The transformation of the healthcare delivery model and the reinvention of the PBMs will have implications for payers – what are the threats and opportunities?

The below post is an excerpt from our white paper Beyond the PBM: A New Order for Healthcare Delivery.

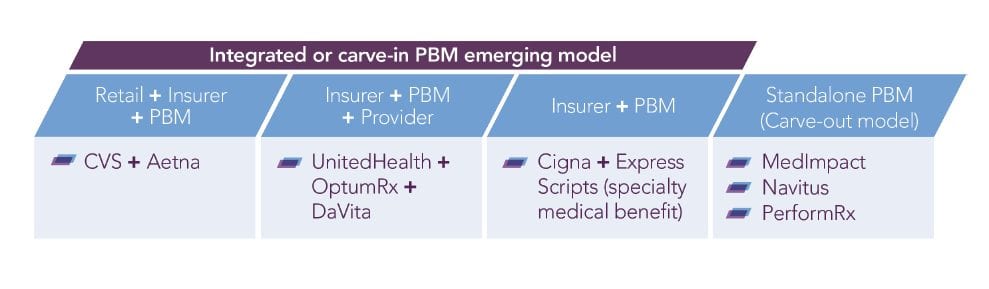

Vertical integration giving PBMs a bigger role in the healthcare value chain

Consolidation in the PBM sector has resulted in just three companies – Express Scripts (ESI), Optum and Caremark – representing 75% of the market by scripts.

In order to protect and further grow their margins, and to fend off potential future plays from the likes of Amazon, the big three are reinventing themselves within vertically integrated conglomerates allowing them to tap into other parts of the healthcare value chain.

They are building out systems, scaling up capabilities, and diversifying service lines. These vertically integrated entities will have a greater focus on total cost of care, and with the pharmacy and medical benefits housed together under one roof, integrated PBMs should be more receptive to engaging in value-based contracts.

What are the opportunities and threats for payers?

Most of the large, national payers have already moved, or are in the process of moving, formulary management in-house, deploying PBMs mainly for channel management services. This first phase of vertical integration of the healthcare value chain has given payers more control over healthcare costs and has better positioned them to link directly with providers and to negotiate value-based contracts. The recent deals by UnitedHealth/Optum to acquire DaVita, CVS Caremark to buy Aetna, and Cigna to acquire Express Scripts have created new verticals with the potential for clinical integration and improved access to low-cost care, aligning medical and pharmacy benefits with healthcare provider networks, and further increasing payers’ influence on prescription drug sales.

Opportunities include…

Reduction of healthcare costs

Vertical integration offers opportunities to lower healthcare costs, improve outcomes, extend relationships with providers, and reduce costly in-patient and ER usage. There are potential savings to be realized by eliminating the wall between PBMs and insurers, particularly if plans are able to effectively leverage PBM tools to manage the medical benefit.

Greater negotiating power and formulary control

The sheer size of combined entities will result in greater negotiating power with pharma, which could mean higher rebates and discounts on drug prices, and larger profit margins. Payers will have more purchasing power over formulary and prescription drugs, the potential to lower drug prices and increase the use of generics in a more transparent system.

Creating a consumer-centric system

The new models offer the potential for greater care coordination and the ability to holistically engage patients, which, to date, insurers haven’t done well. Potentially some of the cost savings could be passed on to patients. For example, Aetna might be able to offer commercial plans with attractive features like co-pay-free primary care services via MinuteClinics, or a pre-deductible for chronic care management.

Value-based contracting

The effective integration of claims data and prescription drug data creates the potential for increased value-based contracting between payers and pharma based on health outcomes.

Aetna and Cigna have focused on forming value-based arrangements with IDNs, hospitals and provider groups in its major markets, while Aetna and CVS have been among the more active payers/PBMs in outcomes-based contracting with drug companies. Given the increased scope of a combined entity, collaboration will likely accelerate.

Steering patients

Vertically integrated systems might allow payers to steer patients towards lower-cost care options, or to providers or pharmacies – especially now that narrow networks are seen as increasingly acceptable by employers and consumers, which gives payers greater leverage. Anthem already steers outpatient care by not reimbursing inpatient MRIs and CTs, and CVS and Aetna look certain to adopt a retail pharmacy steerage strategy.

Threats include…

Consumer pushback

Of course, payers also risk taking the heat for limiting patient choice. CVS-Aetna, for example, must guard against members feeling overly restricted, or confined to CVS pharmacies or Aetna-affiliated providers, by promoting advantages of staying in-network. Aetna would need to socialize and transition the many seniors who are reluctant to use walk-in clinics, preferring their own doctors instead. Similarly, formulary restrictions enforced by the combined entity could affect up to 12 million additional pharmacy lives held by Aetna.

Provider pushback

Providers, too, might push back against patient steerage. Physicians may oppose their patients being sent to a retail clinic after picking up a symptom on a home monitoring system, perceiving it as interference. For patients with complex disease, physicians may consider retail clinics ill-equipped to provide proper treatment.

Federal and state regulations

Federal regulators could restrict the degree of linkage in a vertically integrated entity. For example, Aetna could be barred from openly steering patients toward CVS pharmacies, or either CVS or Aetna may have to shed some Medicare assets for the merger to be approved. And at the State level, because retail clinics are generally run by advanced NPs and different states regulate the scope of practice differently, it will be difficult to achieve the same range of services from one state to the next.

Increased competition within payers

Mergers such as CVS–Aetna and Cigna–Express Scripts continue to realign the healthcare system. They also signal that despite UnitedHealth Group outpacing its rivals by establishing its PBM unit first, competition among national insurers will only increase.

Download the full report to learn more about the transformation of the healthcare commercial model and the connected implications for pharma, payer, providers, and patients.