Clarivate medtech experts Usman Syed and Lucy Guan share findings from their analysis of the diabetes market and discuss how partnerships and innovation are transforming treatment options for diabetes patients.

The demand for diabetes care devices is being fueled by the drastic increase in the number of Americans with diabetes, coupled with the serious and costly consequences of poor condition management (e.g., heart disease, neuropathy, kidney disease, wounds, worse post-surgical outcomes) and inadequate access to care due to expensive insurance plans with high copays.

As a result, patient care currently revolves around the most affordable diabetes care products, such as traditionally more commoditized devices for multiple daily injections (MDI; syringes, durable pens) and self-monitoring blood glucose (SMBG) devices. Uptake of newer, innovative but higher-priced devices has therefore been somewhat slow.

However, manufacturers, third-party digital health companies and payers still aim to provide better solutions to reduce patient burden, enhance management adherence and improve patient lives. Novel devices that provide superior ease-of-use and simplify diabetes management appeal to patients, while those that improve treatment compliance and reduce costly complications appeal to payers, even when they come at a premium price.

For example, a number of competitors have recently introduced pre-calibrated continuous glucose monitoring (CGM) devices that eliminate the need for daily finger prick calibrations. Companies are also developing closed-loop systems that partially automate adjustments to insulin delivery in response to blood glucose levels, which will significantly simplify diabetes management for patients.

Table 1. Significant innovation is occurring in the U.S. diabetes care device market

| Product type | Brand | Company | Launch date | Status |

| CGM Devices | Freestyle Libre 3

G7 CGM Device |

Abbott

Dexcom Inc |

Expected 2021

Expected 2021 |

The device has received CE marking in Europe, and the company is awaiting FDA approval

The company has begun clinical trials in the U.S. |

|

SugarBEAT |

Nemaura Pharma Ltd |

Expected 2021 |

The device has received CE marking in Europe, and the company is awaiting FDA approval |

|

| WaveForm CGM Device | WaveForm Technologies Inc | Expected 2021–2022 | The device has received CE marking in Europe, and the company is preparing for FDA submission | |

| Eversense XL CGM System | Senseonics Holdings | Expected 2021–2022 | The 180-day system has received CE marking in Europe, and the company has begun clinical trials in the U.S. | |

| Eclipse ICGM | GlySens Inc | Unknown | Currently undergoing development | |

| UBAND CGM | Know Labs Inc | Unknown | Currently undergoing development | |

| Unknown | LifeScan Inc and Sanvita Medical LLC | Unknown | Currently undergoing development | |

| Insulin Pumps | PaQ | CeQur | Expected 2021 | The patch pump has received CE marking in Europe, and the company is awaiting FDA approval |

| Omnipod Horizon | Insulet Corp | Expected 2021 | The company is awaiting FDA approval | |

| MiniMed 780G Insulin Pump | Medtronic | Expected 2021 | The company is preparing for FDA submission | |

| Bigfoot Loop | Bigfoot Biomedical Inc | Expected 2021 | The company is preparing for FDA submission | |

| iLet | Beta Bionics Inc | Expected 2021–2022 | Currently undergoing clinical evaluation |

Source: 2021 Diabetes Care Devices – Market Insights – United States (Clarivate)

Integrated devices, such as closed-loop systems, gain popularity, with a number of new launches and partnerships

Medtronic’s MiniMed 670G—the first “artificial pancreas” system—represented a significant step forward in diabetes care when it was launched in 2017. The closed-loop system combines both CGM and insulin delivery technology in a single device, responding to the patient’s insulin needs in real time by monitoring glucose levels and automatically adjusting insulin delivery. Although adoption was initially hindered by its high cost, increased coverage by insurance companies improved its affordability. Since then, Medtronic has developed additional models within the family and launched its next-generation hybrid closed-loop Mini Med 780G in the summer of 2020 with CE marking in Europe.

