Pharma’s pain from the Inflation Reduction Act will be felt well beyond the first 10 brands facing price cuts

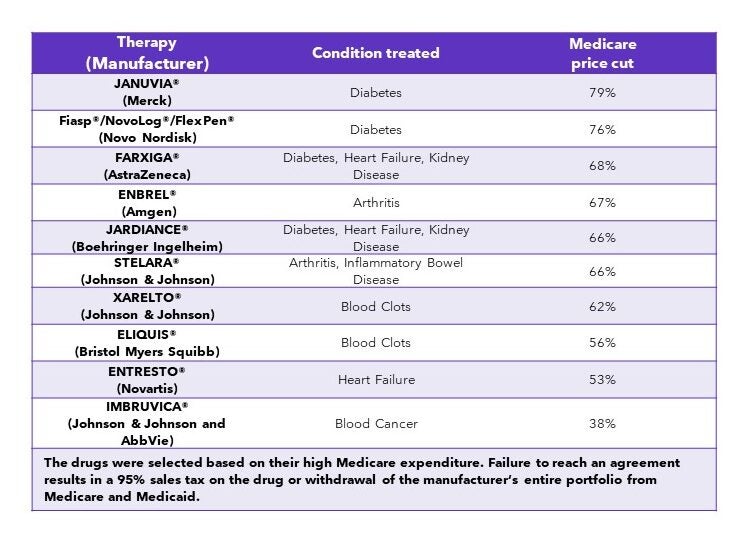

With the passage of the Inflation Reduction Act (IRA), the United States government gained the ability to directly negotiate drug prices with manufacturers. Starting in 2026, the first ten self-administered Part D drugs in the law’s cross hairs will receive price cuts of 38%-79%.

Private health insurers had not been expecting such steep cuts — in all ten negotiations, the federal Centers for Medicare & Medicare Services (CMS) obtained reductions greater than the mandatory minimums required under the IRA of 25% or 60% (depending on the drug’s time on market). Only one of 30 insurance company executives surveyed by Clarivate in March and April expected CMS to obtain a cut larger than the mandatory minimum for all 10 drugs.

Fig. 1: CMS obtained steep price cuts in its first round of negotiations

Source: The Centers for Medicare & Medicaid Services

By 2027, 20 additional drugs per year will be negotiated, including often complex and expensive physician-administered Medicare Part B drugs, such as infusible biologics.

The IRA also reforms stakeholders’ financial obligations for therapies covered under Medicare Part D. The benefit redesign has negative repercussions for health plans, most notably a quadrupling of their cost-share for high-cost drugs in the catastrophic coverage phase. Meanwhile, patients will benefit from a new $2,000 cap on out-of-pocket costs (Read Clarivate Primer on the IRA for more details about the law’s reforms).

Clarivate payer survey on the impact of the IRA

To better understand the impact of the IRA on health insurers and the pharmaceutical industry, Clarivate market access consultants conducted a survey of 30 insurance company medical pharmacy and medical directors (“payers”) from national and regional health plans, healthcare providers with integrated insurance arms, and pharmacy benefit managers (PBMs) in March and April 2024. This blog summarizes a portion of the data collected, which was previously shared in a poster presented at the May 2024 International Society for Pharmacoeconomics and Outcomes Research (ISPOR) Conference (Read the poster).

Impact of the IRA on the price of drugs not selected for negotiation

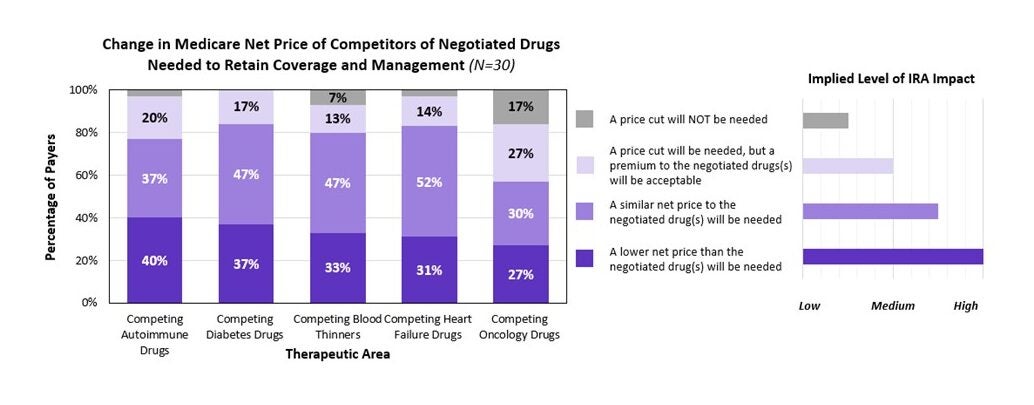

The Clarivate survey found that the impact of negotiations will not be limited to directly negotiated drugs. Their competitors will be expected to lower their prices as well.

