A new study by the Centre for Innovation in Regulatory Science (CIRS) has shown that the approval times of major global regulatory agencies have reduced and converged over the last decade, though there are still differences between them. Increased collaboration between regulatory agencies also appears to be having a positive impact on the roll out of new drugs. The following blog post summarizes key findings from the latest CIRS R&D Briefing, New drug approvals in six major authorities 2012-2021.

CIRS has been benchmarking regulatory agencies since 2002 using a methodology developed with agencies that ensures like-for-like comparisons. The resulting analyses, published annually since 2012, give unique insights into regulatory processes and practices, identify where improvements can be made and inform company and agency strategies.

Four major trends came to light from CIRS’ most recent analysis of new active substance (NAS) approvals for the European Medicines Agency (EMA), US Food and Drug Administration (FDA), Japanese Pharmaceuticals and Medical Devices Agency (PMDA), Health Canada, Swissmedic and the Australian Therapeutic Goods Administration (TGA).

The following trends we discuss in this post are:

1. NAS approval times have improved but still differ

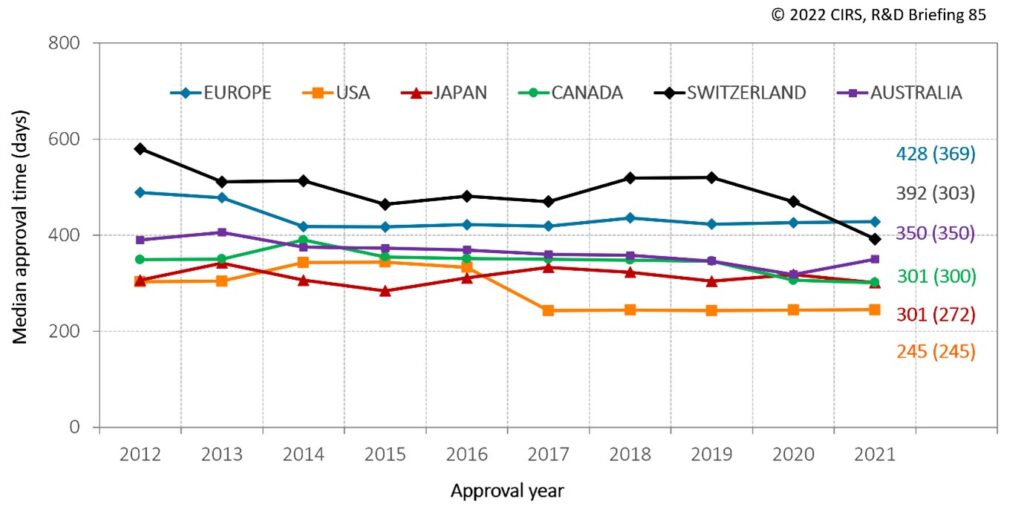

The CIRS study showed that, despite the COVID-19 pandemic, NAS approval times in 2021 for most of the six agencies were shorter or similar to those in 2020 (Figure 1). The only exception was the TGA, which had a median approval time of 350 days in 2021, compared to 315 days in 2020. This suggests that COVID-19 may have had an impact on the workload of the Australian agency.

Despite regulatory convergence over the last 20 years, there were still differences in approval times across the six agencies in 2021 (Figure 1). However, there was less variation between the agencies when the time from submission to the end of scientific assessment was compared (number in parentheses, Figure 1). This highlights that, at least for some agencies, there are activities that occur following the end of scientific assessment, such as administrative activities or additional negotiations with the sponsor, which contribute to the overall approval time.

Figure 1: NAS median approval time for six regulatory authorities in 2012-2021

Approval time is calculated from the date of submission to the date of approval by the agency. This time includes agency and company time. EMA approval time includes the EU Commission time. N1 = median approval time for products approved in 2021; (N2) = median time from submission to the end of scientific assessment for products approved in 2021.

