How foreign vs. domestic filing flows are reshaping global trademark strategy in 2026

Trademark offices around the world are experiencing meaningful shifts in the balance between foreign and domestic applicants. These filing-flow patterns offer valuable insight into how brands are expanding across borders, how local markets are strengthening and where competitive pressure is intensifying.

Using insights from the Trademark Filing Trends Report and data from the SAEGIS platform, we examine how filing flows are changing across key jurisdictions and how IP teams can use this intelligence to guide clearance, monitoring and portfolio decisions today.

Here are four major filing-flow dynamics shaping how brand owners and legal teams are navigating global protection efforts.

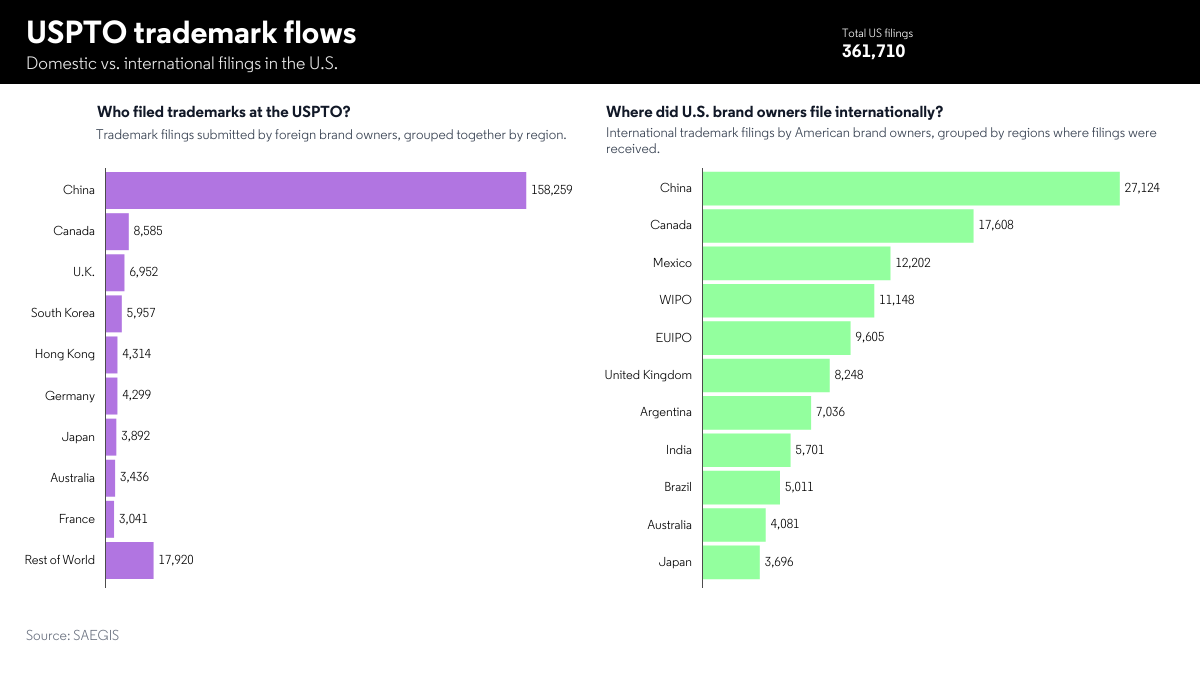

1. The United States remains the world’s filing magnet, but outbound activity is stabilizing

Source: The Trademark Filing Trends 2025 report

The United States (U.S.) continues to serve as the strongest global draw for foreign applicants. Even as overall volumes fluctuate, foreign filing into the U.S. consistently outpaces outbound U.S. filings into other markets.

Foreign applicants from Mainland China, the United Kingdom (U.K.) and Germany remained among the most active filers into the U.S., reinforcing its role as a priority launch market.

Meanwhile, outbound U.S. filing into European and Asian markets has shown signs of stabilizing after several years of elevated growth. This balance suggests global brands may be refining their international filing strategies and being more selective about the jurisdictions they pursue.

What does this indicate?

- The U.S. retains its position as a primary competitive battleground for brand protection.

- Global applicants continue to invest in early U.S. protection to support expansion.

- Stabilizing U.S. outbound filing may reflect more targeted international portfolio planning.

