Methodology

Patent lawsuits involving Non-Practicing Entities (NPE), a group of actors playing a unique role in the history of the IP industry, are becoming a global matter. With the development of a Chinese IP protection system, NPEs have taken more notice of China. This paper presents the landscape of NPE litigation in China, based on exclusive data available through the Darts-ip™ database.

This report defines NPEs as: legal organizations which benefit from patent rights but do not sell or manufacture goods or provide goods-related services and take an active role in infringement litigations as plaintiffs to enforce their patent rights. Individuals and universities are not included in this data.

The statistics presented below are extracted from NPE litigation data in Mainland China, where at least one party is an NPE. The data covers a period between 2010 and 2019.1 All relevant actions involving the same parties on the same subject matter are presented as independent litigation and will be referred to as a ’case’ in the context of this paper.

For example, if Party A filed an invalidity action against Party B before the CNIPA Patent appeal board, with a subsequent appeal sent to the Beijing IP Court and finally escalated to the Supreme Court, this is still considered one case despite there being three different rulings. As long as any document in a case was made within the 2010 to 2019 timeframe2, the case will appear in the below data.

Facts and figures

The evolution of NPE litigation in Mainland China

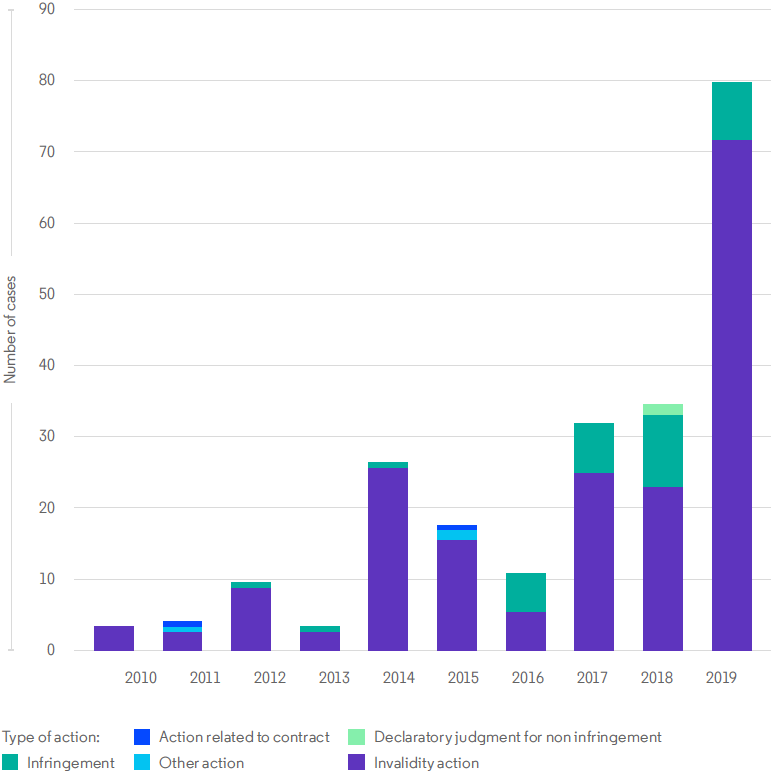

Figure 1 shows an undeniable, growing trend of NPE patent-related actions over time, although a few dips in the year-over-year statistics do exist. The number of cases increased significantly in 2014 and 2019. It is noteworthy that there also exists a marked increase (by 62%) of NPE litigation in Europe in 2014. That year also happens to see the first decline in patent litigation case volume in the United States.

When it comes to the types of action, the proportion of invalidity actions3 is by far the largest. Invalidity actions account for 80% of all actions in each year on average. The smallest proportion (50%) occurred in 2016. Infringement actions increased suddenly after 2016, then kept a steady rise. It can be inferred from the surge of invalidity actions in 2014 that a large amount of infringement actions were initiated by NPEs in 2014 but were reflected after 2016, as the judgements of infringement actions were usually made after those of invalidity decisions. As a final thought to this point, it would seem a safe assumption that since 2014, NPEs have most likely shifted focus from America to other countries or regions, such as Europe and China.

