How the Inflation Reduction Act could impact access to more convenient therapeutics

Many biologic drugs start their journey as intravenous (IV) therapies, administered in a clinic or infusion center. Later, some launch as self-administered subcutaneous (SC) injections. For patients, the appeal is obvious: fewer trips, more independence, and a better experience overall.

But what about payers? Will they support premium pricing or access for SC formulations simply because they’re more convenient? The answer is surprisingly complex and often depends on the type of insurance and health plan covering the patient.

Here’s why it gets tricky: in the U.S., IV- and self-administered SC drugs are typically reimbursed under different benefits, with distinct utilization management tools and policies. And starting in 2025, the Inflation Reduction Act limits Medicare patient out-of-pocket costs for self-administered drugs to $2,000 per year. The same drug delivered as an IV has a $9,350 cap for in-network Part A/B services (Medicare Advantage) or no cap at all (traditional Medicare). That can be a substantial difference in cost to the patient and to the health plan.

Imagine a hypothetical therapy with both IV and SC options, the same list price of $60,000 per year, and 20% co-insurance. For the IV, after the patient meets the deductible traditional Medicare is responsible for only 80% of the net cost for the full year. For the SC, Medicare starts paying the full cost in April (or earlier) when the $2,000 out-of-pocket cap is exceeded.[1] For the health plan, covering the SC option can cost more because of the difference in out-of-pocket caps.

This dynamic creates an incentive for Medicare plans to favor IV coverage: patients receive clinically equivalent care, but the plan controls its costs. Early evidence suggests this is happening with specialty immunology therapies for conditions like rheumatoid arthritis, Crohn’s disease, and generalized myasthenia gravis, which typically have a large proportion of Medicare patients.