In December 2019, Tandem Diabetes Care’s t:slim X2 insulin pump with Control-IQ advanced hybrid closed-loop technology was approved for use by the FDA. This represented the first interoperable automated glycemic controller device approved by the FDA and paved the way for integrated CGMs and alternate controller-enabled (ACE) insulin pumps to be used with interoperable automated glycemic controllers as a complete automated insulin dosing (AID) system. When launched, the integration of the t:slim X2 with Dexcom’s G6 CGM enabled automated correction boluses within an AID system.

Other strategic partnerships aimed at pairing insulin delivery technology with CGMs for a closed-loop AID system include:

- Insulet’s Omnipod DASH and Horizon closed-loop tubeless insulin pump systems with the Dexcom G6 and G7 (expected launch in early 2021) CGMs and the Omnipod Horizon with the Abbott Freestyle Libre CGM (Omnipod Horizon is slated for an early 2021 launch in the U.S.)

- Beta Bionics’ iLet insulin pump (slated for 2021 launch in the U.S.) with the Dexcom G6 CGM or Senseonics Eversense CGM

- Bigfoot Biomedical’s Unity “smart” insulin pen (submitted to the FDA in December 2020) with the Abbott Freestyle Libre CGM

- Tandem Diabetes Care’s t:slim X2 insulin pump with the Abbott Freestyle Libre CGM

- Novo Nordisk’s NovoPen 6 and NovoPen Echo Plus (delayed launch for both) “connected” insulin pens with the Dexcom G6 and Abbott FreeStyle Libre CGMs

- Agreement for exclusive rights for Eli Lilly to commercialize Ypsomed’s YpsoPump in the U.S. once approved by the FDA, in preparation for a smartphone-based AID system combining the YpsoPump and Dexcom CGM for automated insulin dosing

To expedite time to market of their insulin delivery technologies, these companies have opted for partnerships rather than developing their own CGM devices. From the CGM device company standpoint, such partnerships allow them to continue generating device sales as closed-loop systems continue to gain popularity.

Collaborations connect diabetes care device manufacturers with technology firms to facilitate digital diabetes management

Mobile technology and advanced analytics have penetrated many industries, and diabetes care is no exception. Partnerships between diabetes care device manufacturers and technology firms enable manufacturers to improve their existing glucose monitoring and insulin delivery devices by taking advantage of mobile phone applications and miniaturized electronic analytics. Patient benefits include improved convenience, self-management capabilities and treatment compliance in addition to fewer support issues, while healthcare providers have enhanced access to patient data for improved care coordination.

The Sugar.IQ app resulted from a partnership between Medtronic and IBM, integrating IBM Watson’s cognitive computing capabilities with Medtronic’s CGM to enable better diabetes management by patients through access to real-time, personalized insights within a mobile app.

Onduo Virtual Diabetes Clinic is a program provided by Verily, Google’s life science-focused sibling company. Intended to provide patient support for diabetes management, the program includes a digital health platform (mobile app), tracking tools such as a CGM (Dexcom is the preferred CGM device supplier), personalize guidance using predictive analytics and a virtual clinic. Since its inception in 2016, its coverage has extended to all 50 states, and clinical trial data have been published showing an average 2.3% reduction in HbA1c levels for patients with baseline HbA1c >9.0% in a preliminary study, supported by similar findings (2.4% reduction in HbA1c for patients with baseline HbA1c >9.0%) in a follow-up study. In addition, Onduo partnered with life insurer John Hancock in its Aspire program for people with diabetes, providing savings on life insurance premiums and rewards for achieving and maintaining target HbA1c levels.

The recent merger between Livongo and Teladoc combines telemedicine with Livongo’s platform for managing chronic conditions, such as diabetes, that provides an application interface, personalized tips and coaching. Livongo had previously established partnerships with Dexcom to integrate Dexcom’s CGM into the platform and worked with plans such as Kaiser Permanente and BlueCross BlueShield of Kansas City to provide their service at no cost to plan members.

