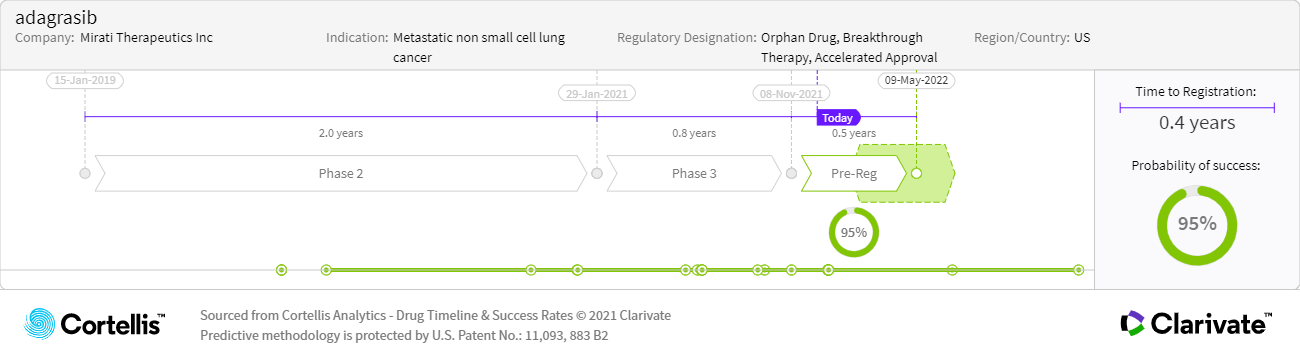

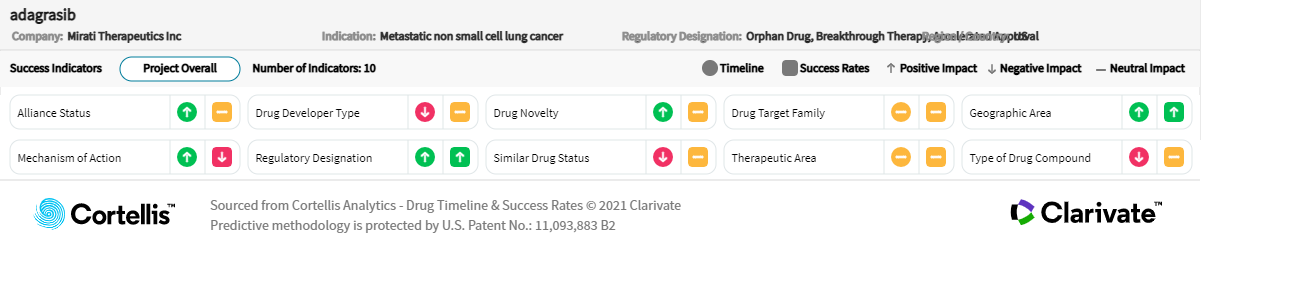

About adagrasib

-

Mirati Therapeutics Inc and Zai Lab Limited

-

KRAS GTPase inhibitor

-

Twice-daily, second-line, oral treatment of advanced KRASG12C-positive solid tumors: metastatic NSCLC and CRC

-

KRASG12C-mutant disease:

• 11-13% of metastatic NSCLC

• 3-4% of metastatic CRC