What the coverage data tells us

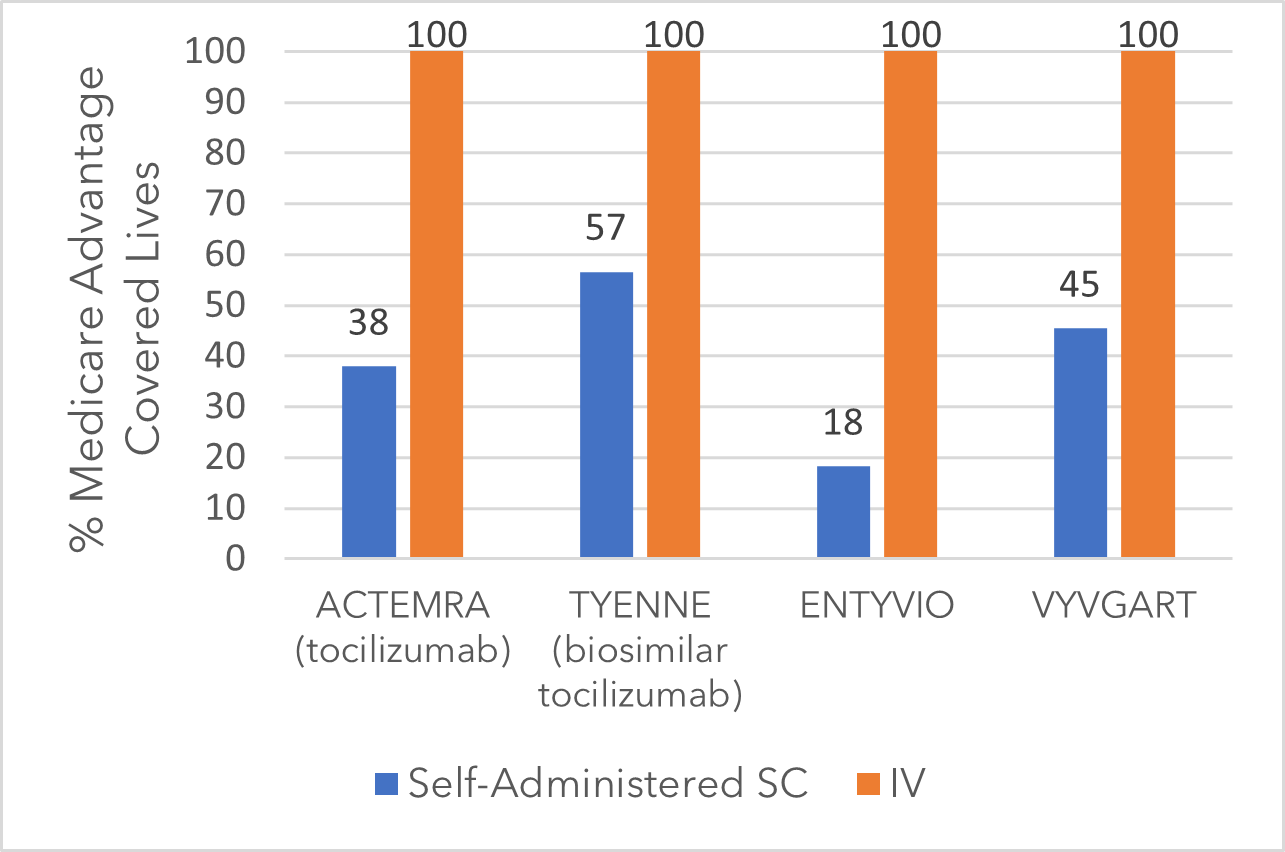

Looking at Medicare Advantage coverage for these immunology therapies (Figure 1), a clear pattern emerges: IV formulations have substantially better access. The SC versions demonstrate the same efficacy and safety as their IV counterparts,[2] yet most Medicare Advantage plans either limit or exclude SC access. Only 1 of the top 10 Medicare Advantage plans, Kaiser Permanente Senior Advantage, covers all four SC formulations listed in Figure 1.

Figure 1: Medicare advantage coverage for select immunology therapies (Oct. 2025)[3]

Not surprisingly, subcutaneous injection biosimilar TYENNE SC is achieving higher coverage than branded ACTEMRA SC. However, 4 of the top 10 Medicare Advantage plans exclude the biosimilar TYENNE SC but include the ACTEMRA IV, which has a substantially higher list price. With the $2,000 out-of-pocket cap for self-administered drugs, plans may end up paying more for SC access than for IV administration, when both deliver equivalent outcomes.

When coverage is limited to self-administered drugs, such as under Medicare Prescription Drug Plans, coverage rates for subcutaneous formulations tend to be lower. This reflects differences in benefit design, where coverage responsibility may fall across plans and clinically comparable intravenous options remain available under medical benefits.

