Outcomes-based contracting (OBC) is a growing value-based purchasing strategy used by U.S. healthcare payers to hold pharmaceutical companies responsible for ensuring that their drugs perform according to expectations in a real-world patient setting.

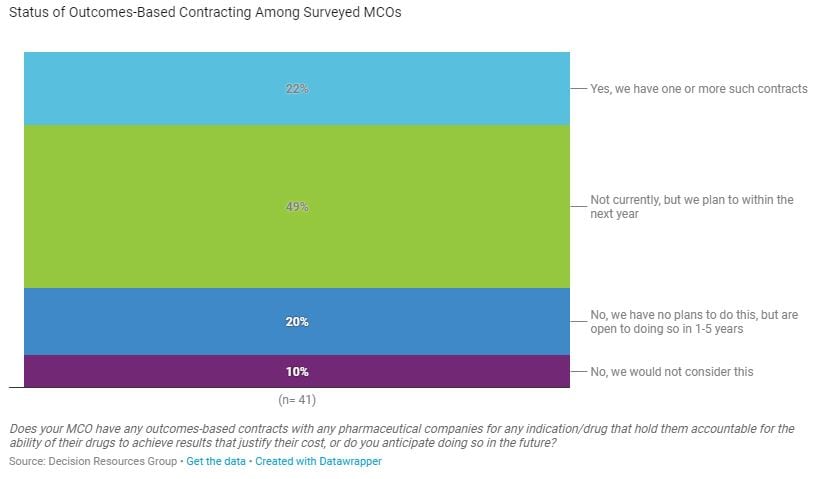

Key finding: OBCs are increasingly embraced by payers, with 71% of surveyed pharmacy and medical directors from managed care organizations (MCOs) reporting that they either have such contracts now (22% of those surveyed) or plan to have them in the next year (49%). Our results show that for commercial plans, chronic heart failure and other cardiology indications are among the most common indications covered by OBCs, as well as Hepatitis C and oncology.

Interest in OBCs in CHF was generated in 2016 when Cigna and Aetna confirmed contracts with Novartis for Entresto, one of the first branded drugs to be publicly associated with the risk-based contracting strategy.

The “so what” for decision makers: A positive showing in an outcomes-based contract can be a stepping stone to good formulary access, but falling short of expectations often means higher discounts from the drug marketer.

Pharmaceutical companies need to understand the implications of this contracting strategy as part of an overall commercialization strategy, particularly at a time when more payers are demanding proof that expensive new therapies will work as promised.

Learn more about the related DRG report:

DRG’s Access & Reimbursement report on chronic heart failure examines the market access factors that influence the success of therapies for chronic heart failure (CHF), with a special focus on payers’ and cardiologists’ involvement in and reactions to the trend in outcomes-based contracts.

The report offers insights into the metrics tracked in OBCs, sources used for data collection, MCO-encountered challenges with OBCs, and cardiologists’ reactions to and involvement in these contracts.

Key questions answered in the full report:

- What the main reasons MCOs adopting the OBC strategy and what are their biggest challenges in implementing these contracts?

- What are the common ways that pharmaceutical contracts are rewarded for positive outcomes in an OBC? And what happens when drugs do not work as expected?

- What are the results, if any, of MCOs’ OBCs for Entresto? What performance benchmarks are most important in an OBC for heart failure drugs?

- How do OBCs affect cardiologists’ prescribing decisions? How will MCOs approach the coverage of drugs that will be indicated for heart failure with preserved ejection fraction (HFpEF)?

Therapies studied: Entresto, Corlanor, Farxiga, Jardiance, vericiguat

Companies mentioned: Amgen, AstraZeneca, Bayer, Boehringer Ingelheim/Eli Lilly, Novartis

Chris Lewis serves as primary research manager, Access and Reimbursement. During her tenure at DRG, Lewis has specialized in tracking and analyzing U.S. market access trends for clients, including reimbursement landscape, managed care, pharmacy benefits, accountable care organizations, Medicare Advantage and Medicaid in each state. She is also a seasoned journalist with a degree in communications from California State University, Sacramento.

Chris Lewis serves as primary research manager, Access and Reimbursement. During her tenure at DRG, Lewis has specialized in tracking and analyzing U.S. market access trends for clients, including reimbursement landscape, managed care, pharmacy benefits, accountable care organizations, Medicare Advantage and Medicaid in each state. She is also a seasoned journalist with a degree in communications from California State University, Sacramento.