The COVID-19 pandemic has had a negative impact on healthcare patient volumes, procedure utilization and sites of service, and the effect has varied by procedure urgency. In this article, Clarivate analysts detail which procedures and sites fared the best and which are most likely to recover as more of the population is vaccinated, a critical component for healthcare facilities to expand capacity and for patients to feel comfortable presenting for elective and deferrable procedures. This article is an excerpt of the COVID-19 vaccine availability and medtech impact report.

Although the COVID-19 pandemic negatively impacted the healthcare industry during lockdowns, we also saw many markets recover quite rapidly within 2020.

Patient volumes and procedure utilization

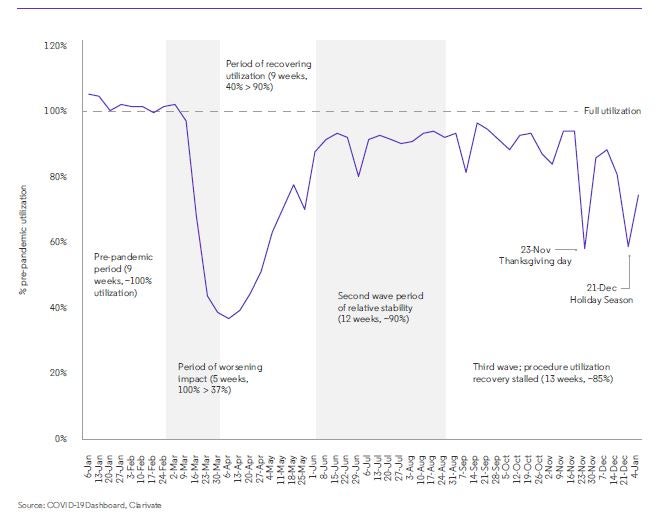

Procedures in the United States saw strong recovery following the initial impact of COVID-19 in March 2020, but stalled below full utilization throughout Q4 2020, due primarily to a resurgence of COVID-19 cases and related public health measures (Figure 1). For a given market, ‘full capacity utilization’ is considered to be the point at which procedures that were not performed in 2020 due to COVID-19 — excluding those that were effectively lost due to alternative treatments or lack of necessity — have been recovered. Beyond full capacity utilization, a given market has effectively returned to its pre-pandemic trends.

Figure 1. COVID-19 impact on procedure capacity utilization, United States

Source: Clarivate COVID-19 Dashboard, based on Clarivate Real World Data. Patient volume data were normalized to a pre-COVID-19 baseline as a proxy for procedures.

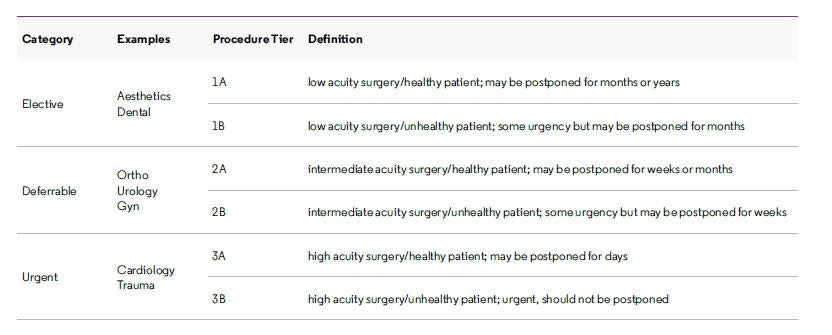

COVID-19 affected patient mobility and willingness to visit healthcare facilities as well as the prioritization of resources, which led to deferrals of procedures and care. In line with initial expectations, the impact was most pronounced among elective procedures, followed by deferrable procedures and then urgent procedures (Figure 2).

Figure 2. Breakdown of procedure tiers

Source: Clarivate, adapted from CMS Non-Emergent, Elective Medical Services, and Treatment Recommendations

Site of service impacts

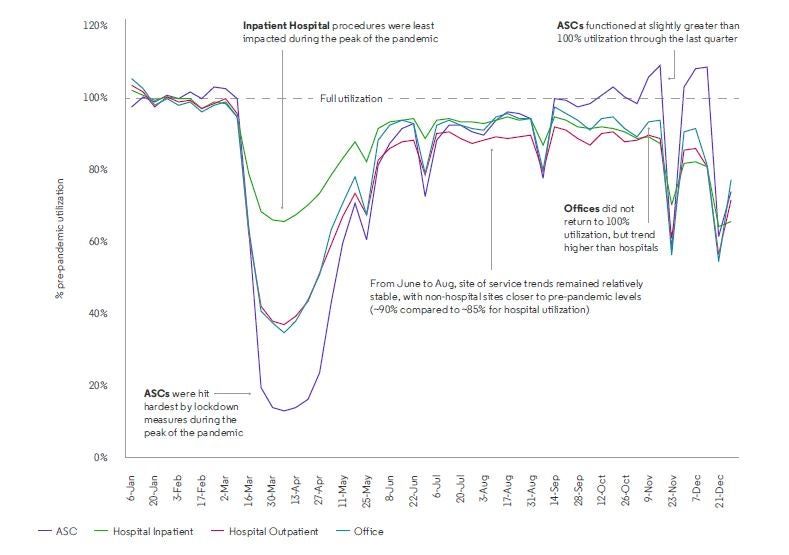

The urgency of the situation also dictated the distribution of procedures across sites of service. For example, procedures that take place in the inpatient setting are generally more urgent than those performed in ambulatory surgery centers (ASCs) and physician offices.

