Co

-

Dipeptidyl peptidase-4 (DPP-IV) inhibitor to treat type 2 diabetes

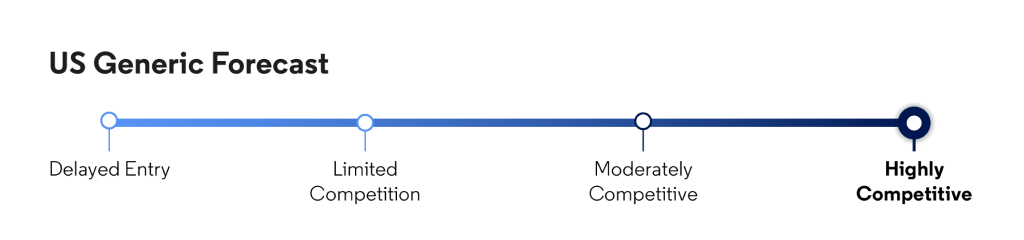

Will Merck settle with more generic filers? How many generic entrants will we see, and how quickly will prices erode for this top-selling drug?

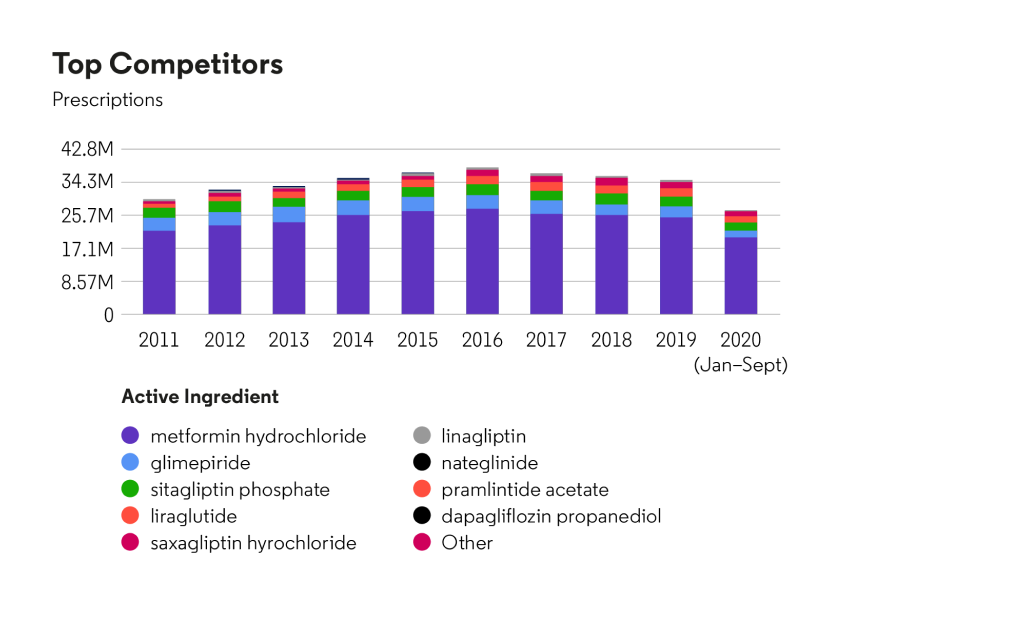

U.S. market share analysis for competitors in the therapeutic area “Drugs used in diabetes”: prescription count

