Recent updates in the NRDL highlight Mainland China’s improving market access and reimbursement environment for innovative therapies. However, this comes at the cost of heavy price cuts that manufacturers must offer in exchange for NRDL inclusion. Are these price cuts worth gaining market access in Mainland China? What other trends have emerged from the recent NRDL updates and what can drug manufacturers do to adapt to these trends? Clarivate experts Amardeep Singh and Akash Saini review in the following article.

A supportive access and reimbursement environment for novel therapies has been an ongoing unmet need in Mainland China’s growing healthcare market. The country’s National Reimbursement Drug List (NRDL), established in 2000 with the aim of improving access and reimbursement for hospital-purchased drugs, was updated only three times before 2017 and focused mostly on reimbursement of generic drugs.1 However, since 2017, regular annual updates and the inclusion of many premium-priced, innovative therapies in NRDL suggest that this unmet need is finally being addressed.1 Clarivate China In-Depth research suggests that many innovative therapies added to the list have begun to see patient uptake comparable to those in the Western markets, thanks to the reimbursement and massive price cuts incurred during the NRDL negotiations.

The latest NRDL update in December 2020 was the largest of the decade with 119 drugs included in the list, of which 50 were Western medicines. In line with the double-digit average discounts seen in the previous four years (58% in 2015, 44% in 2017, 58% in 2018 and 61% in 2019), this update also enacted tremendous price cuts of 51%, on average. The National Healthcare Security Administration (NHSA) believes that this will save approximately $4.3 billion USD in healthcare spending for Chinese patients in 20211. With the provincial reimbursement drug lists (PRDLs) effectively prohibited from making local-level adjustments, reimbursement at the provincial levels is no longer a viable option2 and NRDL inclusion has become even more crucial for drug manufacturers.

As NRDL updates become regular and increasingly indispensable for drug manufacturers operating in Mainland China, we analyze three key trends that have emerged from the last four updates of the list and offer recommendations for manufacturers setting market access and reimbursement strategy in the country.

Three trends from recent NRDL updates

Decreasing time lag between approval and NRDL inclusion

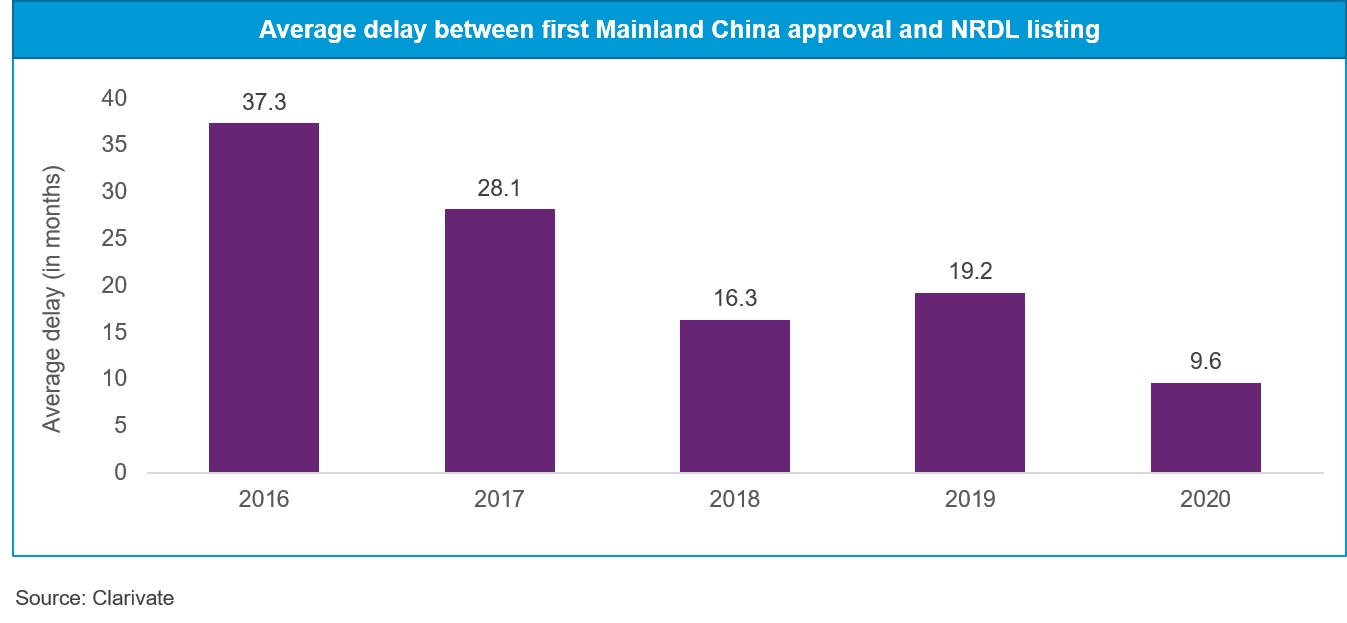

According to Clarivate China In-Depth research, the average time delay between first Mainland China approval and NRDL listing has dramatically reduced from 37 months in 2016 to just ten months in 2020. Several key anti-cancer drugs approved in early 2020 made it to the NRDL update of the same year—something never seen before.

Reducing delays in NRDL inclusion will allow drug manufacturers to maximize market penetration before they lose patent protection, encouraging other innovators and rewarding manufacturers of novel therapies.

