While big PBMs like ESI and CVS Caremark promote exceptional market control through their 2019 PBM trend reports, Prime Therapeutics failed to effectively control drug price inflation. In line with the trend for slow growth, commercial drug spending grew at an average of three percent. While drug utilization remains the leading cause of increasing specialty drug spend for most PBMs, MedImpact’s cost management strategy has not worked well in 2019.

Key Takeaways from 2019 Drug Trend Report from top PBMs:

COMMERCIAL TREND

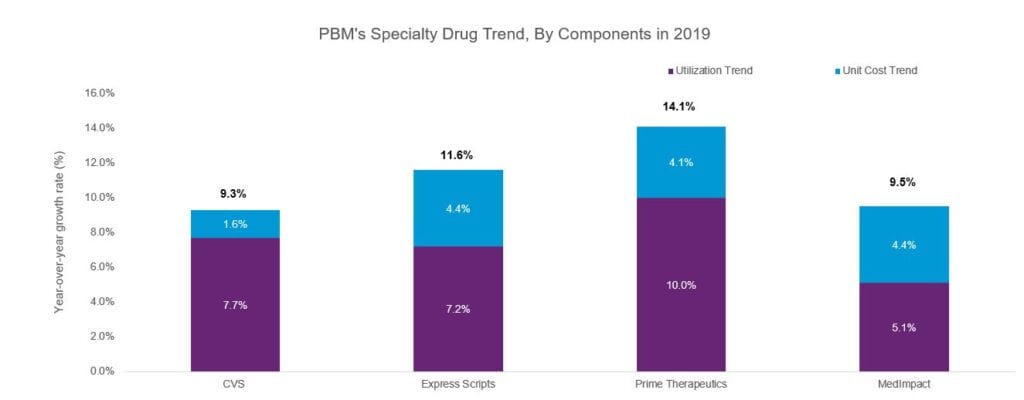

As the 2019 PBM spend comes into focus, the year-over-year percentage difference in patient spend continues to be lower single digits and the specialty wave continues to drive most of the change. For all PBMs, specialty drug spending accounted for a greater share of total spend than in 2018. As inflammatory disease therapies expanded in 2019, through label expansion of Stelara and drug approval of Skyrizi, this drug class continues to contribute heavily to spending through value and volume. While higher drug utilization remains the driver of increasing drug spend for most PBMs, Prime Therapeutics and MedImpact report unit cost increases higher than utilization increase.

SPECIALTY TREND

The average specialty trend was much higher than the total drug trend for all PBMs considered. Utilization increases rather than unit cost surge is attributed to the high specialty trend, at least that is the case with tightly run PBMs. PBM management of specialty drugs will continue to be in the spotlight as that sector continues to shape many industry decisions. Inflammatory drugs top the charts of high-spend specialty drugs and remain a dynamic class with indication expansion, drug approvals, and generic entries.

TRADITIONAL TREND

Traditional drug spend growth continues to decline as unit price drops and generic dispensing rates remain constant. Cost reduction in pain and inflammatory drug class in 2019 due to generic entry coupled with lower utilization of opioids due to concerns of opioid abuse is causing the traditional category spend to slide down. The diabetic drug class has authorized generics entering the market in 2020. Also, insulins to be deemed biologic might drive the category price up marginally. Drug classes that have spiked in utilization are antipsychotics, antidepressants, and anti-diabetic agents.

PBM 2020 – TRENDS TO WATCH

- As restrictions on prescriptions and fill volume fade during the COVID-19 pandemic, per month expenditure could see fluctuations for plan sponsors. Although initial glitches around supply would affect drug utilization, drug consumption should stabilize long-term.

- Label expansion of Xeljanz XR and Stelara for use in ulcerative colitis and approval of Xeljanz for active polyarticular course juvenile idiopathic arthritis are going to boost autoimmune disease category, which is a major contributor to specialty drug trend.