2. FDA continues to approve the most NASs

The CIRS study found that the FDA approved the highest number of NASs in 2021, continuing its streak of being the leading NAS approver since 2017. The high number of approvals may be due to the availability of facilitated regulatory pathways at the FDA, or that some medicines approved by the FDA, particularly from smaller companies, do not become internationalized.

There was a general increase in the number of NASs approved by the six agencies over the last decade. However, when only the last five years were considered, there was a plateau in approvals by the FDA and Health Canada. The variance in the number of products approved by each agency may be explained by a number of factors such as different submission strategies to each agency, depending on company size, unmet medical need and review speed.

3. Regulatory collaboration reduces NAS roll out times

This CIRS study took a closer look at the impact of two collaborative regulatory initiatives featuring some of the six agencies as well as other major global agencies: the Access Consortium and Project Orbis.

The Access Consortium is a work-sharing initiative that aims to maximize international regulatory cooperation, reduce duplication and increase each participating agency’s capacity. As part of the work-sharing process, the agencies involved review different parts of the submitted dossier. Although the review is shared, each agency makes an independent decision regarding approval of the new medicine.

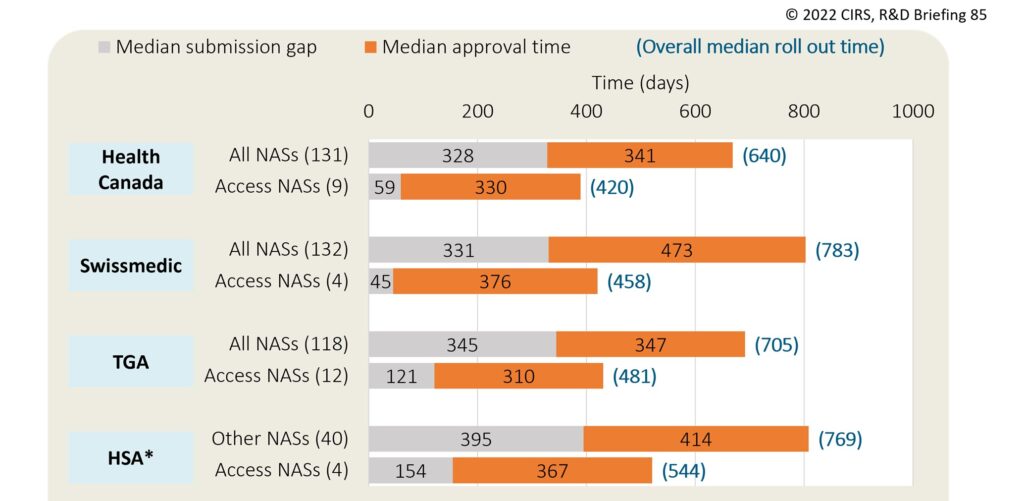

Between 2018-2021, 12 NASs were approved in total through the Access Consortium; the TGA participated the most in the work sharing, approving all 12 NASs, followed by Health Canada (9 NASs), the Singaporean Health Sciences Authority (HSA) (4 NASs) and Swissmedic (4 NASs). The UK Medicines and Healthcare Products Regulatory Agency (MHRA) joined the Access Consortium in January 2021 but did not approve any NASs in that year. Compared to all NASs approved between 2018 and 2021, NASs approved via the Access Consortium had shorter roll out times, which was largely due to lower submission gaps (Figure 2). This suggests that work sharing is helping to bring medicines to patients quicker.

Figure 2: Median submission lag and approval times for NASs approved by Access Consortium members between 2018-2021

(N) = number of approvals. Submission gap is calculated as the time from date of submission at the first regulatory agency to the date of regulatory submission to the target agency. Approval time is calculated from the date of submission to the date of approval by the agency; this includes both agency and company time. Roll out time is calculated from the date of submission at the first regulatory agency to the date of regulatory approval at the target agency. *For HSA, the timelines for other NASs were obtained from the CIRS Emerging Markets Industry Metrics Program (2019-2021 approvals).

Project Orbis is a collaborative initiative of the US FDA Oncology Center of Excellence that aims to give patients faster access to promising cancer treatments across the globe. Partners of Project Orbis work together on the review of oncology submissions by conducting parallel evaluations and sharing information with each other.

