Mainland China has streamlined regulatory protocols for testing and approving prescription drugs in recent years, making dozens of urgently needed treatments, from domestic and international manufacturers alike, available to patients in the process.

Over the past five years, healthcare leaders in Mainland China have made significant strides in their efforts to reduce lag time in availability of novel drugs versus western markets.

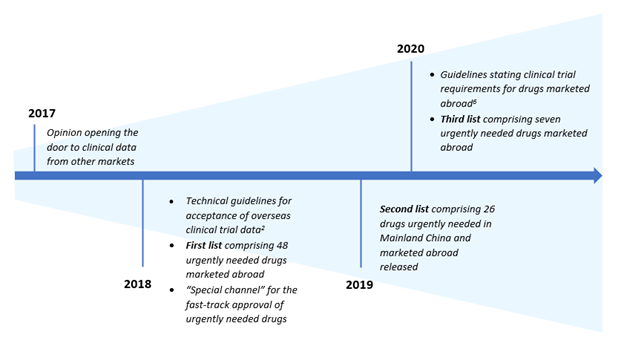

One major impediment to faster approvals was stringent registration requirements to conduct domestic trials in order to supplement clinical evidence generated in global trials. To address this pain point, the Center for Drug Evaluation (CDE) announced in 2017 that it would accept marketing applications based on clinical evidence generated in multicenter studies conducted overseas[1]. However, to gain approval for a new drug or label expansion, developers needed to meet specific requirements laid out by the CDE.

The following year, the Mainland Chinese government empaneled a working committee comprised of experts from the State Council (SC) and the National Health Commission (NHC) to identify drugs already approved in western market sand urgently needed in Mainland China. The identified drugs would before the management of rare diseases and seriously life-threatening conditions for which no effective treatment options were available, as well as those offering distinct advantages over existing therapies for the treatment of serious life-threatening conditions[2]. In parallel, the CDE also established a special channel to facilitate these approvals. Over a period of three years, the working group published a list of 81 drugs (released in three batches) more than half of which were for the management of rare indications where there was a lack of availability of effective treatment options[2-5]. Over 60% of the enlisted drugs were subsequently approved for the intended indication, signaling the need for newer and more effective treatment options in this market.

Figure 1: Key steps taken to facilitate quicker access to urgently needed drugs in China