Numerous other partnerships have occurred in this space to provide more patient options, such as:

- Novo Nordisk’s NovoPen 6 and NovoPen Echo Plus insulin pens are planned to connect with Roche’s mySugr app and Accu-Chek Smart Pix device reader as well as the Glooko Diasend diabetes management platform

- Eli Lilly’s personalized diabetes management system, which is currently in development, will integrate products from Dexcom

- The Tidepool Loop mobile app (submitted to the FDA in December 2020), which was developed by an open-source data nonprofit, is designed to work with integrated CGMs, such as the Dexcom G6, and ACE insulin pumps, such as Tandem Diabetes Care’s t:slim X2 and Insulet’s Omnipod DASH

- Glytec’s Glucommander, a software-as-medical-device (SaMD) platform, was recently tested in combination with Abbott’s Freestyle Libre CGM in a prospective study with 25 adults with type 2 diabetes and HbA1c >8%. Time in range significantly increased from 48% to 74% over the 4-week study period.

- Omada, a digital health startup with a digital diabetes prevention program, recently released positive results from a 599-person clinical trial showing the program’s effectiveness, including reduced HbA1c levels and weight.

Studies like these are likely to become more common as companies aim to show evidence for the efficacy of their devices and platforms on patient outcomes.

Companies that expand coverage of their devices will reach more patients and be at a competitive advantage

Although only patients with type 1 diabetes have historically received full reimbursement for more expensive diabetes care devices such as CGM devices, a number of companies have recently sought to expand this coverage to include the large pool of patients with type 2 diabetes. Because most of patients with diabetes have type 2 diabetes, gaining coverage for these patients should improve disease management and patient quality of life, decrease the healthcare costs associated with poor management and increase device sales.

In 2017, Dexcom’s G5 CGM device became the first to be covered for patients with type 1 or type 2 diabetes managing their condition with insulin. Abbott Laboratories also gained Medicare coverage soon after FDA approval for non-adjunctive use of its CGM devices, which is required for the Centers for Medicare and Medicaid Services (CMS) to consider covering CGM devices. Medtronic has also been working with U.S. insurance companies to expand access to its MiniMed 670G device to patients with type 2 diabetes using insulin.