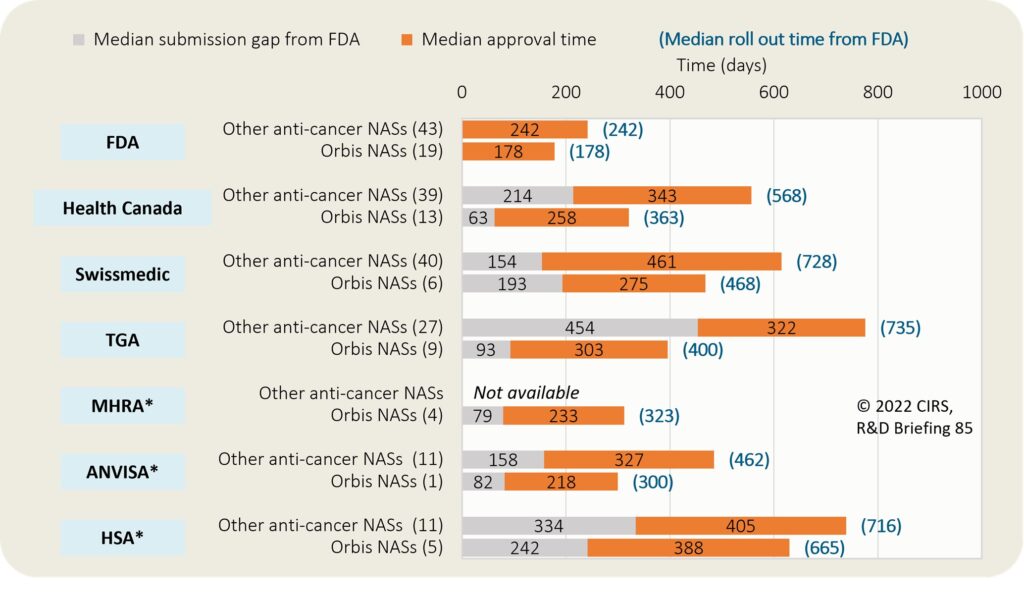

Between 2019-2021, Project Orbis facilitated the approval of 13 NASs by Health Canada, nine by the TGA, six by Swissmedic, five by the HSA, four by the MHRA and one by the Brazilian Health Regulatory Agency (ANVISA) (Figure 3). Compared to other anti-cancer and immunomodulator approvals, Project Orbis approvals tended to have quicker median roll out times, thus demonstrating that global regulatory collaboration can deliver faster access to new therapies for patients with cancer.

Figure 3: Median submission lag and roll out times for anti-cancer and immunomodulator NASs approved via Project Orbis between 2019-2021

(N) = number of approvals. Submission gap from FDA is calculated as the time from date of submission at FDA to the date of regulatory submission to the target agency. Approval time is calculated from the date of submission to the date of approval by the agency. This time includes agency and company time. Roll out from FDA is calculated from date of submission at FDA to the date of regulatory approval at the target agency. *For ANVISA and HSA, the timelines for other anti-cancer and immunomodulator NASs were obtained from the CIRS Emerging Markets Industry Metrics Program (2019-2021 approval). For MHRA, the submission dates were obtained directly from the companies.

4. Changes in company strategy

The CIRS study found that the number of products approved by all six agencies decreased by 23% from 2012-2016 (56 NASs) to 2017-2021 (43 NASs). Compared to CIRS analyses in the past years where there was an increase in the number of products approved by all six agencies, this decrease suggests that the pace of internationalization may be levelling off. However, it is worth noting that the proportion of NASs approved by two or more agencies did increase from 2012-2016 to 2017-2021.

There also appeared to be a change in the waves of submission to agencies other than the FDA and EMA. The median submission gap to the PMDA had halved from 330 days in 2012-2016 to 165 days in 2017-2021, meaning submissions to the PMDA were becoming more simultaneous with those to Health Canada, Swissmedic and the TGA.