Figure 1: Evolution of NPE litigation4 and types of action breakdown over the last decade

Please note that the year indicated is the year of filing. If this is unavailable then the earliest known document in the case is referenced.Source: Darts-ip

The map of NPE litigation

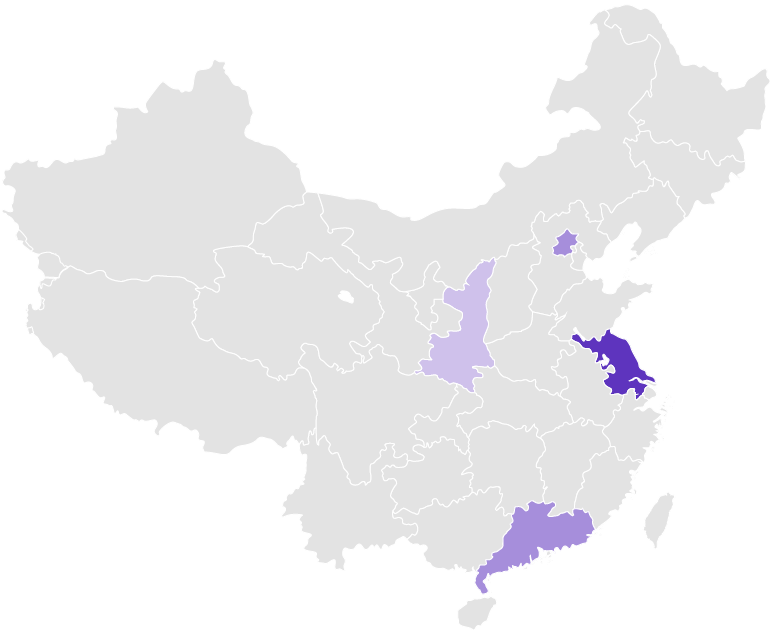

Figure 2 outlines the areas where cases are concentrated. NPEs prefer litigating in well-developed Chinese provinces or cities, i.e. Jiangsu province (13 cases), Guangdong province (10 cases), Beijing city (10 cases), Shanghai city (7 cases) and Shaanxi province (1 case). Among them, six cases were finally heard by the Supreme Court. And NPEs filed most of the litigations before the following courts: Shenzhen Intermediate Court, Nanjing Intermediate Court and Beijing IP Court.

Figure 2: The geographical distribution of NPE litigation in Mainland China

Figure 2’s map presents geographical distribution of all actions except for invalidity actions. The darker the purple is, the more cases occur in the area.Source: Darts-ip

Technical fields of litigated patents

The technology of patents involved is mainly distributed in the field of electronic communication techniques, with the largest amount of cases in wireless communication networks, as the result of the intensive innovation, fierce competition and rapid development of domestic communication industry.

Table 1: Top 10 IPC classifications of litigated patents

| IPC | Technical fields | Cases | |

|---|---|---|---|

| 1 | H04W | wireless communication networks | 104 |

| 2 | H04L | transmission of digital information, e.g. telegraphic communication | 84 |

| 3 | H04B | transmission | 60 |

| 4 | H04Q | selecting | 27 |

| 5 | H03M | coding, decoding or code conversion, in general | 26 |

| 6 | H04J | multiplex communication | 25 |

| 7 | H01Q | antennas, e.g. radio aerials | 21 |

| 8 | H03H | impedance networks, e.g. resonant circuits; resonators | 16 |

| G10L | speech analysis or synthesis; speech recognition; speech or voice processing; speech or audio coding or decoding | 16 | |

| 9 | G01L | measuring force, stress, torque, work, mechanical power, mechanical efficiency, or fluid pressure | 14 |

| 10 | H04M | telephonic communication | 10 |

The patents include both NPEs and non-NPEs (For example, NPEs that filed an invalidity action against non-NPEs.)Source: Darts-ip

