Clarivate U.S. market access experts discuss recent Medicaid policy changes in some states meant to control drug costs and increase transparency. Read more.

In recent years, state governments began to notice rising costs of drugs and hidden charges associated with them. As state and federal governments contribute to a large portion of Medicaid expenses, they are committed to controlling rising Medicaid expenses. Now, they are trying to control these costs by trying to implement various reforms. When a pharmacy benefit manager (PBM) gets higher payment from the insurer, compared to what it pays the pharmacy for the drug and keeps the additional amount as profit, it is called spread pricing.

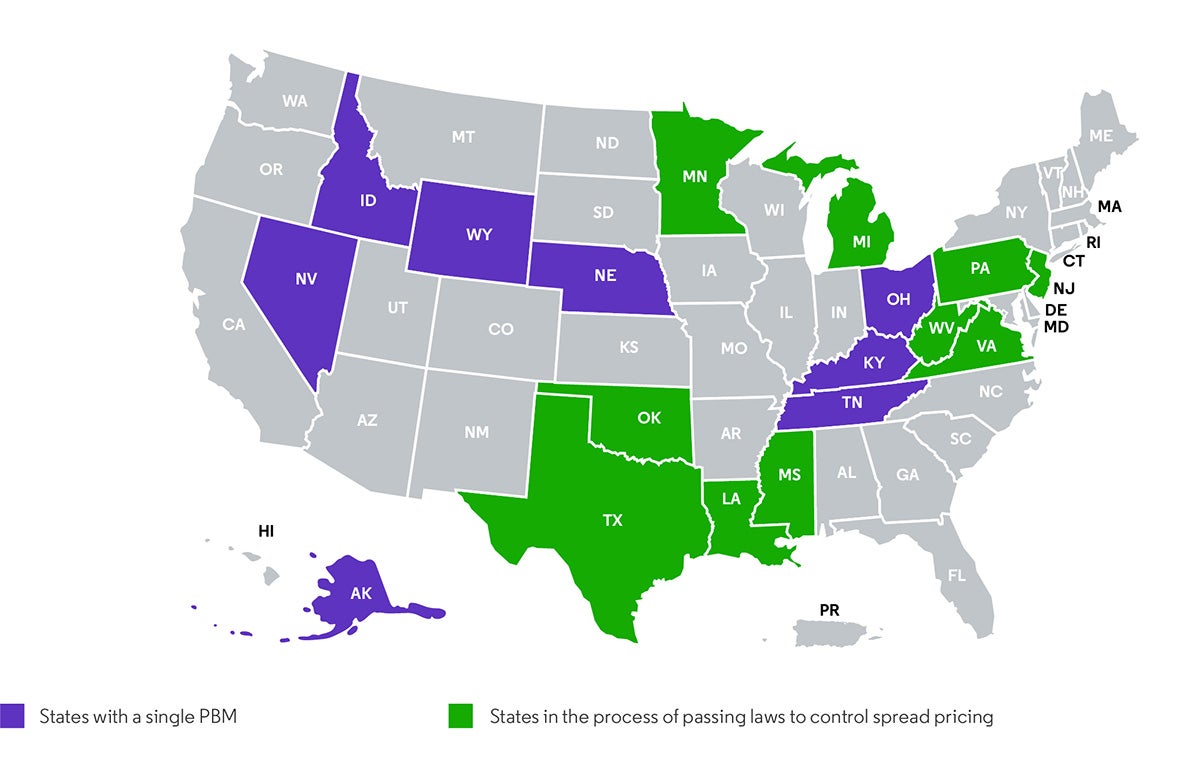

Some states have been trying to prevent spread pricing by selecting a single PBM to manage Medicaid pharmacy benefits.

- In February 2021, Ohio moved to a single pharmacy benefit manager system, hiring Gainwell Technologies (previously DXC technologies) to manage all PBM functions.

- Kentucky awarded Medicaid pharmacy benefits contract to MedImpact went into effect in July 2021.

- Louisiana has its own internal state pharmacy benefit program.

- Michigan has carved-out pharmacy benefits and transitioned to fee-for-service.

- New York is considering a similar approach of shifting to a fee-for service program, but its plans have been delayed through April 2023.

Other states have passed bills or are trying to get a single PBM to manage Medicaid.

- Nebraska, Tennessee, Ohio, Kentucky, Nevada, Idaho, Alaska, Puerto Rico and Wyoming have a single PBM administering Medicaid benefits (Clarivate Medicaid profiles as of September 2021).

- Nearly 16 states have bills to control spread pricing, including Kentucky, Ohio, Tennessee and New York, which have implemented single PBM reforms.

What could this mean for pharmacy benefit managers?

- CVS Caremark manages pharmacy benefits for Molina Healthcare, Centene and Aetna, which hold a Medicaid contract in states that are transitioning to a single PBM. This could potentially cause CVS to lose Medicaid memberships, but it may gain other lives.

- Magellan Medicaid Administration is a popular choice among states to manage pharmacy benefits for Medicaid fee-for-service (FFS) members (Alaska, Idaho, Nebraska and New York). Centene is close to finalizing its acquisition of Magellan Health, which could augment Centene’s position as a strong government sponsored insurer. OptumRx is a single PBM for Nevada and Tennessee. (Clarivate Medicaid profiles as of September 2021).

- Smaller PBMs with a transparent pricing model have an advantage over larger PBMs that struggle with price transparency. While some large PBMs like CVS have announced the adoption of a transparent pricing model, gaining trust has been difficult.

- Larger PBMs like CVS have grown their portfolio of care delivery in most states, making them better positioned to take on a contract involving a large client, or in this instance the entire state.

States that have taken steps to control spread pricing

Source: Clarivate Medicaid profiles, September 2021

Drug pricing transparency, coupled with the enormous bargaining clout of being the only PBM managing Medicaid in a state, may reduce the total cost of drugs significantly. If more states move to a single PBM model, there could be rising competition to win a state contract that guarantees significant membership for a long period of time. Such reforms will answer questions regarding the effectiveness of a “pass-through model” adopted by most PBMs.

Key takeaways

Overtime, states have increased their reliance on third party payers and PBMs, making them prone to financial losses due to spread pricing. A report by Ohio state auditor in 2018, found that the overall drug costs had increased through spread pricing. Now, states are finding different ways to curb these rising prices in Medicaid. For example, Ohio’s model of a state-regulated single PBM may be one of the answers to this problem. Additionally, Michigan’s decision to move back to FFS might be a good choice to control spread pricing, but will add to the state’s administrative load. Moving forward, we can expect new state level policies that dictate more control over pricing issues and eliminate multiple third party PBMs.

Contributors to this blog include Nishitha N. Prabhu, Market Access Senior Analyst and Lonita Lobo, Market Access Analyst.

Get a comprehensive and granular view of the healthcare ecosystem and market dynamics and how to break down barriers to access with Clarivate market access intelligence.