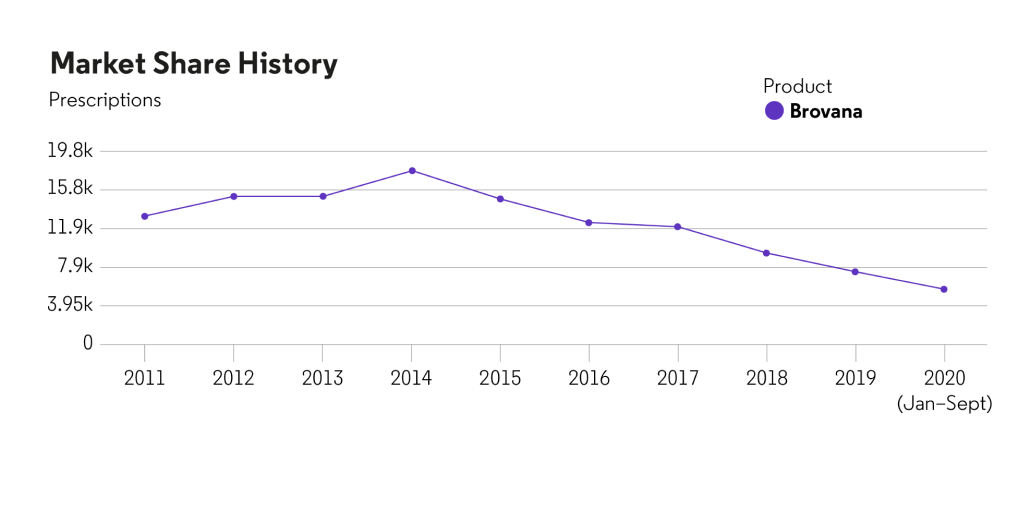

About BROVANA®

-

Marketed by Sunovion Pharmaceuticals Inc., a U.S. subsidiary of Sumitomo Dainippon Pharma Co., Ltd.

-

Long-acting beta 2 adrenergic agonist (LABA) with bronchodilator activity used for symptomatic control of chronic obstructive pulmonary disease (COPD)