Right validity of NPE patents

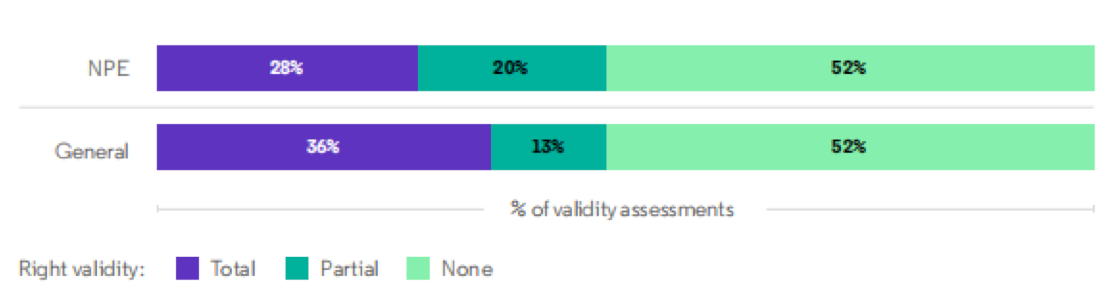

The graphs below compare the right validity of NPE asserted patents to general patents (understood here as patents belonging to any party, regardless of their type). The bar graphs of Figures 3 and 4 illustrate the scope of protection extended to the patents. Purple indicates a full scope of protection based on the application, dark green represents patents that have been granted protection but with a reduced scope, and light green represents revoked patent applications.

According to Figure 3, the percentage of NPE patents that are valid without any reduction to the scope of protection5 is 8% lower than with general patents, suggesting that NPE patents are weaker. However, the revocation rate for both general and NPE patents is comparable.

Figure 3: Validity rate of challenged patents owned by NPEs versus general patents

Source: Darts-ip

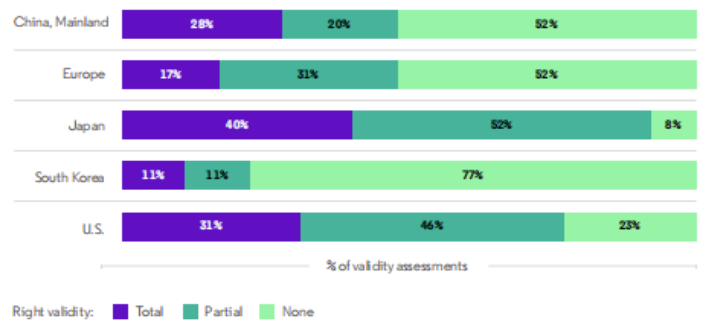

Figure 4: Validity rate of challenged patents owned by NPEs in China versus other jurisdictions

Patent challenge actions including invalidity actions, oppositions, inter-partes reviews and right assessments in infringement actions.Source: Darts-ip

Figure 4 suggests that NPE patents considered valid, without any reduction to the scope of protection, is very low in South Korea, at 11%, and very high in Japan at 40%, while China is in between those numbers. When looking at other jurisdictions, we can see that the NPE patent validity rate in China is close to that in the U.S., and significantly higher than in Europe.

Summary of trends

The analysis of the statistics examined above reveals these key trends in NPE litigation in China:

- NPEs started to actively bring lawsuits in China as of 2014. The case volume has seen a dramatic increase in 2019.

- NPEs prefer litigating in developed provinces or cities.

- The patents are mainly regarding electronic communication technologies.

- When a NPE patent is considered valid, it is more likely to have a reduction in the scope of protection and granted partial protection.

References

- All numbers checked as of March 6, 2020.

- This paper accounts for filing dates between 2010 to 2019, if filing date unavailable, earliest known document’s date in the case is referenced.

- An invalidity action can be brought against a patent at any time in its lifecycle. The purpose of this action is to challenge a patent and remove the protection granted to the holder. If the action is successful, a patent holder loses the protection and may have to reevaluate licensing agreements and rights that may have been granted. Invalidity actions in China can only be brought before the Re-examination and Invalidation Department of the Patent Office, China National Intellectual Property Administration (CNIPA).

- There are 250 NPE-related patent cases that have been entered in the Darts-ip case-law collection during the period of 2010 to 2019.

- Represented by the purple section of the bar chart.