China is overhauling its healthcare system to align with the changing economic and demographic situation

China’s healthcare system is undergoing a series of major reforms to the regulatory and reimbursement policies. These reforms are aimed at closing the demand gap for novel and cost-effective therapies, particularly those generally developed and available in the western countries but have not reached the growing domestic market due to approval hurdles. The growing demand is the consequence of a phenomenal boom in the Chinese economy over the last few decades that has lifted millions of people out of poverty and has given birth to an affluent middle class. The rapid increase in consumer wealth has led the Chinese people to demand world-class healthcare and, in turn, China’s pharmaceutical market is now the second largest in the world after the United States.

The 4+7 program aims to improve patient-access to generics by centralizing drug procurement

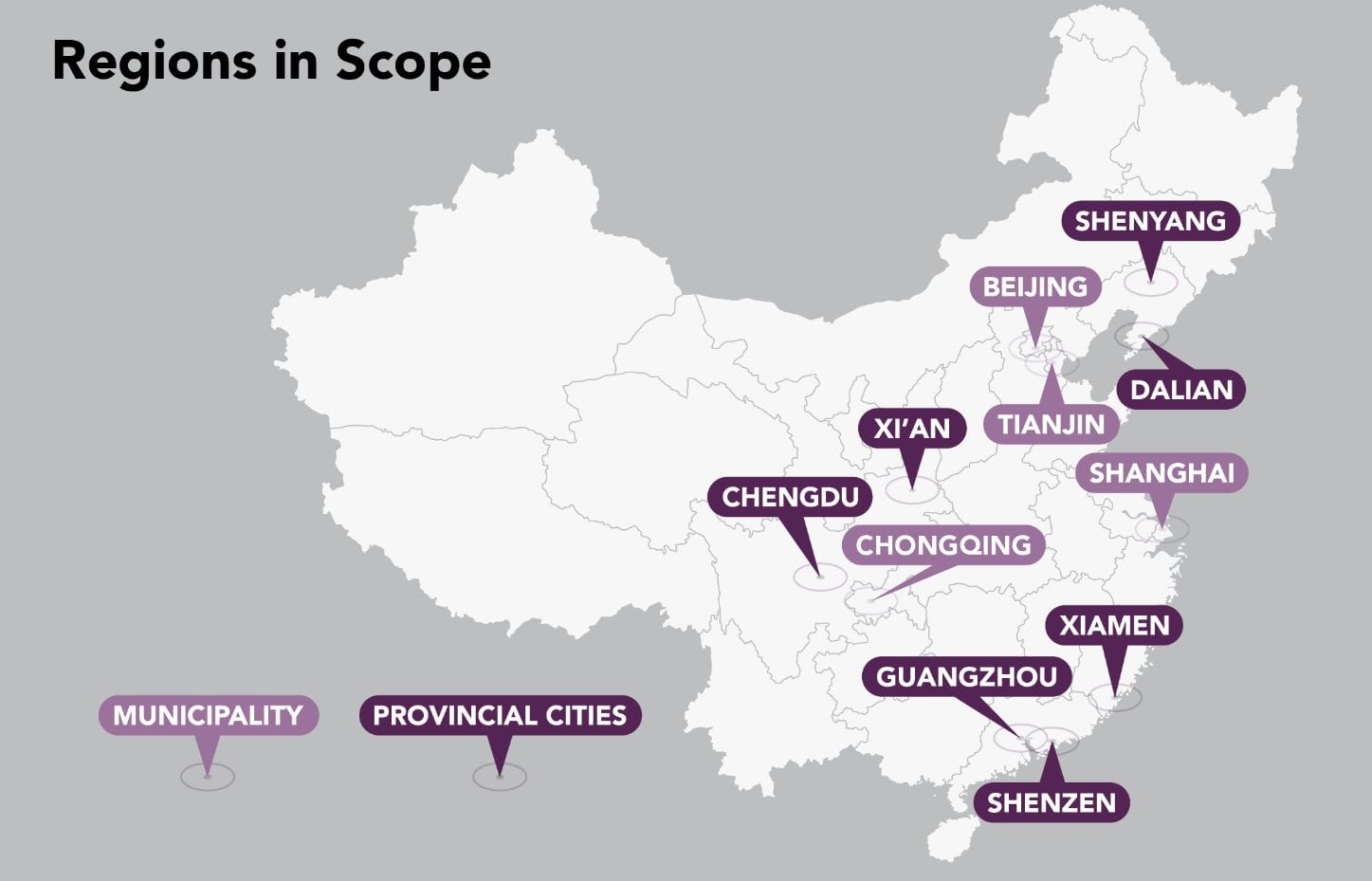

Many of China’s reforms aim to streamline the regulatory processes and improve access and reimbursement to encourage developers to enter China’s healthcare market. In November 2018, the State Medical Insurance Administration (SMIA) of China officially launched the National Drug Centralized Procurement Pilot Scheme, commonly known as the 4+7 Scheme, with the aim to slash generic drug prices and encourage the consolidation of a fragmented system for procuring generic drugs in the country, starting with 11 major cities (4 municipalities and 7 provincial cities).