2. Canada and the U.K. serve as balancing points in global filing flows

Canada and the U.K. remain high-volume destinations for foreign filings, often receiving significantly more inbound applications than they send outbound. These markets act as strategic footholds for global brands entering North America or Europe.

In Canada, foreign filings in consumer-facing classes materially outpaced domestic outbound filings, showing its role as an early-stage test market. The U.K. displayed a similar dynamic, with inbound filings from both U.S. and EU applicants exceeding domestic outbound activity.

What does this indicate?

- Canada and the U.K. continue to function as entry hubs for broader regional expansion.

- Filing teams should expect sustained competition from internally diverse applications.

- Clearance strategies may require earlier, broader monitoring coverage to reflect global inflow.

3. India and Mainland China show contrasting domestic vs. foreign dynamics

India remains one of the most domestically driven registers in the world. Domestic applicants consistently make up the overwhelming share of filings, outpacing foreign inbound volumes across most classes. Such strong domestic-led filing activity reflects the accelerating growth of India’s innovation ecosystem and its maturing internal market.

Mainland China shows movement in the opposite direction. While domestic filing volume remains dominant, foreign inbound filings from the U.S., South Korea and Europe continued to increase across several Nice classes, especially technology and consumer goods.

What does this indicate?

- India’s filing landscape is becoming increasingly competitive for domestic-first applicants.

- Foreign brands expanding into India must be especially careful in clearance and monitoring.

- Mainland China’s continued growth as both inbound and outbound filer signals increasing global reach.

4. EUIPO continues to be a high-efficiency engine for cross-border filing activity

The European Union Intellectual Property Office (EUIPO) remains one of the most active destinations for trademark filings, driven by its unique ability to grant coverage across 27 markets with a single application. Foreign inbound filings into the EUIPO continue to exceed outbound EU filings into individual countries, reflecting the value of consolidated protection.

Foreign filers, including applicants from the U.S., U.K., Mainland China and Japan, rely heavily on the EUIPO for regional coverage. Meanwhile, EU-based filers send proportionally fewer applications outward, suggesting the EU register is serving both a defensive and expansion-focused platform.

What does this indicate?

- The EUIPO remains central to global filing strategies given its ability to consolidate protection across multiple markets.

- Clearance in the EU continues to require broad monitoring across a diverse mix of inbound filers.

- IP teams are increasingly selecting the EUIPO as a first-stop jurisdiction when coordinating regional brand launches.

How IP teams are using filing-flow insights today

The filing-flow patterns reveal more than where applications are being submitted. They illustrate how market confidence, expansion priorities and competitive pressure are shifting — and how IP teams are already applying these insights to shape more responsive, data-backed portfolio decisions. The four ways this data can be used to impact your IP strategy are:

- Prioritizing early clearance in high-inflow jurisdictions

Markets with disproportionately high foreign inbound filings — such as the U.S., Canada and the EU — will require earlier and more comprehensive clearance and watch coverage. - Using filing-flow data to identify emerging markets

Increases in foreign activity in Southeast Asia, India and the Middle East signal markets where competition is rising and early market entry may be accelerating. - Adjusting filing plans to reflect domestic vs. foreign pressure

Domestic-heavy registers like India may require different filing, monitoring and risk-tolerance strategies than highly international registers like the U.S. or EUIPO. - Aligning portfolios with real movement, not legacy patterns

Outbound filing levels are shifting in key economies. IP teams should reassess where protection is genuinely needed rather than relying on historic filing templates.

As jurisdictional dynamics continue to evolve, access to reliable, up-to-date trademark data – and tools that make it actionable – will be essential for making informed decisions at speed.

Clarivate supports data-driven filing-flow decisions

Clarivate provides unmatched real-time visibility into how filing flows are shifting, including who is filing, where activity is accelerating and where competitive pressure is building. With curated trademark data, watch tools and analytics designed for clarity and speed, IP teams can evaluate risk earlier, strengthen clearance decisions and prioritize markets with greater confidence.

If you’re looking to apply filing-flow intelligence to your current portfolio or client work, our team can help you get started.

Speak to an expert to find out how our CompuMark tools can help you apply filing-flow insights to real-world clearance portfolio decisions.