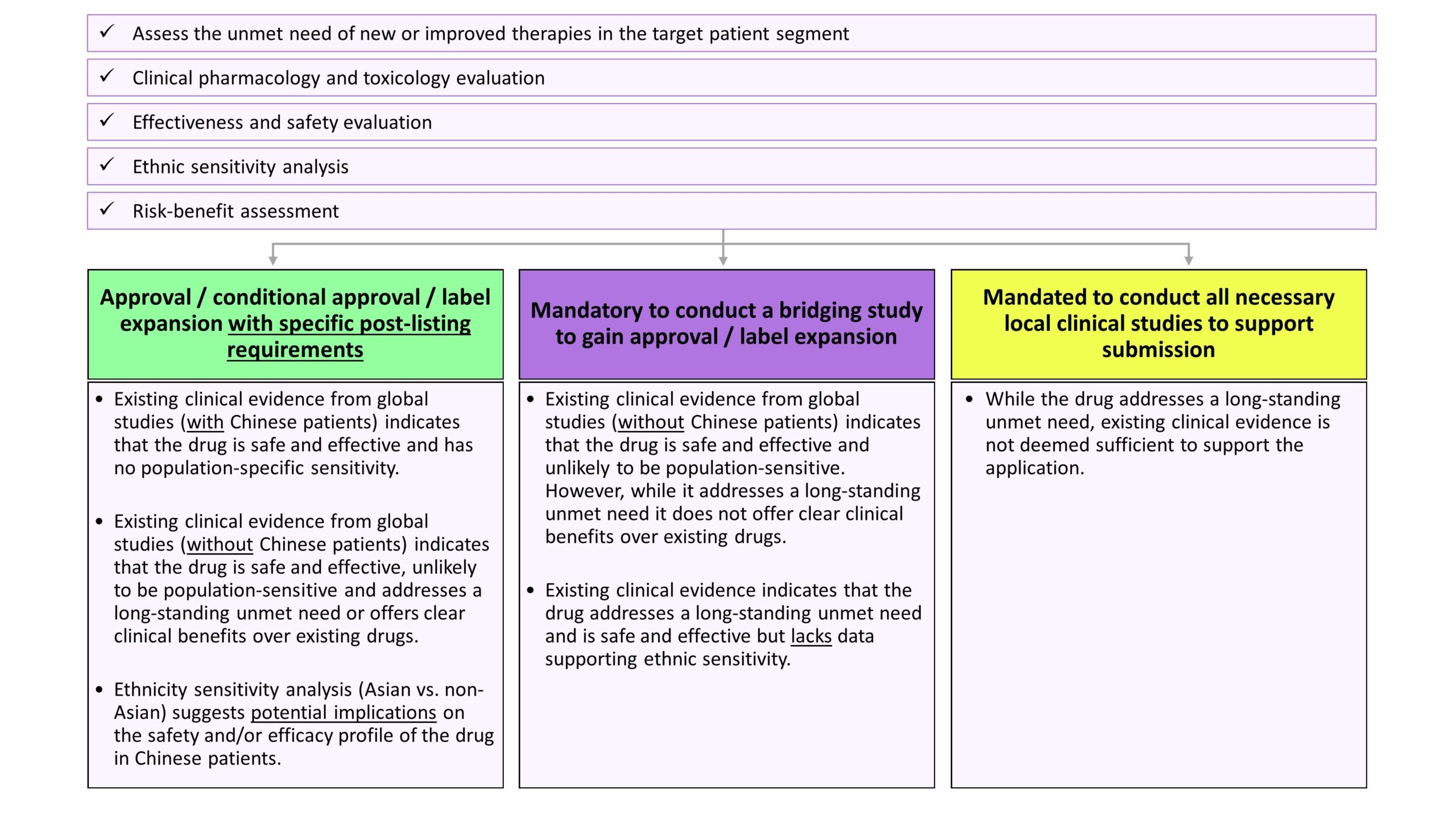

To accelerate the approval process further, in 2020, the CDE adopted a more expansive approach wherein these provisions were not just restricted to drugs identified by the working group. CDE also released guidelines on Clinical trial requirements for overseas drugs. Per the guidelines, while the underlying objective of the review process is to establish the safety and efficacy of the product in the target population, the determination of whether the existing clinical evidence supports use for patients in Mainland China or additional data is needed will be based on the outcomes of the risk-benefit assessment.

Figure 2: Key steps involved in the review process and possible outcomes[6]

Our research suggests that many patients, particularly those suffering from rare diseases and/or for whom existing treatment options are ineffective, have benefited from the revised provisions.

Table 1: Select indications that have witnessed major approval(s) / label expansion(s) in Mainland China based on overseas clinical evidence

| Indication | Molecule | Brand | Company | Year of approval | Label | Clinical rationale |

| Multiple sclerosis (MS) | Fingolimod | Gilenya | Novartis | 2019 | Relapsing forms of MS | MS is designated as a rare disease in Mainland China and is part of the China’s First List of Rare Diseases (CRDL). Despite the availability of multiple DMTs in the Western markets, there was a dearth of DMTs in Mainland China before 2018. |

| Dimethyl fumarate | Tecfidera | Biogen | 2021 | |||

| Ofatumumab | Kesimpta | Novartis | 2021 | |||

| Ozanimod | Zeposia | Celgene | 2023 | |||

| Eosinophilia granulomatous polyangiitis (EGPA) | Mepolizumab | Nucala | GSK | 2021 | Adult patients with EGPA | EGPA is a rare life-threatening autoimmune condition. There are a lack of available treatment options that address the underlying disease pathology. |

| Hemophagocytic lymphohistiocytosis (HLH) | Emapalumab | Gamifant | Swedish Orphan Biovitrum AB | 2022 | Patients with refractory or relapsed HLH

|

HLH is an extremely rare, highly progressive hyperinflammatory disorder. No drugs are approved for the treatment of HLH and mortality rates are high (30-40%). |

| Breast cancer | Pembrolizumab | Keytruda | Merck | 2022 | High-risk early-stage triple-negative breast cancer (TNBC) patients whose tumors express PD-L1 (CPS ≥20) | Lack of effective treatment options available for the management of early stage TNBC; 30%-40% of cases progress to later lines following standard treatment. |

| Ovarian cancer | Bevacizumab | Avastin | Roche | 2021 | Patients with platinum-resistant, recurrent or metastatic cervical cancer in combination with paclitaxel and cisplatin or paclitaxel and topotecan | Chemotherapy is the standard first-line treatment option for relapsed-refractory patients; however, clinical benefits are limited and many patients cannot tolerate these drugs. |

| Prostate cancer | Olaparib | Lynparza | Astra

Zeneca |

2021 | Adult patients with metastatic castration-resistant prostate cancer (mCRPC) with BRCA mutation who have progressed following prior treatment with a hormonal therapy | Lack of effective treatment options available for late-stage mCRPC patients who have already received a hormonal therapy in the first-line treatment setting. |

Source: CDE.org, Clarivate analysis

A ’win-win’ situation

While regional officials are continuously working towards establishing a robust approval process that enables quicker access to innovative therapies in Mainland China, they are also working in parallel towards improving patient access and affordability to these therapies by including them on the National Reimbursement Drug List (NRDL) and enabling access via other innovative channels such as Huiminbao (supplementary commercial insurance). In addition, the NMPA has also established the Hainan Boao Lecheng International medical tourism pilot zone to facilitate the approval of urgently needed, imported drugs based on real-world clinical evidence generated in the pilot zone.

Taken together, these recent reforms and provisions have:

- facilitated quicker access to many innovative and improved therapies in Mainland China,

- increased the number of treatment options available, especially for those who are resistant to existing treatment options and/or niche patient segments that are unaddressed due to a lack of effective treatment option sand

- allowed multinational corporations (MNCs) to enter a very lucrative market through a variety of channels.

To learn how Clarivate Disease Landscape and Forecast reports can help you optimize your long-term disease strategy to maximize market share in Mainland China and other markets, please visit us here.

References:

[1]Opinion on deepening the reform of the review and approval system and encouraging the innovation of drugs and medical devices, October 2017.

[2]Opinion on the list of new drugs marketed overseas urgently needed in China, August 2018.

[3]First list of overseas new drugs urgently needed in clinical practice, November 2018.

[4]Second list of overseas new drugs urgently needed in clinical practice, May 2019.

[5]Third list of overseas new drugs urgently needed in clinical practice, November 2020.

[6]Clinical technical requirements for overseas drugs not yet imported to China, October 2020.