Branded therapies see a major boost in sales following NRDL inclusion

According to Clarivate China In-Depth research, most branded therapies see a sharp sales surge post NRDL inclusion, despite incurring huge price cuts in negotiations. Roche reported more than two- and three-times higher sales of Herceptin and Avastin, respectively, in the two years following their NRDL inclusion in 2017, even though both the therapies had price cuts of more than 60%3.

This trend suggests that steep price discounts are worth the bargain for NRDL inclusion in Mainland China – a price-sensitive market with a high patient burden and huge unmet need for innovative therapies.

Growing visibility of domestic firms in NRDL listing

Historically, domestic manufacturers included in the NRDL were limited to mostly generic drugs or traditional Chinese medicines. However, a push for domestic innovation in Mainland China has led to the emergence of many domestic players who are now competing with multinational companies in the innovative medicines market. Consequently, the share of domestically developed novel medicines in Mainland China’s pharmaceutical market has grown significantly in recent years, and their footprint in the NRDL has expanded with every update.

Domestic firms accounted for 35% and 44% of the total new drug listings in the 2019 and 2020 NRDL updates, respectively.1 Clarivate experts believe that domestic manufacturers’ willingness to compromise on prices puts them in a better position to win during the NRDL negotiations, and, therefore, their visibility in the NRDL may continue to increase in future updates. Mainland China’s PD-1/PD-L1-inhibitor market — perhaps the most crowded in the world — is a testament to this notion, as all four domestically developed PD-1 inhibitors made it to the NRDL, while Merck’s Keytruda and BMS’s Opdivo remain excluded.

Three recommendations for manufacturers

Prepare early for NRDL listings

Early NRDL inclusion assures faster and higher market penetration, allowing better lifecycle management of the drug for the manufacturer. Therefore, manufacturers that start preparations for NRDL negotiations well in advance of, or in parallel to, regulatory filing for approval in Mainland China may better realize the full commercial potential of their new drug. A well thought out pricing strategy could improve the chances of a successful negotiation.

Notably, the National Healthcare Security Administration (NHSA) now invites formal applications for NRDL listing — a change from previous years when selection of drugs for negotiations was done by a committee of specialists with no input from the manufacturers — making the process more transparent and navigable for manufacturers. With the shrinking time lag between regulatory approval and NRDL inclusion, and with the option to apply for NRDL negotiations, the process now appears more efficient and transparent than ever before, and early acting manufacturers will be well-placed to benefit from it.

Use real-world data to support NRDL inclusion

The NMPA now recognizes real-world evidence to support regulatory filings4. In June 2020, Sanofi leveraged the recently initiated “Hainan Bo’Ao Lecheng International Medical Tourism Pilot Zone” scheme, which allows approvals of drugs in this pilot zone without formal regulatory approval by the NMPA5, to launch Dupixent (dupilumab) for the treatment of atopic dermatitis. The company may have generated real-world evidence from Chinese patients in the pilot zone on the efficacy of Dupixent to get NMPA approval for the drug in June 2020, within six months of NDA filing. Dupixent also secured NRDL inclusion soon afterwards1, in the 2020 update of the list.

Now that Mainland China officially allows the use of real world data for regulatory filings, manufacturers may have the opportunity to showcase not just safety and efficacy, but also cost-effectiveness of their drugs through real-world evidence to support their case for NRDL inclusion.

Focus on alternative pathways to stay competitive

In case of failure to negotiate for NRDL inclusion, drug manufacturers may focus on alternate routes of patient access — such as by offering patient assistance programs (PAPs), undergoing voluntary price cuts to showcase favorable pharmacoeconomic value or demonstrating their willingness to negotiate on pricing. These paths may not only lead to better patient uptake of their drugs in the short term, but also improve their chances of successful negotiations in future NRDL updates. For example, after failing consecutively to negotiate for their PD-1 inhibitors Keytruda and Opdivo, Merck and BMS have offered attractive PAPs that make these drugs significantly more affordable for patients.

Such initiatives allow manufacturers to build the market presence and physician trust that might help them eventually win during NRDL negotiations. In addition, manufacturers may also leverage the growing private insurance market in Mainland China by partnering with commercial insurers to be listed on their plans.

The road ahead for NRDL

Mainland China has achieved great progress in affordable healthcare by rolling out regular NRDL updates in the last few years and expanding the NRDL’s scope to include innovative and expensive drugs. However, because NRDL is now the only channel to secure reimbursement, manufacturers now face enormous pricing pressure to get their drugs listed, given the huge price cuts being witnessed each year during the negotiations. While these price cuts may prove advantageous in the long run upon successful NRDL listing, failure to negotiate on the grounds of pricing should not be taken as the ‘end of the road’ for a given drug. Manufacturers can seek alternative ways to secure patient access, such as by offering patient assistance programs, venturing outside the confined public hospital sector space and focusing on capturing the growing private health insurance market.

Insights provided in this article were developed by Clarivate analysts, using data and analysis from China In-Depth, which covers patient populations, access and reimbursement environment, treatment paradigms, pipelines and drug-level forecasts.

Learn more about gaining access to intelligence on Mainland China’s healthcare market and disease-specific trends here.

References

- nhsa.gov.cn

- gov.cn/zhengce/2020-03/05/content_5487407.htm

- roche.com/investors/annualreport19.htm

- nmpa.gov.cn

- lecityhn.com/2020-07/01/c_505419.htm