Source: Cortellis Generics Intelligence

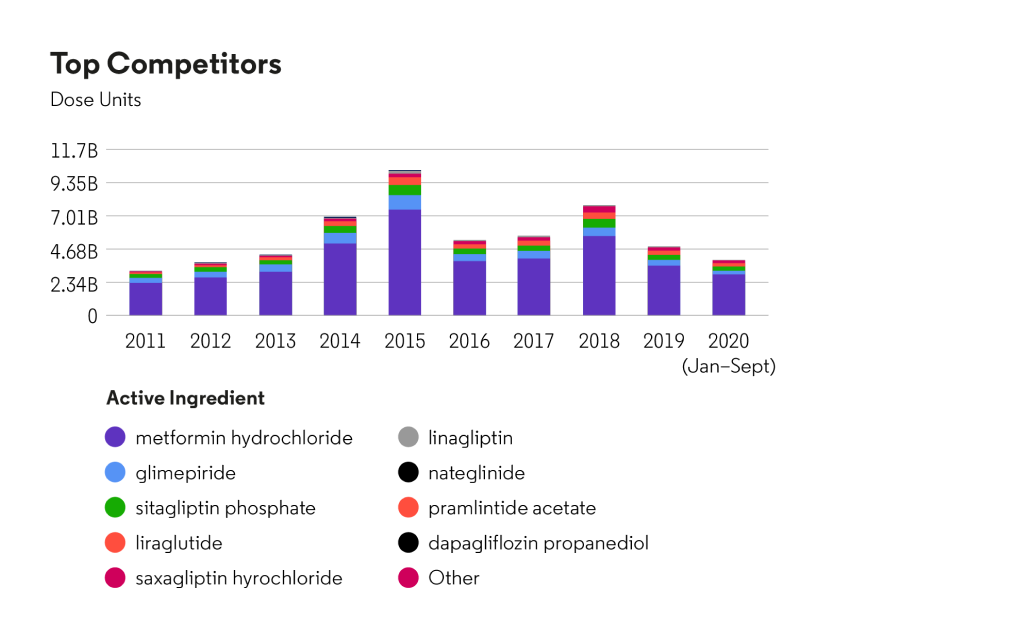

U.S. market share analysis for competitors in the therapeutic area “Drugs used in diabetes”: dose units count

Source: Cortellis Generics Intelligence

Because DPP-IV inhibitors have excellent safety and tolerability profiles, physicians are willing to prescribe them as adjunctive therapy for a wide range of patients, including those with early-stage disease and elderly patients at risk of hypoglycemia.

They are also being increasingly used as a first-line option in patients who cannot tolerate metformin. However, cost is currently an issue, so physicians are frequently restricted to prescribing this drug class to patients who have already failed less-costly therapies such as metformin and the sulfonylureas.

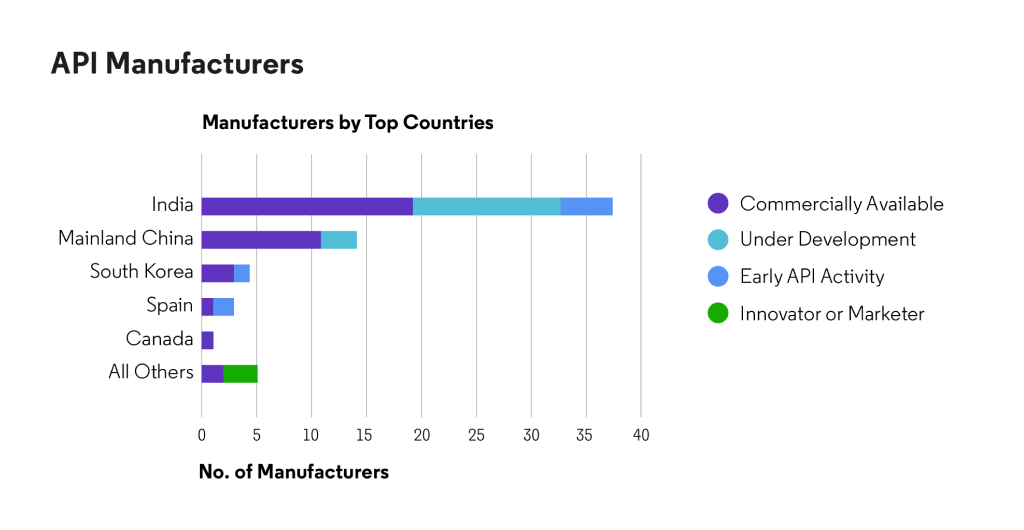

Based on Cortellis data, API is excessively available, primarily from manufacturers in India and Mainland China.

Source: Cortellis Generics Intelligence

Source: Cortellis Generics Intelligence

Data current as of April 14, 2021

Access our global intelligence, advanced analytics and global team of experts.