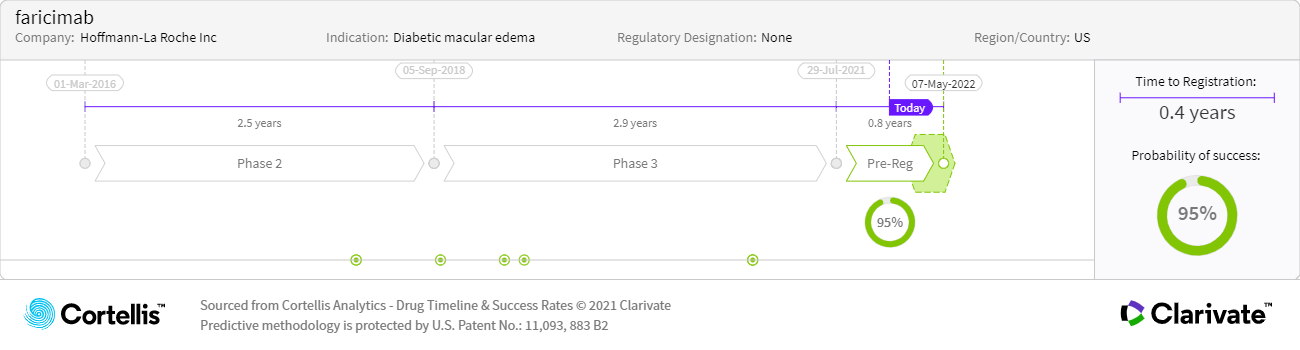

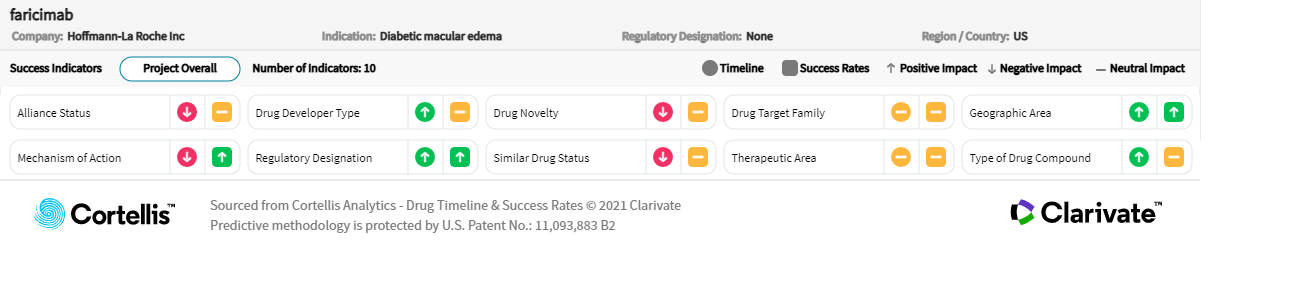

About faricimab

-

Roche and Chugai Pharmaceutical

-

Bispecific VEGF/Ang-2 mAb

-

Intravitreal (IVT)-administered treatment of DME and wet AMD

-

Also being studied to treat retinal vein occlusion (RVO)

-

15% of adults with T2DM have DME

-

3.6M people have wet AMD in the G7 markets