This pilot program intended to bring a centralized system of quality control in the Chinese pharmaceutical industry; the absence of which has allowed multiple manufacturers to operate in the market, many with low-quality versions of a drug. Previously, such domestic manufacturers thrived and enjoyed high profit margins that significantly exceeded the global average, while multinationals, which usually offer better-quality drugs, suffered long waiting periods to gain import licenses from the government. For the multinational manufacturers who did manage to secure import licenses, most had to negotiate for hospital tenders for their high-cost generic drugs by offering higher quality assurances than their domestic counterparts; this in turn, resulted in keeping drug prices elevated and, often, unaffordable throughout the pharmaceutical sector.

In addition to improving affordability and quality assurance, the pilot program also aims to curb favoritism and corruption that often-enabled manufacturers to win local hospital tendering bids through their regional influence. Under the 4+7 program, the government awards the tender for a generic drug to the lowest bidder, who will be guaranteed a sale volume of 60-70% of the total market for a year across 11 major cities of China including Beijing, Shanghai, and Guangzhou, which account for approximately one-third of the Chinese pharmaceutical market.

The 4+7 program has seemingly achieved its goal of improved affordability, resulting in an average price cut of 52% across 25 recently approved drugs with some of the companies slashing up to 96% of the drugs’ prices. Of the 25 generic drugs impacted by the 4+7 program, which include Gefitinib, Tenofovir, and Imatinib, tenders were won by only two multinational manufacturers—AstraZeneca and Bristol-Myers Squibb, suggesting that it will be increasingly difficult for multinational generic manufacturers, who are usually less willing to compromise on prices, to survive in this changing environment. Nonetheless, the 4+7 scheme has been cited as an early success for patient access in China healthcare.

In April 2019, the National Healthcare Security Administration (NHSA) announced that approximately 27% of the total agreed volumes, amounting to 438 million drug units worth RMB 533 million (USD 79.69 million), have already been procured within the first 14 days of the program’s launch even though it is expected to continue for an additional 11 months. Per the NHSA, patients admitted in hospitals across the 11 cities have benefitted enormously from the negotiated price cuts for several generic drugs, including those for the treatment of multiple types of cancer, hypertension, psychosis, and hepatitis B. Moreover, patients in outlying areas are beginning to travel to one of the 11 cities for treatment, to receive the benefits of the price discounts, justifying potential expansion of the program outside of the 11 cities.

How will centralized drug procurement change China’s healthcare?

The 4+7 pilot program is poised to drive significant improvements in China’s generic pharmaceutical industry that is highly fragmented, suffers from quality control challenges, and is seemingly more focused on profit than on patient access. With price regularization, patients can expect improved access to affordable medicines and therapies of lower quality to be eliminated. Furthermore, this policy will encourage the domestic manufacturers to invest in R&D, ensuring that difficult-to-manufacture generics with high revenue potential are manufactured in China. Most importantly, it will promote fair competition between manufacturers, both domestic and multinational, which is advantageous for the patient community. However, wider implementation of centralized procurement could be challenging in many ways. For example, diminished profit margins due to lower drug prices may discourage multinational manufacturers from operating in China and small domestic manufacturers who fail to win tendering bids, risk being completely displaced from the market. Therefore, multinationals manufacturers must tailor their commercialization strategies to effectively compete in bidding wars, while domestic manufacturers will need to focus more on R&D to thrive in a highly regulated and competitive environment.

Learn more with China In-Depth

Are you interested in learning more about the China healthcare market and disease-specific trends? Our China-In-Depth solution is a comprehensive source of vital disease-specific business and market intelligence in China with world-class epidemiology, keen insights into current treatment paradigms, in-depth pipeline assessments, and multivariable market forecasts. All, which are supported by primary and secondary research conducted in China by analysts with deep indication and therapy-area expertise and a keen understanding of the Chinese healthcare market.

Access our in-depth analysis of the Non-Small Cell Lung Cancer (NSCLC) and Hepatocellular Carcinoma (HCC) markets in China or ask for our upcoming in-depth analysis for NASH, Rheumatoid Arthritis, Multiple Sclerosis, Gastric Cancer, Colorectal Cancer, Type-2 Diabetes, Squamous Cell Head and Neck Cancer, and Bladder Cancer markets in China.