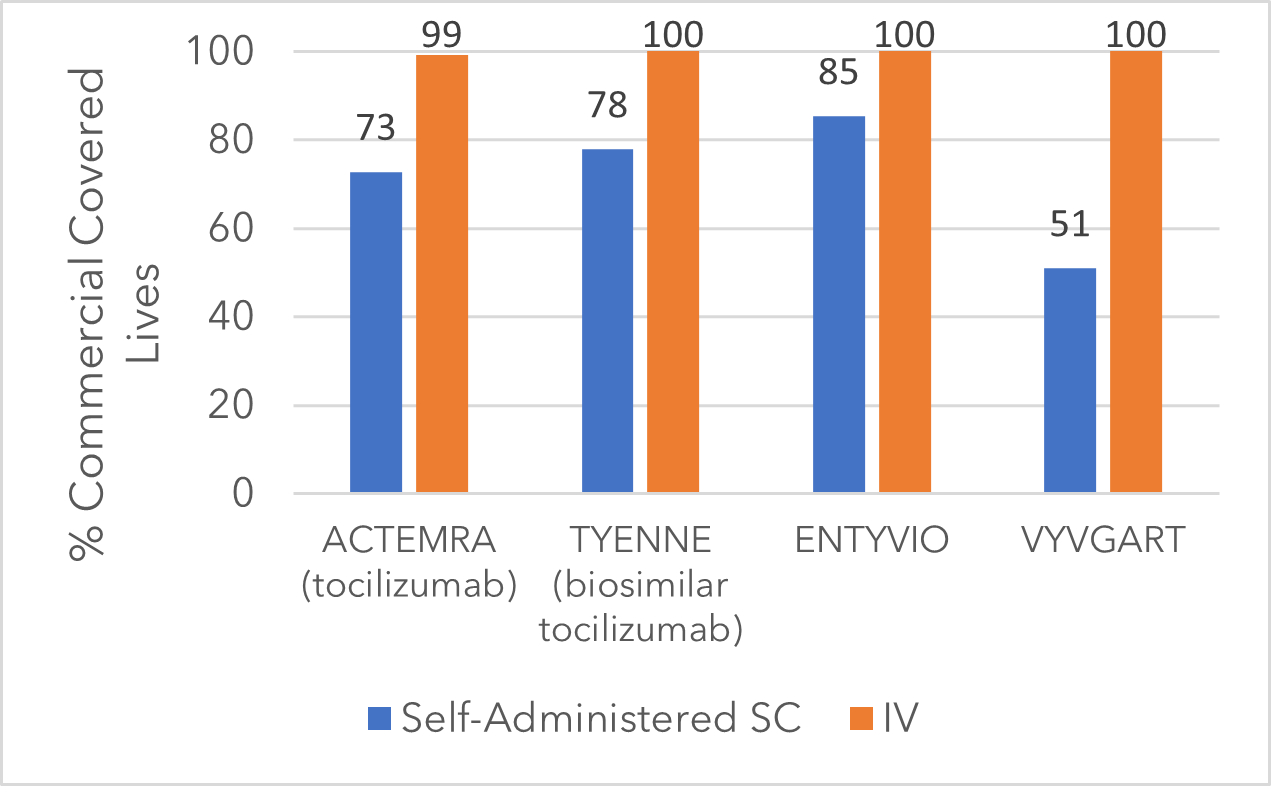

Commercial health plans, by contrast, show a smaller gap in coverage between IV and SC formulations (Figure 2). Why the difference? Many commercial plans have higher annual out-of-pocket limits, reducing the financial impact of SC therapy on the plan. There is also potential for cost sharing with manufacturer-sponsored patient financial support. For commercial plans, offering SC access doesn’t carry the same cost incentive to restrict coverage.

Figure 2: Commercial Health Plan Coverage for Select Immunology Therapies [3]

Some restrictions may apply

There are limitations to Medicare Part D or Medicare Advantage health plans disadvantaging self-administered dosage forms. Legislation requires all Medicare Advantage plans to “substantially” cover oncology drugs. No such “protected class” exists for immunology drugs.

Taken together, the data illustrate a nuanced reality: convenience doesn’t automatically translate into payer support. The type of health plan, the structure of patient cost-sharing, and the benefits under which the drug is reimbursed all play a critical role. Medicare plans may favor IV administration, not because SC is less effective, but because it could cost the plan more under the new out-of-pocket rules.

Key takeaways:

- Convenience has value — but not always in the eyes of payers. SC formulations reduce patient burden but may increase plan costs under Medicare rules.

- Insurance type matters. Medicare plans are more likely to favor IV access, while commercial plans show a smaller coverage gap.

- Cost structure drives decisions. Out-of-pocket caps, benefit design, and net pricing transparency influence which formulations get preferred coverage.

Clarivate’s experienced market access and pricing experts can help you analyze, optimize, and tailor your strategy to maximize commercial success. Visit us to learn more or connect with our experts: Healthcare Commercial Consulting Services | Clarivate

This post was written by Moira Ringo, Director, Commercial Consulting, and Leyla Jiang, Senior Consultant, Commercial Consulting

[1]Illustrative example only and not representative of all scenarios. Assumes that the patient has no other pharmacy expenses in that year, and that any discounts from manufacturer to payer are applied to the patient financial contribution.

[2] See Highlights of Prescribing Information for each therapy

[3]DRG Fingertip Formulary