Source: Clarivate payer survey on the impact of the IRA

Across all therapeutic areas, a majority of payers surveyed expected the competitors of the negotiated drugs to match or beat the reduced net price of the drug selected for negotiation if they seek to retain their current coverage and management, though more leniency may be shown toward oncology drugs (see figure 2). Payers also said they are likely to penalize drugs that do not adjust their price sufficiently via downgraded coverage, including the imposition of step therapy, meaning patients would be required to try the lower-cost negotiated option first.

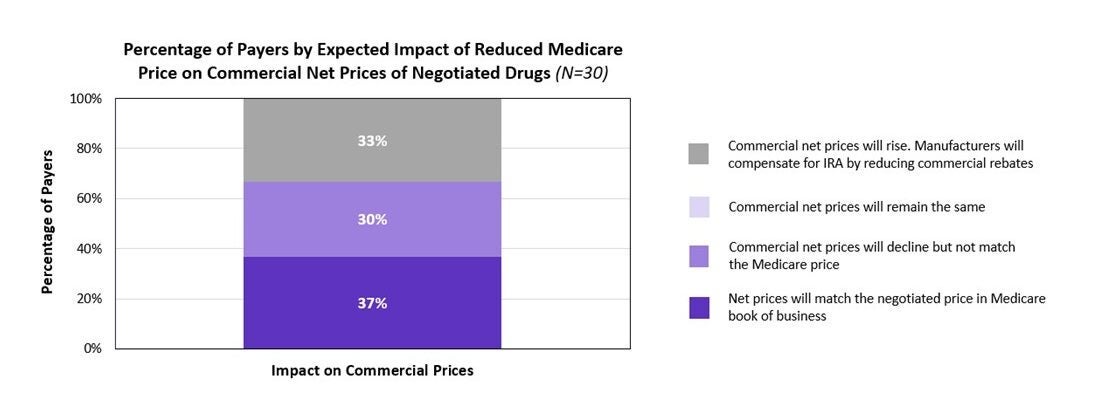

Impact of the IRA on commercial market drug prices

IRA price controls and insurance company regulations apply to the Medicare market only. However, the payers surveyed by Clarivate indicated that some indirect repercussions on commercial prices are likely. When asked how they expect the impact of reduced Medicare prices to affect commercial net prices, none of the payers surveyed by Clarivate expected commercial net prices to remain the same. One-third of those surveyed expected commercial net prices for negotiated drugs to rise because the manufacturers will compensate for the IRA by reducing commercial rebates. Two-thirds expected commercial net prices for negotiated drugs to fall (see figure 3).

Figure 3: Two-thirds of payers expect commercial net prices of negotiated drugs to drop

Source: Clarivate payer survey on the impact of the IRA

Interestingly, payers at large national plans were more likely to expect commercial net prices to drop than those working at smaller regional counterparts, who tend to have less leverage due to their members’ lower aggregate purchasing power. Regardless of plan size, the IRA will likely complicate commercial net price negotiations because both insurers and manufacturers are expected to seek to offset the financial impact of the IRA in the commercial market.

