About tirzepatide

-

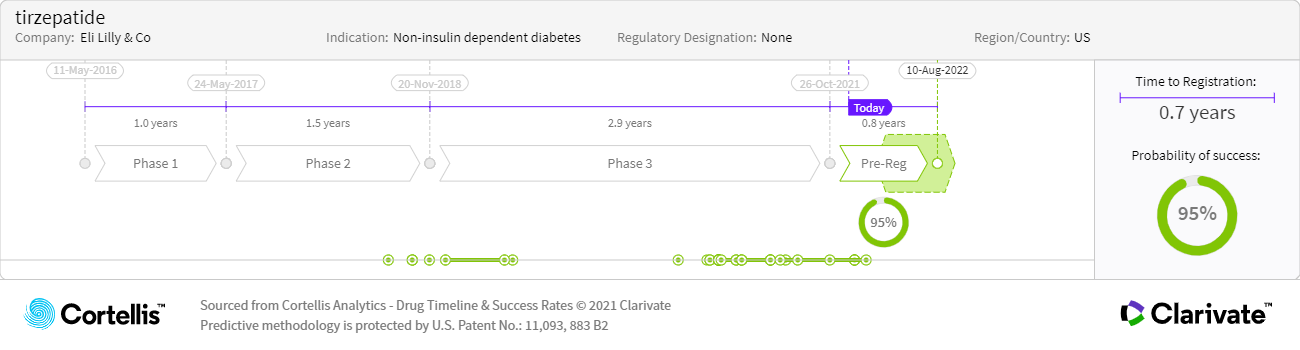

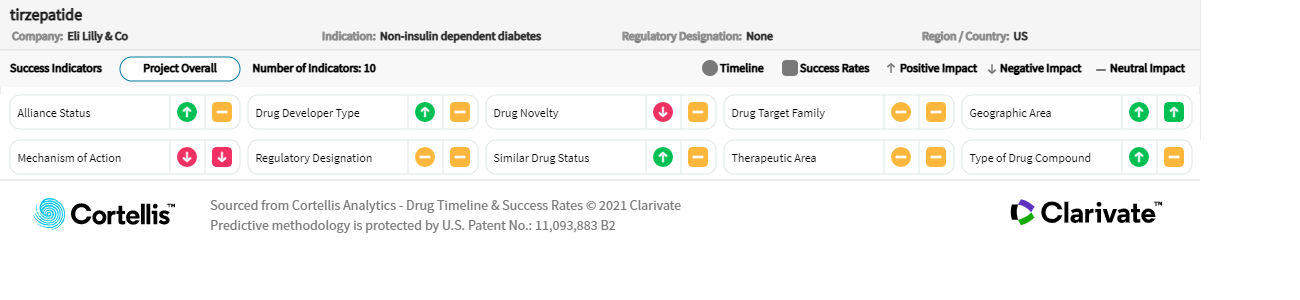

Eli Lilly and Company

-

GLP-1/gastric inhibitory polypeptide (GIP) receptor agonist

-

Weekly SC administration to treat T2DM

-

Also being studied to treat obesity and non-alcoholic steatohepatitis (NASH)

-

462 million people globally have T2DM

-

1.4% annual increase in drug-treated populations in G7 due to increasing rates of obesity and the aging population