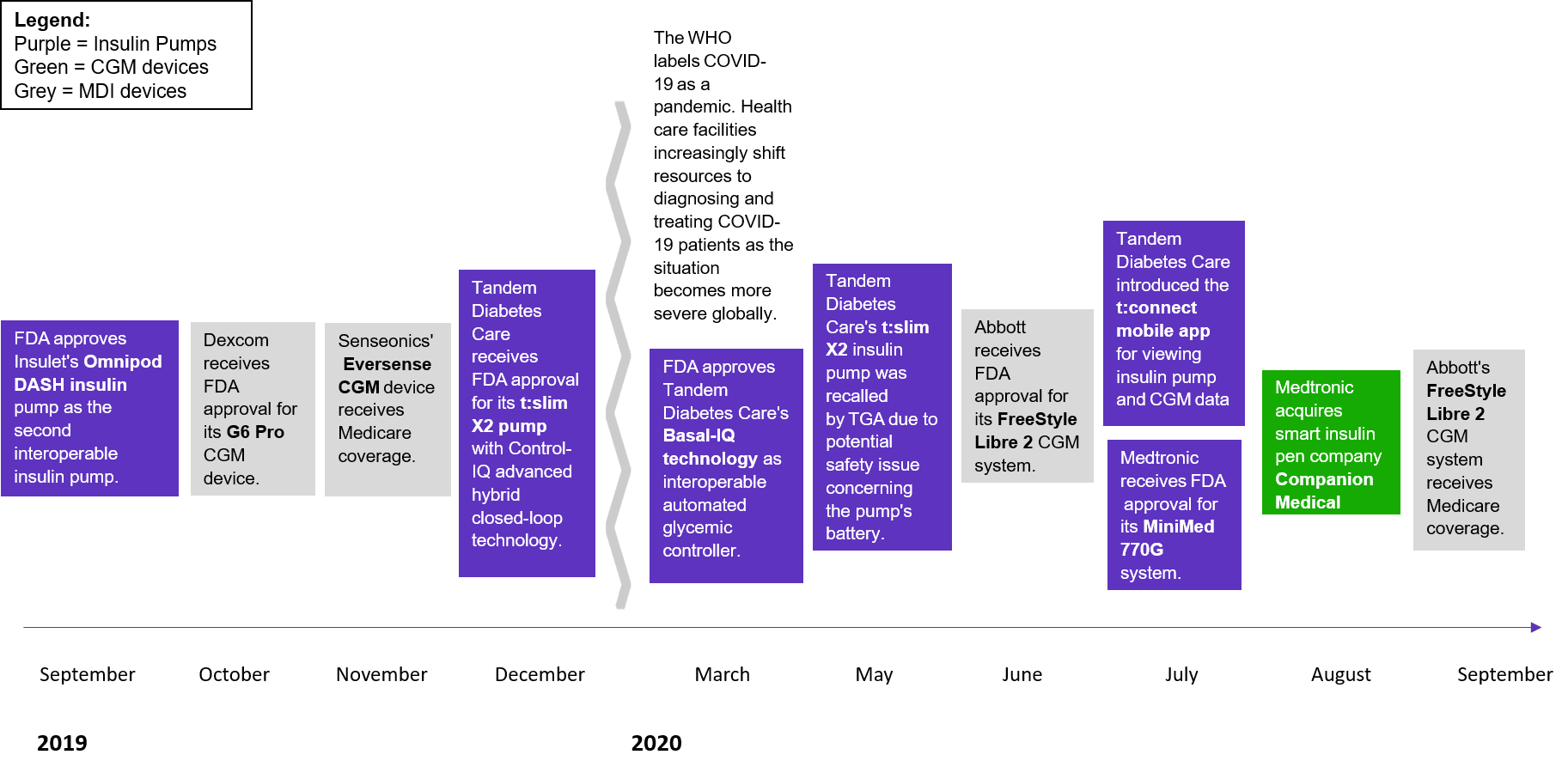

Figure 1. Regulatory approvals and expanded coverage has increased within the U.S. diabetes care device market

Source: 2021 Diabetes Care Devices – Market Insights – United States (Clarivate)

To provide broader, easier patient access to diabetes management devices, there has also been a recent trend of moving these devices, including insulin delivery devices and CGMs, from medical benefit management to pharmacy benefit, which also improves utilization management, achieves higher market penetration for manufacturers and provides additional rebates to payers.

Obtaining reimbursement for devices and management systems has partly been challenging because payers typically look to grant coverage for less costly (in terms of up-front costs) options for diagnosing and treating patients with diabetes. However, as companies such as Onduo and Omada continue to show efficacy and improved outcomes through clinical trials, the long-term cost benefit and ability to outweigh up-front costs will become more obvious to payers.

COVID-19 has impacted patient care, accelerating device integration and acceptance

Disruptions to daily life and healthcare access during the COVID-19 pandemic have resulted in suboptimal care for many people, including those with type 2 diabetes. In a recent Clarivate survey conducted with adults in the U.S., 44% had experienced a change in healthcare routine as a result of COVID-19; the impact was greater for adults with type 2 diabetes, with 65% reporting a change. These respondents with type 2 diabetes:

- Experienced disruptions in doctor appointments (42%)

- Had delayed treatments (22%)

- Were non-adherent to treatment (41%)

- Missed prescription refills (23%)

- Had their care shifted to digital delivery (e.g., remote monitoring, virtual consults; 32%).

Because of these challenges in accessing care, 33% of respondents with type 2 diabetes felt that the importance for digital support tools that help with health management, particularly wearable devices (18%), had increased due to the pandemic.

Innovations in diabetes management devices and platforms are likely to continue

Innovations in digital diabetes management provide greater options for patients to manage their own care, which is attractive to patients, providers and payers alike. The increased patient demand for telemedicine and remote healthcare monitoring in the context of COVID-19 has changed the fabric of healthcare provision and highlighted the convenience and greater patient reach associated with devices and patient-centered platforms. The diabetes care device market has the opportunity to take advantage of this increased interest and acceptance for continued innovation to solve patient needs in a post-COVID world.

Learn more about Clarivate diabetes market intelligence here.

Insights provided in this article were developed by Clarivate medical device market experts, using data and analysis of the diabetes market. Clarivate analysts will continue to keep a close eye on developments in fast-moving medtech markets.