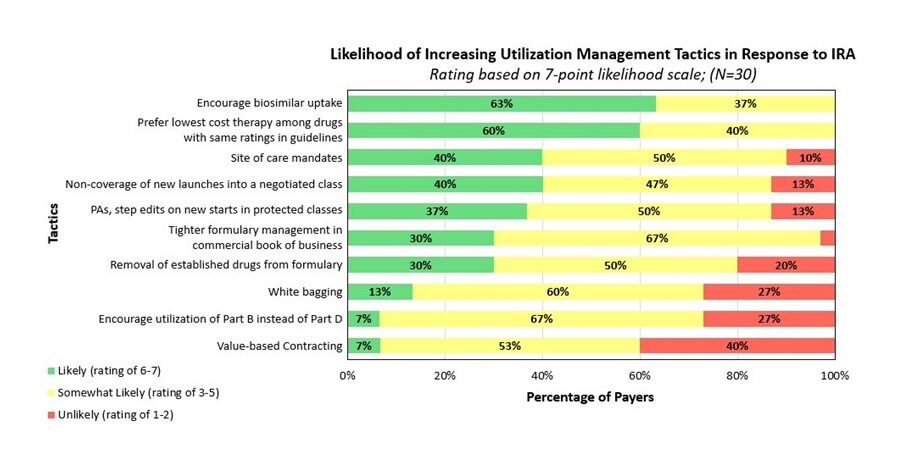

Impact of the IRA on patient access to innovative medications

The Clarivate survey results suggested that the challenging payer environment under the IRA could complicate manufacturer efforts to secure strong patient access to their therapies. The law is likely to promote greater use of a variety of insurance company utilization management tactics (see figure 4). Mostly notably, payers indicated that they are likely to push their members toward biosimilars as a result. Respondents also indicated they will leverage medical guidelines (such as those issued by the National Comprehensive Cancer Network, or NCCN) by encouraging utilization of the lowest-cost therapy among similar drugs with the same clinical rating.

Figure 4: Biosimilars and lowest-cost therapies become more attractive to payers

Source: Clarivate payer survey on the impact of the IRA

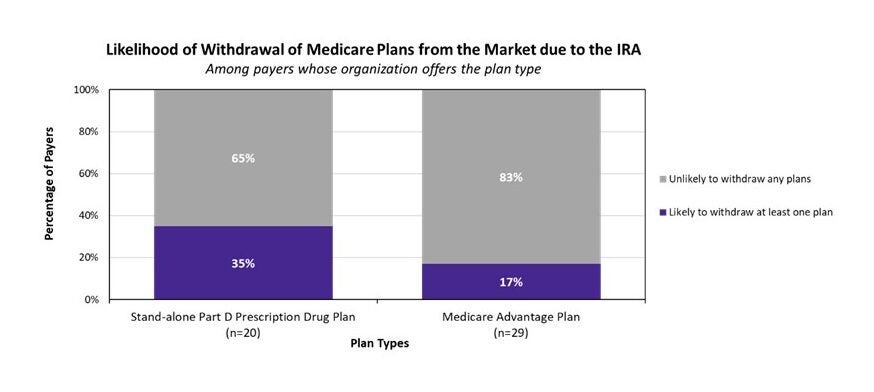

Impact of the IRA on insurance company willingness to provide Medicare plans

One-third of payers said they are likely to withdraw Medicare Part D Prescription Drugs Plans (PDPs) from the market in response to the challenges posed by the IRA. Nearly early 1 in 5 expect to withdraw some Medicare Advantage plans from the market due to the law (see figure 4). The adverse impact of the IRA upon PDPs is perceived to be higher because Medicare Advantage plans can offset some of the increased Part D expenditure by increasing management of the Medicare Part B medical benefit, including non-drug costs such as surgeries. PDPs cover Medicare Part D benefits, while Medicare Advantage plans cover Parts B and D, enabling them to spread the increased Part D financial risk across both benefits.

Figure 5: IRA pressures could push 1 in 3 Prescription Drug Plans off the market

Source: Clarivate Payer survey on the impact of the IRA

Overall impact of the IRA on the pharmaceutical industry

The impact of the IRA appears likely to extend beyond drugs selected by the government for Medicare price negotiation. The majority of payers surveyed expected competitors of the negotiated drugs to match or beat the price obtained by Medicare, and 100% of respondents stated they expect Medicare drug price negotiations to impact net price negotiations between payers and manufacturers in the commercial market.

Payers said their leading concern about the IRA is their 60% cost-share in the catastrophic coverage phase of the Medicare Part D redesign, followed by the $2,000 patient out-of-pocket cap, a new feature that further increases their expenses. Other worrisome scenarios for insurers include rising compliance costs, reduced commercial market rebates, and financial constraints due to the 6% cap on Medicare premium increases. These hits to payers will be passed along to the pharmaceutical industry in the form of tougher price negotiating positions and increased utilization management.

To learn more about how Clarivate helps biopharma innovators navigate a fast-changing market access environment, please visit us our website. For more on the IRA, view Clarivate Primer on the IRA, and read our recent post on the first round of price negotiations and what they portend for manufacturers going forward.

For detailed results from the survey, read the poster presented at the ISPOR conference by Clarivate Market Access and Evidence, Value, and Access consultants Varun Saxena, Mengyun Liu, John Stahl, Dee Chaudhury, and Margaux Cornell