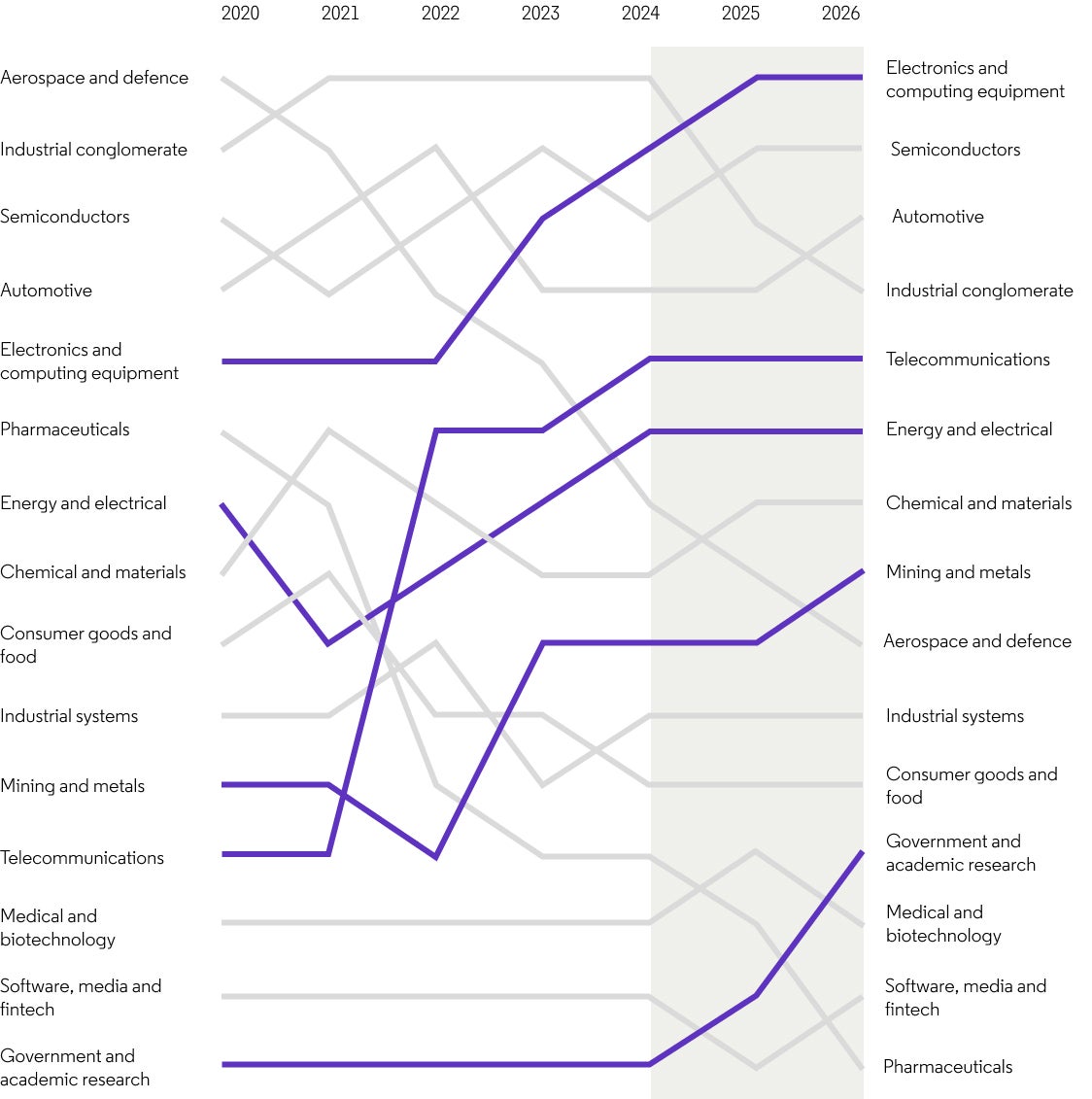

The spectrum of research

When we broaden the review of invention-to-research paper links beyond the Top 100, to the Top 1,000 Global Innovators, we can see the intensity of research links, where bringing ideas to market are more tightly interwoven with the science and research within academia.

The top segment, as a function of citations to research per invention, is the pharmaceutical sector – reflecting the fundamental importance of life sciences research on the development of new drugs and therapies. It shows the need for broader thinking and the role of research in discovering new approaches. It also likely demonstrates the roughly 20-year trend towards academic-commercial research partnerships.

With the medical and biotechnology sector ranked fifth out of 15 in the same analysis, this effect clearly crosses into the wider life sciences industry.

Viewed at a higher level, the intensity of research linkage per sector shows a split between those that are more engineering related (automotive and aerospace, electronics and semiconductors, telecommunications) versus heavier science sectors (chemistry and materials science). One field which sits outside this general split is the energy and electrical sector, potentially reflecting the ongoing importance of academic research in the transition to more sustainable energy sources.

Finally, the entities in the Top 1,000 Global Innovators which are themselves research institutions demonstrate their direct transfer of ideas generated by their faculty members to commercially available inventions – with government and academic research ranked second in research link intensity.