As shown in Figure 3, during the initial COVID-19 wave, ASCs were hardest hit, while inpatient settings were the least impacted. However, ASCs and offices were trending at higher procedure capacity utilization rates than hospitals in Q4 2020, which may signal stronger 2021 recovery for those settings. The fact that ASCs were functioning at slightly higher than 100% full utilization (i.e., exceeding pre-COVID-19 levels) through the last quarter of the year may signal a shift of some procedures from inpatient settings to ASCs during a COVID-19 resurgence.

Figure 3. COVID-19 impact on medical procedure utilization, by site of service, in the United States

Source: Clarivate COVID-19 Dashboard

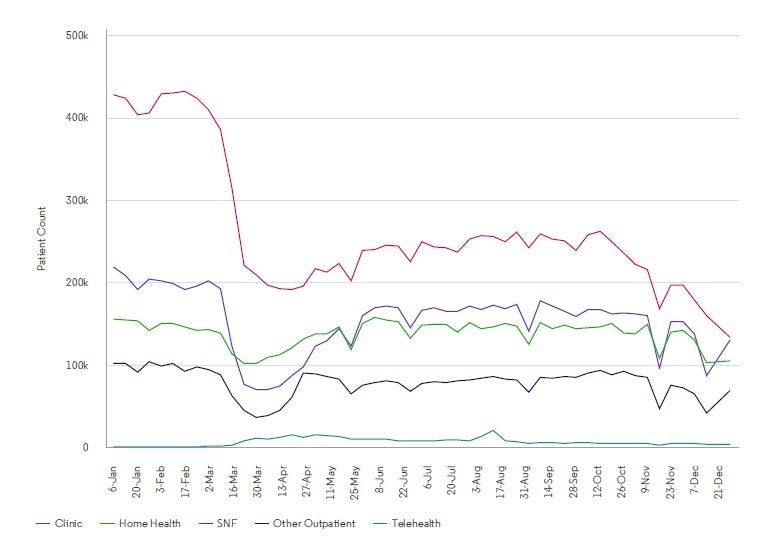

Figure 4 shows a similar view for non-acute settings, demonstrating how skilled nursing facilities remain substantially below full procedure capacity utilization, possibly due to the need for expanded nursing staff in hospitals treating COVID-19 patients. Simultaneously, clinics and home health also took a strong hit in the initial wave but have seen stronger recovery since. Notably, telehealth emerged as a useful alternative for in-person care in 2020; although telehealth volumes remain relatively quite low, we expect that the increased use will likely expand beyond the pandemic.

Figure 4. COVID-19 impact on medical procedure utilization, by site of service, in the United States

Source: Clarivate COVID-19 Dashboard

Effect of vaccination on healthcare recovery

Many factors affect capacity utilization, including facility resource prioritization and ongoing physical distancing measures. Because these will continue to affect capacity utilization until significant portions of the population have been vaccinated, Clarivate market models use vaccination milestones as a key metric to predict recovery, which itself varies by procedure tier and urgency.

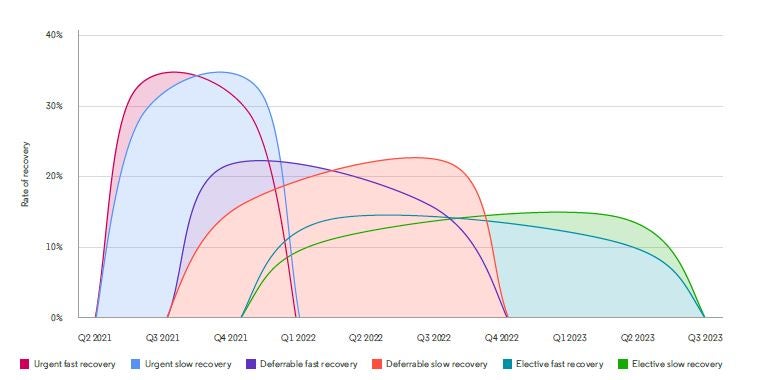

We assume that procedure capacity utilization will begin to return to 100%—measured against the nine-week pre-pandemic baseline—starting in Q2 2021 (Figure 5). Urgent procedures are expected to recover starting in Q2 2021, lasting for three quarters. Deferrable procedure recovery is forecasted to take place from Q3 2021 to Q4 2022, and elective procedure recovery is expected to start in Q4 2021 and last well into 2023. However, these timelines may be affected by the increased prevalence of more transmissible COVID-19 strains and other unforeseen challenges.

Figure 5. Rate of procedural recovery, by procedure tier

Source: Clarivate

Moreover, thresholds for loosening restrictions and reopening economies will vary by country based on immunization rates, as well as economic circumstances and political considerations. Therefore, the relationship between procedure urgency and economic reopening will determine the recovery of capacity utilization for a given procedure in a given country. This will also depend on vaccination administration goals and whether vaccination campaigns meet them; our experts’ forecasts of vaccination rates by region and country are described in detail in the full report COVID-19 vaccine availability and medtech impact.

Download the full report COVID-19 vaccine availability and medtech impact for more findings on:

- 2020 impact and recovery insights

- Current vaccine development status and the various distinctions between different vaccines

- How we believe the vaccination campaigns will roll out globally and how this influences forecasting

- Impact of vaccination availability on health care markets and sectors

Analysis and data sources

Forecasts and insights provided in this blog were developed by Clarivate analysts using a diversity of proprietary sources:

- Clarivate Real World Data™ product provides access to real-world data, such as patient volumes by procedure group and site of service.

- Market Tracking: Medical Supply Distribution data enables manufacturers to identify opportunities and risks by confidently assessing market share based on real-time insights.

- Medtech Insights™ provides comprehensive data forecasts and analysis for global and regional medical device markets.

- Market Assessment Epidemiology™ provides solutions to understand the complete disease landscape and size global markets with real-world data.

Clarivate experts who contributed to this article include Kevin Yin, Mark O’Reilly, Meenu Sankar and Raghav Tangri.