- To remain competitive and retain clients, Prime aligned with Express Scripts in a three-year agreement that took effect April 1, 2020. Express Scripts handles rebate negotiation and retail pharmacy contracting for Prime, which will be channeled through its foreign-based GPO Ascent Health offering tax savings and enable the PBM to collect GPO administration fee in return.

- Biosimilars for Neulasta and Epogen showed faster penetration and growth in 2019, which led to a decline in prices. Specialty category is expected to see more biosimilar launches by 2023. The FDA has already approved five biosimilars for Herceptin and two for Avastin; these biosimilars are likely to penetrate the market faster, creating competition within a high-spend therapeutic category and generate cost savings on drug spend.

Key Takeaway

Specialty drugs remain the major cause for drug spend increase and it continues to dominate the pipeline and drive utilization trend. Utilization management and formulary design innovations—preference for generics and biosimilars, and formulary exclusions—will continue to focus on drug classes to drive down cost.

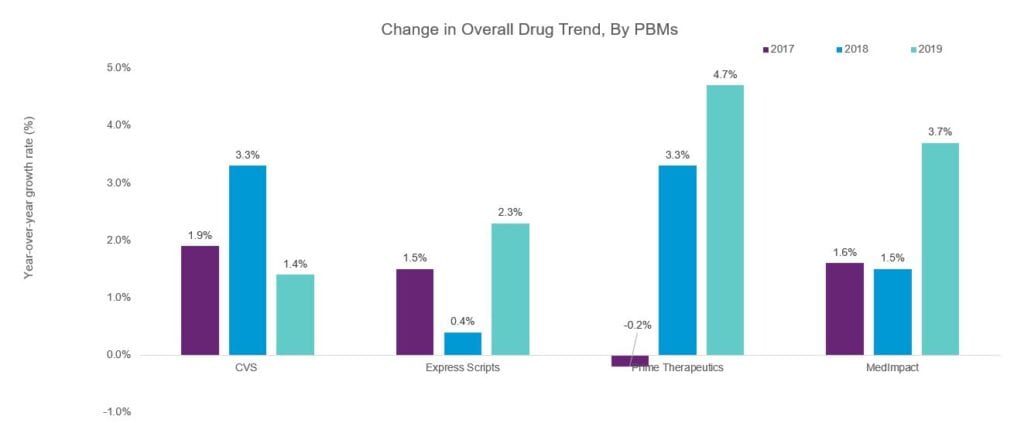

The chart below compares overall drug trend figures for CVS, Express Scripts, Prime Therapeutics and MedImpact, 2017 to 2019.

Source: PBM Drug Trend Report published by CVS, Express Scripts, Prime Therapeutics and MedImpact across three years: 2017, 2018 and 2019.

Source: PBM Drug Trend Report published by CVS, Express Scripts, Prime Therapeutics and MedImpact for 2019.

Source: PBM Drug Trend Report published by CVS, Express Scripts, Prime Therapeutics and MedImpact for 2019.

A complete analysis can be downloaded from the chart below

| PBMs | Express Scripts | CVS Caremark | Prime Therapeutics | MedImpact |

| Total drug trend | 2.3 percent | 1.4 percent | 4.7 percent | 3.7 percent |

| Specialty drug trend | 11.6 percent | 9.3 percent | 14.1 percent | 9.5 percent |

| Traditional drug trend | (5.0) percent | (4.9) percent | (0.8) percent | 0.9 percent |

| Utilization trend | 1.4 percent | 1.5 percent | 2.2 percent | 0.6 percent |

| Unit cost trend | 0.9 percent | (0.1) percent | 2.5 percent | 3.0 percent |

| Key drivers of the drug trend | Inflammatory drugs, oncology drugs and diabetes class drive trend in 2019 | Increase in specialty drug utilization and unit cost | Increase in specialty drug utilization, especially for drugs treating new indications of cancer (oral drugs) and autoimmune disease. | Notable tends in asthma and COPD, multiple sclerosis and autoimmune disease. New orphan/rare disease drugs with high per-member cost |

Source: Express Scripts trend report, MedImpact trend report, CVS Caremark trend report, Prime therapeutics trend report